Inheritance and estate taxes can be confusing and overwhelming, especially when it comes to heir property in Alaska. It is important to understand the laws in order to efficiently divide assets and make sure that all parties involved are taken care of properly.

Estate tax is a tax imposed on the transfer of property from an individual who has passed away, which can include money, real estate or other items of value. Inheritance tax is a state-level tax paid by the beneficiary receiving the assets from the estate.

In Alaska, inheritance tax does not exist; rather, there is an estate tax with exemptions depending on factors such as family relationship and size of the estate. Understanding these taxes can help you navigate heir property in Alaska with confidence.

Additionally, if more than one person inherits property, it can be divided according to their wishes through a will as long as it remains within certain parameters set out by Alaskan law. While this may seem complicated, being aware of these regulations will ensure that your legal rights are respected when dealing with heir property in Alaska.

When inheriting property in Alaska, it is important to understand the necessary paperwork requirements for the transfer of ownership. In order for an inheritance to be valid, all relevant documents must be completed and submitted appropriately.

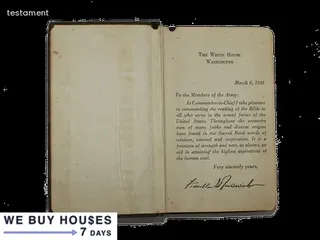

These can include death certificates, wills or other last testamentary documents, and probate court orders. Additionally, in some cases if the deceased had a trust established prior to death, documentation related to that may need to be filed as well.

Depending on the nature of the assets being transferred, additional forms and documents may also be required. It is essential that all paperwork is accurately filled out and submitted with any appropriate fees or taxes paid in a timely manner before the transfer of ownership can be completed.

In Alaska, it is important to understand the laws concerning inheritance when someone dies with a will. The most common form of estate planning for individuals in Alaska is to use a Last Will and Testament.

This document provides instructions for how the person's assets will be distributed upon their death. If someone does not have a valid and enforceable last will and testament in place, then their estate will go through probate court and the state will decide how to distribute the assets.

A person's heirs can also contest or challenge any provisions of a last will and testament if they believe that it was made under duress or undue influence. It is important to note that some types of property, such as heir property, cannot be sold without the consent of all heirs regardless of what is stated in a last will and testament.

As such, understanding the laws concerning dying with a will in Alaska is essential when it comes to dividing up an inheritance.

Inheriting property in Alaska can be a complex process, especially when the deceased did not have a will. Without a will, the distribution of property depends on Alaska's intestacy laws.

These laws dictate who inherits the estate and how it is divided among heirs. Generally, if there are no surviving parents, siblings or children of the deceased, then their spouse is eligible to inherit all of their assets.

If there are surviving relatives but no spouse, the deceased's assets will be divided among them according to the state's intestacy statutes. In some cases, if none of these parties exist, then any remaining property may become heir property and could pass on to distant relatives or even become part of the public domain.

Understanding these laws is essential for those hoping to inherit or sell heir property in Alaska. Various factors such as relationship status and living relatives must be taken into account before making a decision about selling heir property in Alaska.

Additionally, it is important to know whether or not an estate has been probated and how this might affect the sale of heir property in Alaska. The complexities involved with inheritance law make it imperative that individuals seek expert legal advice before attempting to sell heir property in Alaska.

In Alaska, when it comes to the transfer of property between spouses on the death of one partner, the law is specific and clear. According to Alaskan inheritance law, the surviving spouse is automatically entitled to a share in the deceased's estate.

This means that if a spouse dies without leaving a will, their property passes automatically to their surviving partner. In addition, any property jointly held by both spouses will pass directly to the surviving partner unless otherwise specified in a trust or other legal document.

Furthermore, if a deceased has children from another marriage, they may be able to receive a portion of the estate as well. When it comes to heir property in Alaska, understanding these laws can help ensure that inheritance rights are respected and that family members receive what they are due after the loss of a loved one.

In Alaska, children are legally allowed to inherit property from their parents. This means that if a parent passes away, their child can become the rightful owner of anything they leave behind.

When it comes to heir property in Alaska, there are special rules and regulations that govern how this inheritance process works. Understanding these laws is essential for ensuring that any potential heirs understand their rights when it comes to inheriting property in the state.

In particular, Alaskan inheritance law offers protections for children including the right to receive an equal share of any inherited assets. Additionally, Alaska’s probate laws provide safeguards to ensure that all beneficiaries of an estate get a fair portion of the estate’s assets.

Furthermore, Alaskan law mandates that all parties involved in an inheritance dispute be given adequate notice and time to respond before any transactions or decisions are made regarding the distribution of assets from an estate. Finally, Alaskan law also requires that all heir property disputes must be settled within a certain period of time so that heirs do not have to wait indefinitely for their share of the estate.

