In the state of Illinois, going through probate after selling a home can be beneficial in a number of ways. This legal process is often seen as time-consuming and tedious, but it also helps to ensure that all debts are paid off, that taxes are accounted for, and that all assets are distributed according to the terms laid out by the deceased.

Probate also provides an opportunity for creditors and other interested parties to make sure everything is handled properly. As part of this process, an executor or administrator is appointed to manage any disputes or disagreements that may arise.

Additionally, probate can help avoid potential conflicts between family members and other beneficiaries of the estate. Ultimately, having a formal court procedure in place allows for greater transparency and clarity surrounding estate settlement.

When a person passes away, their estate must go through the probate process in order to settle their debts and distribute assets among beneficiaries. In Illinois, the process typically takes several months to complete.

In order to begin the probate process in Illinois, the executor of the estate must file a petition for probate with the local court. After filing this petition, creditors will be notified and given an opportunity to make claims on outstanding debts.

An inventory of all assets belonging to the deceased must also be completed and submitted to the court. The executor must then obtain appraisals for any real estate or other valuable items within the estate.

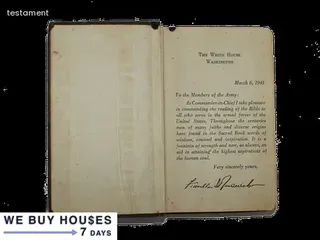

Next, they must pay off any debts or taxes associated with the estate using funds from liquid assets or by selling real property if necessary. Finally, once all unsecured debts have been paid off and taxes accounted for, beneficiaries can receive their inheritance distributions according to terms set forth in a last will and testament or state law if no will is available.

In Illinois, the court system is responsible for handling probate. This means that the executor of an estate has to file paperwork with the Probate Division of the Circuit Court and follow a set of procedures in order to settle an estate.

The executor is appointed by the court to administer or manage the estate, including selling a home if there is one. They are responsible for filing all documents and paperwork related to the sale of property, and also for making sure that all debts and taxes are paid before any money is distributed to heirs.

It can take several months or even years to settle an estate depending on its complexity, but typically it will take around six months from start to finish.

In Illinois, the process of settling an estate after selling a home can be lengthy and complicated. It is important to make sure that you understand the laws in Illinois regarding wills, estates, and probate so that you are able to properly file a will.

After the death of a loved one, their estate must go through probate court. Probate is the legal process by which the deceased's assets are distributed according to their will or state law if they do not have a will.

In order to file a will in Illinois, you must first obtain probate documents from the court. This includes filing a petition for probate with the appropriate court and having it approved by a judge.

Once this is completed, you can then begin gathering all of the necessary paperwork to prepare for filing your will in court. This includes collecting all financial information related to the deceased's estate, such as bank accounts and investments, along with any other property or assets that need to be divided up amongst heirs.

Additionally, you may need to consult with an attorney or other legal professional who can help guide you through the process of settling an estate after selling a home in Illinois.

When settling an estate after selling a home in Illinois, there are two different methods of probate available: supervised and independent. Supervised probate requires court supervision, while independent probate is not overseen by the court.

Supervised probate is known as a formal process and can take many months to complete. It requires that the executor of the estate file certain documents with the court, including a petition for administration, inventories of property held by the estate, and notices to creditors.

If all requirements are met, the court will issue an order for distribution of assets to beneficiaries. Independent probate is often referred to as an informal process and does not require court approval before distributing assets from the estate.

The executor of the estate must still file certain documents with the court to prove ownership of any real or personal property held by the deceased, but this can be done without formal courtroom proceedings. It is important to note that while independent probate may be faster than supervised probate, it does not provide protection against any potential legal challenges that may arise regarding distribution of assets or other matters related to settling an estate.

Hiring an attorney for probate services in Illinois can be expensive and time consuming. Understanding the cost of probate services is important when settling an estate after selling a home in Illinois.

The charges for these services vary depending on the complexity and size of the estate, as well as the individual attorney’s fees. Generally, attorneys will charge for their services by either an hourly rate or a flat fee.

Hourly rates can range from $150 to $300 per hour, while flat fees might start at around $2,000 and could go up depending on the size and complexity of the estate. The attorney may also charge additional fees for filing documents or taking other actions related to settling the estate.

It is important to consider all costs associated with hiring an attorney before deciding whether or not to do so, as it can be expensive but ultimately necessary in some cases when settling an estate after selling a home in Illinois.

When it comes to selling a home in Illinois, the estate must be settled before the sale can be finalized. Many people are unsure of how long this process may take and if they need to hire an attorney for the probate process.

The answer to this question depends on a few factors such as the complexity of the estate, any disputes that may arise, and whether or not there is an attorney involved. Generally speaking, hiring an attorney can help expedite the process and make sure that all of your legal rights are protected.

An experienced attorney will be familiar with all of the laws and regulations related to settling estates in Illinois, so it is important to find one who has experience with similar cases. Additionally, having an attorney involved can help ensure that you receive a fair settlement for your home and that any disputes that may arise during the process are handled quickly and effectively.

In Illinois, the probate process of settling an estate after selling a home typically takes anywhere from six months to two years. Generally, assets that are included in the probate process are those owned solely by the deceased, such as real estate, bank accounts and investments.

