In Idaho, the probate process is a court-supervised procedure for transferring the assets of a deceased person to the rightful heirs. The requirements for probate in Idaho include obtaining court approval and filing an inventory of all estate assets.

The executor of the estate must provide proof that all debts are paid and that creditors have been notified of their right to file a claim against the estate. Additionally, all beneficiaries must be identified and given notice of their right to receive assets from the estate.

In some cases, a bond may be required if there is risk that assets could be misused or mismanaged during the probate process. Idaho law also requires that any will be filed with the court before probate proceedings can begin.

Finally, it is necessary to prepare an accounting of all transactions related to the administration of the estate which must be approved by the court before distribution can take place.

Filing a petition for probate in Idaho is an important step for those wishing to sell a house that belonged to a deceased individual. Before any sale can take place, the court must first determine the validity of the will, if applicable.

The process starts with filing a petition for probate in the county where the decedent was living at the time of their death, as well as any other counties where they may have owned property. In some cases, it may also be necessary to file an inventory of assets and liabilities associated with the estate.

After filing, a personal representative will be appointed by the court to administer proceedings. It is important that all steps are followed correctly and in order; otherwise, delays or additional fees may occur.

Once all necessary documents have been filed and approved by the court, a Notice of Probate Sale will be issued indicating when and where the sale of real estate assets can take place. Understanding Idaho's laws regarding probate and estate administration is essential for anyone planning on selling a home inherited from an Idaho resident who has passed away.

In Idaho, an executor is responsible for settling the estate of a deceased person. This process begins with filing paperwork with the court to open probate.

As part of their duties, the executor must collect assets and pay any outstanding debts or taxes owed by the estate. They will also be responsible for distributing property and assets according to the deceased's wishes as stated in their will.

In addition, they are expected to keep careful records of all transactions made during the probate process so that they can provide a full accounting of the estate's dealings to the court. The executor must also see that all final distributions are made to beneficiaries in accordance with Idaho law before closing out the estate.

Their role is essential throughout this entire process and it can take many months or even years before an estate is fully settled.

In Idaho, court involvement is required in the probate process if the property owner dies without a will or valid trust. In this case, the court must appoint an executor or personal representative to carry out the wishes of the deceased and finalize any outstanding financial issues related to their estate.

If there is a will or trust, then it is typically possible to avoid court involvement through informal probate proceedings. However, even in this case, the executor may choose to seek assistance from the court if there are any questions or disputes that need resolution.

The timeline for selling a house during probate in Idaho depends on whether formal or informal proceedings are used and whether there are any complications that require additional time to resolve.

There are alternative ways to handle the probate process when selling a house in Idaho. One method is called “informal probate”, which is an easier and quicker way to transfer ownership of a property.

This process requires the executor of the estate (named in the will) to file a petition with the court, along with a death certificate and listing of assets. Once approved by the court, the executor can go ahead and transfer title of the property without any further court supervision.

Another option is “affidavit procedure” in which an heir or beneficiary can sign an affidavit stating that they are entitled to inherit certain assets from the estate. The affidavit must be filed with the court and upon approval, it allows them to take possession of property without going through a formal probate proceeding.

Finally, there is “small estate administration” which involves transferring title of a small estate (under $100,000) directly to heirs or beneficiaries without going through formal probate. This requires filing an application with the court but does not require any other formal paperwork or hearings before title is transferred.

All three alternatives provide Idahoans with options for avoiding long and expensive probate proceedings when selling their homes after a death in the family.

When selling a house in Idaho during the probate process, there are certain expenses and taxes that must be taken into consideration. It is essential to understand the costs associated with probate proceedings in order to ensure a smooth transaction.

These expenses may include court filing fees, attorney or executor fees, and inheritance or estate taxes. Depending on the size of the estate, an appraiser might also need to be hired to determine property values.

In some cases, an accounting expert may need to be consulted as well. All of these fees should be estimated before proceeding with the sale of a home during probate in Idaho so that it is not held up by any unexpected surprises.

Additionally, it is important to keep track of all receipts and documents related to the sale for future reference.

When it comes to understanding the probate process and timeline for selling a house in Idaho, one of the most important stages is identifying estate assets. This involves an inventory of all property, possessions, debts and other assets owned by the deceased.

The executor, or personal representative, is responsible for collecting all documents needed to file the estate with the court. This includes deeds and titles, insurance policies, bank account statements, retirement accounts and more.

The executor must also locate any wills or trusts that may be relevant to the estate. After all this information is gathered and reviewed by the court, it will assess whether or not a bond must be posted before distribution of assets can occur.