Understanding these rights and laws surrounding heir property in Alaska is essential for successfully navigating the inheritance process in this state and ensuring that all heirs receive what is rightfully theirs.

Inheritance laws in Alaska are complex and can often be difficult to navigate, especially when it comes to unmarried individuals without children. In terms of heir property, the state of Alaska follows very specific rules and regulations that must be followed in order to ensure that any potential sale or transfer is done correctly.

Generally speaking, if an unmarried person without children dies in Alaska, their estate will go to their siblings or nieces and nephews before it is distributed amongst other family members. If there are no surviving relatives, the assets may pass on to the state.

Furthermore, it is important to note that those who are inheriting real estate or other types of property must submit a probate application in order to receive official ownership of their inheritance. The process of submitting this application must be done within a certain timeframe in order for the inheritance rights to remain valid; failure to do so may result in the property being sold off by the state.

Ultimately, understanding Alaska's inheritance laws can help unmarried individuals with no children properly manage heir property when faced with a death in the family.

Inheriting property in Alaska can be a complex process and understanding the laws surrounding it is essential. Non-probate inventories and assets are an important part of the equation when it comes to inheritance in Alaska.

Non-probate inventories are those that do not need to go through probate court, for example, life insurance policies, stocks and bonds, or retirement accounts. Assets such as these typically have their own beneficiary designation forms which are filled out when they are purchased.

This makes them easier to transfer ownership after death without going through probate court. Other non-probate assets may include real estate held in joint tenancy with right of survivorship or held through a living trust.

These types of inheritances do not require probate court approval but should still be discussed with an experienced attorney or accountant since there may be taxes due on these types of transfers. Understanding the different types of non-probate assets makes navigating Alaska’s inheritance laws easier and can help ensure that heirs receive the full value of their inheritance quickly and efficiently.

When discussing inheritance laws in Alaska, there are many other scenarios that can arise. For example, what if the deceased person had a will that was never probated? In this case, the law will determine the rightful heirs and the court will decide how to distribute the estate.

Additionally, there may be times when family members disagree on who should receive an inheritance or how it should be divided. This can lead to complicated legal issues which require a lawyer's assistance to resolve.

Furthermore, when deciding whether heir property in Alaska can be sold, it is important to consider any restrictions placed on real estate by local and state governments such as zoning regulations or deed restrictions. Finally, another factor that must be considered is whether any of the potential heirs have creditors who might try to collect from their inheritance.

Navigating these various scenarios requires careful consideration of Alaskan inheritance law and consulting with an attorney can help ensure that all parties involved understand their rights and obligations under the law.

Understanding the intestate succession laws of Alaska, and how they affect the distribution of property among heirs, is an important part of understanding whether or not heir property in Alaska can be sold. Intestate succession is the process of distributing a deceased person's estate when they have not left a valid will.

Generally speaking, when someone dies without a will in Alaska, their estate is distributed according to the state's intestacy laws. The laws determine who has legal rights to inherit from the deceased – generally starting with a surviving spouse or registered domestic partner, then children and other relatives – and how much each beneficiary receives.

This can include money, real estate, personal belongings, and more. When determining if heir property in Alaska can be sold, it’s important to consider that under intestacy laws the surviving spouse or domestic partner may hold certain rights over the distribution and sale of inherited property.

It is also worth noting that if there are no surviving relatives listed by law as potential heirs then the state may take possession of any assets left behind.

In Alaska, a person who dies without leaving a will is said to have died "intestate" and the legal process for deciding who inherits the deceased's property can be complex. In general, when no will has been created, the state of Alaska follows its intestate succession laws that determine which family members are entitled to receive the inheritance.

Generally speaking, when someone dies without a will, their surviving spouse and any children they have are typically first in line to inherit the property. If there is no surviving spouse or children, then parents may receive the inheritance.

If there are still no eligible heirs, then siblings and other close relatives may also be able to claim part of the estate. Ultimately, if all other potential heirs do not exist or cannot be located, then the estate passes to the state itself.

It is important to note that Alaska does not recognize half-siblings as legal heirs under its intestate succession laws. Understandably navigating these laws can often be difficult and consulting an attorney can help clarify any confusion about how heir property in Alaska may be sold or divided among family members.

When it comes to heir property in Alaska, the rights of a surviving spouse can be complicated. In general, a surviving spouse is entitled to certain assets that are specific to their relationship with the deceased.

However, depending on the type of inheritance laws in place, they may be able to take more than what they would typically expect. This includes assets such as real estate and money acquired through probate or trust distribution.