Other items that are typically part of the probate process include tangible personal property, such as furniture and jewelry. On the other hand, any assets that have been transferred out of the decedent’s name prior to death or those with named beneficiaries, such as life insurance policies and retirement accounts, are not subject to probate.

Therefore, these types of assets may not be included in the settlement of an estate in Illinois. Additionally, if a deceased individual has created a trust for their assets before passing away, these too would not be subject to probate - circumventing the need for court involvement altogether.

When selling a home in Illinois, there are other options to avoid the probate process. One way to do this is by setting up a living trust.

This allows for the estate to be passed on without having to go through the court system or filing state paperwork. Additionally, transferring ownership of assets before death can also help avoid probate.

Allowing beneficiaries to receive assets upon death is another option that may be beneficial in avoiding probate. The executor of the estate can contact an attorney or accountant to discuss these alternatives and determine which option fits best with their situation.

It's also important for all parties involved to understand any potential tax implications when making decisions about settling an estate in Illinois.

Filing a will in Illinois requires various documents, such as proof of identity, a signed and witnessed will, and an inventory of all assets. In order to file a valid will, it must be signed by the testator (the individual writing the will) and two witnesses over the age of 18 who are not named in the document.

Additionally, if you are filing a complicated estate with real estate or other large assets involved, you may need to provide an inventory of all assets for review by a probate court. This inventory must include details like the estimated value of each asset, its current location, any liens or mortgages on it, and its estimated fair market value.

Once these documents have been filed with the court, it can take anywhere from several months to over a year before your estate is settled after selling your home in Illinois.

Settling an estate after selling a home in Illinois can be a long and tedious process depending on the size and complexity of the estate. It is important to understand that many factors play into the timeline of settling an estate, including the size of assets to be distributed, tax obligations, and difficulty finding beneficiaries.

Generally speaking, the process of settling an estate can take anywhere from six months to two years or more. The executor of the estate is responsible for organizing all financial documents and assets, filing any necessary paperwork with state or local authorities, notifying creditors, paying debts and taxes, distributing assets among heirs or beneficiaries, and filing court documents to close out the estate.

It is important during this period to keep accurate records to ensure that all parties are properly compensated for their share of inheritance. Additionally, it is critical to consult with an experienced attorney who can guide you through each step of the way in order to ensure that the settlement process runs smoothly.

When probating an estate in Illinois, there are certain costs associated with the process. These costs vary and depend on the complexity of the estate.

Generally, fees include court filing fees, executor fees, appraisal and attorney fees. In addition to these standard fees, additional costs may apply such as bond premiums if a bond is required or estate administration tax if the gross value of the estate exceeds $100,000.

The cost of selling a home in an estate can also be significant depending on the state of the housing market. It is important to factor in all potential costs when exploring how long it will take to settle an estate after selling a home in Illinois.

Yes, there is a time limit to settle an estate in Illinois when selling a home. Generally, the process can take between three and six months, depending on the complexity of the estate.

The first step is to obtain a Certificate of Authority from the Circuit Court Clerk's office which will grant you authority to represent the estate and conduct legal business on their behalf. Next, any debts must be paid, such as mortgages and other liens.

After this is done, you must have all heirs sign documents that transfer ownership of the property to new owners or disposes of it according to instructions in the will. Depending on the size and complexity of the estate, this process can take anywhere from several weeks to several months before title transfers are completed and funds are distributed to beneficiaries.

Finally, all taxes must be paid including income tax returns for both the decedent and any heirs who received assets from the estate. If these steps are taken properly and quickly, settling an estate in Illinois after selling a home should take no longer than six months.

Settling an estate in Illinois can be a lengthy process, particularly if a home is involved. The first step is to appoint an executor of the will.

This individual will be responsible for paying off any debts or taxes that need to be paid and distributing the remaining assets according to the decedent's wishes. It is important for the executor to have the necessary documentation available, such as a death certificate and a copy of the will.

Next, all property must be appraised so that its value can be determined. Depending on the size of the estate, this process can take up to several weeks or even months.

After all assets have been valued, they must then be liquidated in order to pay off any outstanding debts or taxes. If a home was part of the estate, it must first be placed on the market and sold before any other assets are distributed.

This process can take several months before everything has been settled and all money has been distributed according to the decedent's wishes.

The length of time it takes to settle an estate after selling a home in Illinois can vary, but most take approximately six months to one year. The time frame for settling an estate is determined by the complexity of the assets, property and liabilities associated with the estate.

Factors such as probate court hearings, tax filings, payment of debts and other activities related to closing out an estate can affect the settlement timeline. Depending on the individual circumstance, some estates may take longer than a year to settle.

Additionally, if there are disputes or disagreements among heirs or beneficiaries regarding distribution of assets, this may extend the process even further. It is important to consult with an attorney and discuss all aspects of settling your estate before making any decisions as this will help ensure that everything is done properly and efficiently.

When settling an estate without a will near Illinois, the timeline can vary depending on the complexity of the estate and the amount of time it takes to sell a home. Generally, the process of settling an estate without a will in Illinois can take anywhere from six months to two years.

This timeline begins when you list your home for sale and can include steps such as determining heirs, collecting assets, paying creditors, filing tax returns and distributing remaining assets to beneficiaries. It is important to understand that selling a home is only part of settling an estate and that other tasks must be completed before closure.

An experienced real estate agent or attorney can help guide you through this process and answer any questions you may have about how long it takes to settle an estate without a will near Illinois.