By taking a comprehensive look at all estate assets during probate process in Idaho, heirs can rest assured that their loved one's wishes are being honored while ensuring that they are receiving their rightful inheritance.

When a loved one passes away, handling the probate process and selling their house can be a difficult task. The Idaho probate process is designed to ensure that all assets are distributed according to the wishes of the deceased.

However, disputes can arise between family members over who should receive which assets. In Idaho, these disputes will generally fall under the jurisdiction of a local court who will decide how assets should be divided.

When disagreements occur, it is important to understand what steps must be taken in order to resolve them in an efficient and fair manner. An experienced attorney can provide guidance on the best approach for resolving any conflicts that may arise during the probate process and timeline for selling a house in Idaho.

Furthermore, having proper legal representation can help ensure that all parties involved are treated fairly, and that the distribution of assets is done according to state law.

In Idaho, executors of a deceased estate must abide by certain laws and regulations when selling a house as part of the probate process. An executor is responsible for carrying out the wishes of the deceased according to the rules set forth in Idaho law.

It is important that executors understand their rights and responsibilities to ensure they are upholding their fiduciary duty while protecting their own interests. The primary responsibility of an executor in Idaho is to inventory the assets of the deceased and pay off any outstanding debts or liabilities.

This includes taxes owed at both the state and federal level, as well as any other debts that may be outstanding such as mortgages or loans. After all debts have been paid, the executor then distributes what remains among heirs or beneficiaries according to instructions in a will or intestacy laws if no will exists.

Executors must also adhere to certain timelines when settling an estate in Idaho; typically, estates can take anywhere from six months to two years for completion depending on various factors such as tax complications and disagreements among heirs. Understanding these laws governing executors' rights and responsibilities is essential for those tasked with selling a house as part of an Idaho probate process.

In Idaho, the timeframe for claiming an inheritance depends upon the type of probate process used. There are three types of probate available in Idaho: Summary Administration, Formal Administration, and Small Estate Affidavit.

The Summary Administration is typically used when there are no creditors to be paid and a Will was not filed. This type of probate generally takes four to six months from start to finish.

Formal Administration is used if there are creditors to be paid or if a Will was filed. This process may take up to two years or more depending on the complexity of the estate.

Finally, the Small Estate Affidavit is used when the value of all assets falls below a certain amount set by statute; this process can take anywhere from one week up to three months depending on how quickly creditors file claims against the estate. In all cases, it's important for heirs to be aware of deadlines for filing claims and for completing other necessary paperwork so that they can receive their inheritance as quickly as possible.

In Idaho, the beneficiaries of an unprobated will are determined by the court. The estate must go through probate before the beneficiaries can be officially named and inherit their shares of the estate.

Probate is a legal process during which a court validates a will and oversees the distribution of assets in accordance with its terms. In Idaho, a personal representative is appointed to manage the estate during this time while all debts and taxes are paid off and assets are distributed to beneficiaries.

To begin the probate process, a petition must be filed with the court and creditors must be notified. The court then decides who the rightful heirs to the estate are, and they become the beneficiaries of an unprobated will in Idaho.

After all claims against the estate have been resolved, it can finally be distributed to those beneficiaries according to Idaho law.

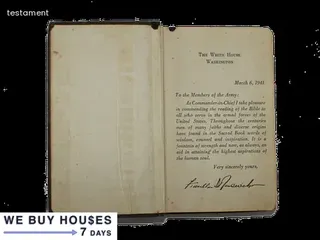

When it comes to selling a house in Idaho, potential buyers and sellers alike may be curious about how to determine whether a will is valid for probate in the state. In Idaho, probate is the process of proving a will's validity and distributing assets according to its instructions.

The court must first verify that the will is valid before it can be submitted for probate. To do this, the person submitting the will must show that it was signed by the testator (the person who wrote the will) with two witnesses present and all other legal requirements met.

After verification, a petition for probate must be filed with the court. Once granted by the court, an executor or administrator is appointed to oversee distribution of the estate according to the terms outlined in each particular will.

Knowing how to properly assess whether a will is valid for probate in Idaho is essential in understanding how long it takes to sell a house through this process.

When administering an estate in Idaho, it is important to understand the probate process and timeline for selling a house. Making mistakes throughout this process can easily cause delays and could potentially be costly.

Avoiding common errors is key to helping ensure that the administration of an estate is successful. A few of the most important points to remember include understanding the deadlines associated with filing a petition for probate and accounting for all assets and debts in a timely manner.

Additionally, family members should be consulted when making decisions about how to divide up property or distribute assets. Finally, it's important to make sure the proper paperwork is completed correctly and that all requirements are met.