It is important to understand how these laws apply in order to determine if a surviving spouse can take more than their fair share of the inheritance. Additionally, it is important to consider other factors such as any prenuptial agreements or wills that may affect the final outcome.

Ultimately, understanding the relevant laws and regulations in regards to heir property in Alaska will help ensure that all parties involved are properly taken care of when it comes time for inheritance distribution.

In the United States, citizenship plays an important role in determining the rights of heirs to property. Generally, noncitizens do not have the same inheritance rights as citizens, and this is particularly true in Alaska where US citizenship is required for inheriting property from a decedent.

For example, if one party is a US citizen and the other is not, then only the US citizen can inherit real estate or other physical possessions in Alaska. In addition to being a citizen of the United States, all heirs must be residents of Alaska at least six months prior to the death of the decedent in order to file an inheritance claim.

It’s important to note that there are some exceptions and special considerations depending on certain circumstances. For instance, if an heir has been declared legally incompetent or deceased before the decedent passed away, they may still be eligible to receive their share of inheritance under certain conditions.

Additionally, adopted children of a decedent are also entitled to their share of any inherited property regardless of their residency or citizenship status.

In some cases, an illegitimate child is considered an heir in the eyes of the law. This means that even if the parents are not married or have never been married, a child may still be eligible to receive a portion of the inheritance when it is divided among heirs.

In Alaska, this can be determined by looking at state laws and regulations about inheritance. If a child is deemed to be an heir, they will have rights to their parent's property after death regardless of any marital status between the two parties.

It is important to note that these rights may vary depending on where in Alaska the property is located as different regions may have slightly different rules. Additionally, an illegitimate child's right to inherit may depend on how far up the list of heirs they are - meaning that if all other potential heirs have already received their portion prior to them being declared an heir, they may not receive anything at all.

In Alaska, it is possible to name a conceived, but not yet born, individual as an heir in the event of an inheritance. There are certain conditions that must be met in order for this to happen.

The child must be able to receive the inheritance if they were born alive at the time of the death of the original owner of the property. Generally, this means that the child must have been conceived before their biological parent's death and have survived after birth.

Additionally, there may be specific legal requirements concerning whether or not a trust can be established for a person who is not yet born, depending on local state laws. It is important to note that this applies only to inheritance laws and does not necessarily apply to other types of estate planning documents such as wills or trusts.

Ultimately, it is important for people who are considering naming a conceived, but not yet born child as an heir in Alaska to understand all applicable laws prior to making any decisions regarding their estate plans.

Navigating the complexities of inheritance laws in Alaska can be a daunting task for those who have recently inherited property. Selling heir property in Alaska requires an understanding of one's rights and knowledge of the legal processes involved.

It is important to recognize that, depending on the circumstances, there may be multiple parties with rights to the same property, including any other heirs or the state itself. In some cases, a court order or other form of approval may be necessary before selling heir property in Alaska can occur.

Additionally, there are often restrictions imposed by federal and state laws that limit how and when heir property can be sold. Furthermore, it is essential to understand how taxes will affect profits from selling heir property in Alaska as this varies depending on whether the seller was related to the deceased or not.

Ultimately, taking the time to learn about relevant laws and regulations is critical for anyone looking to sell heir property in Alaska.

Navigating contested wills in Alaska can be a complex task to undertake, especially when it comes to heir property. In this guide, we will provide a comprehensive understanding of the inheritance laws in Alaska and how they can be used to settle disputes over an estate’s ownership.

From determining who is legally considered an heir, to understanding how interests in an estate are divided among multiple heirs, this guide will provide all the necessary information one needs to understand the intricacies of heir property in Alaska. We will also discuss how these laws apply when a will is contested, as well as some of the various strategies available for resolving such disputes.

By providing a thorough understanding of Alaska’s inheritance laws and their implications for contesting a will, this guide will help equip individuals with the knowledge they need to make informed decisions about their own legal rights and obligations.

When a person passes away in Alaska, their heir property may be subject to paying off outstanding debts as part of the inheritance process. It is important to understand the state's laws on inheritance and debt repayment after death.

In Alaska, heirs are not liable for the deceased's debts unless they cosigned on the loan or credit agreement. If this is the case, then the estate must pay off any debt before transferring any assets to an heir.

The executor of a will is responsible for using estate funds to pay off any remaining debts before distributing property to heirs. Creditors may also place liens against property if unpaid debts are substantial and cannot be paid through estate funds.

A lien will prevent an heir from selling or transferring ownership of that property until the debt is satisfied. Additionally, creditors have up to four years to file a claim against the deceased’s estate in order to collect payment for their debt.

It is important that heirs understand all applicable laws surrounding inheritance and debt repayment so they can ensure proper payment of any debts owed by their loved one’s estate before taking possession of their inherited property.