By being aware of these issues beforehand, you can help prevent any unnecessary delays or problems from arising during the administration of an estate in Idaho.

In Idaho, creditors have the right to make claims against an estate during the probate process. Creditors include financial institutions, credit card companies, and individuals who are owed money or goods by the deceased.

In order to make a claim against the estate, creditors must submit their claim in writing within four months of the date that Letters of Administration or Letters Testamentary are issued. Creditors must also provide proof of their debt such as invoices and bills.

If a creditor does not file a claim within this time frame, they will be barred from making any claims against the estate. After all creditors’ claims have been submitted and reviewed by the probate court, any remaining assets will be distributed according to state law.

It is important for executors to understand when creditors can make claims on an estate during probate in Idaho in order to ensure that all debts are handled properly before selling a house through probate.

When selling a house in Idaho during the probate process, it is important to be aware of strategies that can be employed to minimize administrative fees and tax liabilities. Knowing the timeline for probate in Idaho can help you plan accordingly and ensure that everything goes as smoothly as possible.

By understanding the types of taxes associated with the sale of a home in Idaho, you will be able to determine what deductions may apply and take advantage of all available opportunities. Additionally, when filing paperwork for probate in Idaho, it is important to understand what forms must be completed and which documents are necessary to move forward with the process.

Working with an experienced attorney who specializes in estate planning or probate law can also be beneficial throughout this process, as they will have a better understanding of how to maximize your savings and reduce the amount of time spent on paperwork.

Understanding the probate process for selling a house in Idaho can be complex and time consuming. The first step is to understand what documents must be filed with the court during probate in Idaho.

This includes filing a petition with the court, an inventory of the decedent's assets, and any creditor claims against the estate. Additionally, a notice needs to be filed with the court and published in a local newspaper informing creditors that they have four months to make any claims they may have against the estate.

It's also important to identify any beneficiaries of the estate who need to sign off on documents related to selling and transferring ownership of the house. Lastly, it is important to understand all applicable state laws regarding taxes that must be paid before closing on a sale of a house during probate.

Preparing for these filings and understanding all necessary steps will help ensure that you are able to complete your probate process as quickly as possible so you can move forward with selling your house in Idaho.

Understanding the differences between testacy and intestacy laws and their impact on estates in Idaho can help when distributing real property after a death without going through probate. Testacy laws in Idaho state that if a person dies with a valid will, then their estate must be distributed according to the terms of the will.

Conversely, intestacy laws dictate that if a person dies without a will, then the estate must be distributed according to the state's pre-determined rules. A power of attorney also affects property distribution after death without going through probate.

In Idaho, an individual may name an agent who has the authority to act on their behalf during life and upon death, allowing them to make decisions about how assets should be distributed. Additionally, joint tenancy ownership is another way for individuals to affect property distribution after death without going through probate in Idaho.

Joint tenancy ownership allows two or more people to own property together; when one tenant dies, their share of the ownership passes automatically to the surviving tenant(s).

In Idaho, an executor appointed to settle an estate typically has at least 6 months from the date of appointment to complete the probate process on a house. The timeline for settling an estate in Idaho is generally divided into three phases: filing the required paperwork, paying creditors and taxes, and distributing assets.

Depending on the complexity of the estate, this process can be lengthy and complex. During phase one, the executor must file specific paperwork with the court in order to begin settling the estate.

This includes filing a petition for probate with the court as well as giving notice to all interested parties. The court will then issue orders setting out deadlines and requirements that must be met before phase two can begin.

In phase two, any outstanding debts or taxes must be paid by the executor using funds from the estate. This includes any outstanding mortgage or tax payments associated with the property in question.

Finally, in phase three, any remaining assets are distributed according to state law or any applicable wills or trusts. Understanding this process and timeline is essential for anyone involved in selling a house during an Idaho probate proceeding.

The probate process and timeline for selling a house in Idaho can vary, but on average most estates take anywhere from 6-12 months to settle.

This timeline begins from the day a deceased person's will is admitted to probate court, and ends when all debts are paid and any remaining property is distributed to heirs or beneficiaries.

During this period of time, an executor must gather information about the deceased person's estate, submit all necessary paperwork to the court, identify and appraise assets, pay any creditors or outstanding debt, file tax returns, and ultimately distribute the estate according to the will.

The length of time this entire process takes can vary greatly depending upon several factors such as complexity of the estate, legal issues that may arise, delays in paperwork processing or communication with family members or other parties involved in the probate process.

In Idaho, the timeline for probate and the sale of a house can vary depending on the complexity of the estate. Generally, probate can take anywhere from nine months to a year or more.

The Idaho Probate Code provides that the court must issue an Order of Final Discharge no later than eighteen months after the initial appointment of personal representative and filing of the inventory and appraisement. If any disputes arise during probate or if there are complications such as missing heirs, this could extend the timeline for probate.

In addition, the sale process itself may add additional time to the overall timeline for selling a house in Idaho. It is important to discuss your specific situation with an attorney who is familiar with Idaho's probate laws in order to determine how long it will take to go through the full process and sell a house in Idaho.

Closing an estate in Idaho requires a lot of preparation and understanding of the probate process. It is important to familiarize yourself with the laws governing probate and the timeline for selling a house in Idaho, as each state has unique procedures for closing an estate.

The first step in closing an estate in Idaho is to get all of the necessary paperwork completed, such as filing a will, opening an estate account, and obtaining Letters of Administration from the court. Once this paperwork is complete, you must complete the inventory process by determining what assets are part of the deceased's estate.

Next, you will need to pay any creditors that may be owed money from the deceased’s estate. After this is done you can begin distributing assets to those entitled under state law.

Finally, you must file a final accounting with the court before closing out the estate. By understanding the probate process and timeline for selling a house in Idaho, you can ensure that your loved one's legacy is properly respected and managed according to their wishes.

A: Generally, the process of probating an estate and petitioning a court for distribution of assets takes around 9 months. However, depending on the complexity of the case and other factors, this timeline can vary.

A: The time frame for settling an estate under the Right of Survivorship in Idaho depends on the complexity of the estate and can vary significantly, but typically takes at least 6-12 months.

A: Under the Uniform Probate Code, the length of time it takes to settle an estate after a house is sold in Idaho can be affected by Inheritance Rights, Inherits and/or Inheritances. Depending on the situation, these factors may cause delays in settling the estate.

A: The understanding of the probate process can vary from state to state, but generally speaking, it can take between 6 months and 2 years for an estate to be settled after a house is sold in Idaho under the Uniform Probate Code.

A: Generally, it can take anywhere from six to eight months to settle an estate after selling a house in Idaho under the Uniform Probate Code.

A: Generally, the timeline for settling an estate after selling a house in Idaho under the Uniform Probate Code is between three to six months.

A: Under the Uniform Probate Code, if a Last Will and Testament mentions a surviving spouse, all communications to them must be sent at least 30 days prior to any hearing or court proceeding related to settling a deceased's estate.

A: Generally, it takes between 3 and 6 months to settle an estate in Idaho if the surviving spouse is mentioned in the Last Will and Testament and the value of the estate has been established.

A: The timeline for settling an estate after selling a house in Idaho under the Uniform Probate Code can vary depending on the complexity of the case, but generally it takes at least four months.

A: The timeline for settling an estate after selling a house in Idaho under the Uniform Probate Code varies depending on the complexity of the estate, but can typically range from six months to two years.

A: The timeline for settling an estate in Idaho under the Uniform Probate Code depends on several factors, including how quickly the court can process paperwork, any disputes that arise during probate proceedings, and whether or not there are creditors to be paid. Generally, it can take between six months to two years for the entire process to be completed.

A: The timeline for settling an estate after selling a house in Idaho under the Uniform Probate Code can vary, depending on the complexity of the estate and any disputes that arise. Generally, it may take from six months to a year or more to settle an estate in Idaho.

A: Under the Uniform Probate Code, settling an estate after selling a house in Idaho typically takes between six months and one year.

A: Generally, the settlement process for an Intestate property can take anywhere from six months to two years depending on the complexity of the estate.

A: The timeline for settling an estate in Idaho that includes State Estate Tax, Federal Estate Tax, and Inheritance Tax will vary depending on the complexity of the case. Generally, it takes between six months to one year to settle an estate after a house is sold in Idaho under the Uniform Probate Code.

A: The timeline for settling an estate in Idaho after selling a house under the Uniform Probate Code can vary depending on the complexity of the estate and any living wills that are part of it. Generally, the process can take anywhere from 6-12 months or longer.

A: The timeline for settling an estate after selling a house in Idaho under the Uniform Probate Code depends on several factors such as the complexity of the estate and compliance with real estate law, executor of the estate requirements, and inheritance tax obligations. Generally speaking, estates may be settled within 6-12 months.

A: The timeline for settling an estate in Idaho when the Last Will and Testament is involved depends on a number of factors, such as the size of the estate, whether any debt or taxes are owed, and if there are any disputes between beneficiaries. Generally speaking, it can take several months to a few years to fully settle an estate.