When it comes to handling jointly owned properties in Alaska after death, there are certain legal considerations that must be taken into account. Inheritance laws in the state dictate how jointly owned property is divided when a co-owner passes away.

To ensure a successful and smooth transfer of joint ownership, both parties should understand the basic principles of inheritance law in Alaska. This comprehensive guide will provide an overview of how heir property can be sold in the state and how to handle jointly owned properties after death.

In the event of a co-owner's death, heirs must first determine whether or not the property is subject to probate. If so, then an application for probate must be filed with the court.

The process for selling heir property depends upon whether or not the deceased co-owner left behind a will. If there is no valid will, then an administrator must be appointed by the court to oversee the sale.

Additionally, if any debts remain unpaid by the decedent at the time of death, they must first be settled before any sale proceeds can be distributed among heirs. Finally, heirs should also consider their tax liabilities when selling heir property in Alaska; certain taxes may apply depending on the circumstances of a particular case.

Establishing a revocable living trust in Alaska is an important step for those who are looking to protect their heir property in the state. A revocable living trust allows property to be transferred from one generation to another without going through probate, thus preserving its value.

This can provide significant financial security for future generations and make managing the estate much simpler. When establishing a revocable living trust, it's important to understand the inheritance laws in Alaska and how they may affect the transfer of property.

The laws regarding heir property vary by state, so it's essential to know what these are before proceeding with any legal action. Additionally, there may be taxes applicable to transfers of heir property that should be considered when making decisions about how best to manage the estate.

With proper planning and understanding of the laws, those looking to ensure their heir property remains in their family can do so with confidence.

In Alaska, inheritance law is governed by the Uniform Probate Code (UPC). This code includes statutes that dictate how property is to be distributed when someone dies.

When it comes to heir property in Alaska, this means that the deceased's estate will be divided among all of their legal heirs according to their rights under the UPC. Generally, each legal heir has an equal right to a portion of the estate regardless of whether they are related by blood or marriage.

If there are no living heirs, then the estate passes on to the state of Alaska. In some cases, when an individual has no living heirs or next of kin, they can choose to designate a beneficiary who will receive their estate upon death.

However, it is important to note that in Alaska, heir property cannot be sold unless all interested parties agree and sign off on the sale. It is also important for individuals looking to sell heir property in Alaska to understand that certain procedures must be followed before any sale can take place.

In Alaska, the laws of intestate succession dictate how property is distributed in the event of an individual's death if no will is present. Intestate succession is determined by a set of laws determined by the state and based on the relationships between family members.

According to Alaskan law, when it comes to intestate succession, spouses are first in line to receive inheritance rights followed by children or other descendants. If there are no surviving relatives, then any remaining assets are given to the state government.

Additionally, if a deceased person had no living relatives, their property can pass directly to their spouse if they have one. It is important to note that certain types of property may not be subject to intestate succession and must be specifically identified in a will or court order such as joint tenancy with rights of survivorship properties, life insurance policies and retirement accounts.

In Alaska, probate of an estate is the legal process to distribute assets after someone has passed away. Under Alaska probate laws, certain property may be exempt from inheritance taxes and other debts.

Exempt property in probate includes assets like bank accounts and real estate that are jointly held with a surviving owner or beneficiary, assets that are transferable on death (such as life insurance policies or retirement accounts), and certain types of trusts. Additionally, if the deceased person had a will in place prior to their death, it is possible that any specific items explicitly indicated in the will would not go through probate and instead directly transfer to the indicated beneficiary or beneficiaries.

Understanding what is exempt property in probate can help you determine whether heir property in Alaska can be sold without going through a lengthy court process.

Probate is a legal process that can be costly and time consuming. In Alaska, probate can be avoided in certain cases if the heir property is sold or transferred properly.

It's important to understand the state's inheritance laws to ensure that all required steps are taken to avoid probate. An experienced estate planning attorney can help devise an effective strategy to transfer heir property without going through probate court.

Transferring heir property through a living trust is an option for some individuals, as it allows them to control the assets until their death, when they are then passed on according to the terms of the trust. A will is another way to avoid probate in Alaska by allowing the testator (person making the will) to direct where their assets should go after they pass away.

Understanding all of these options and working with an experienced attorney can help ensure that you and your family are able to quickly and easily transfer heir property in Alaska without going through a long, complicated probate process.

A: The Alaska Department of Law provides a comprehensive guide to understanding Alaska's inheritance laws, which includes information about heir property and how it can be sold.

A: The rules and regulations regarding heir property in Alaska are complex and vary depending on the particular situation. It is recommended to consult a comprehensive guide or an attorney to gain more insight into the specific requirements for selling heir property in Alaska.