Navigating Kentucky's probate laws and real estate can be daunting for many individuals, especially if they are not familiar with the process. The probate process is the legal procedure of distributing a deceased person’s assets to their beneficiaries and creditors.

In Kentucky, probate proceedings are typically handled in the county where the decedent resided at the time of their death. Understanding how the Kentucky probate process works is essential for individuals who want to ensure that their heirs receive what they are entitled to without delays or issues.

Furthermore, understanding inheritance advances and avoiding probate are important considerations when dealing with real estate in Kentucky. In order to effectively navigate Kentucky's probate laws, it is necessary to understand how the court system distributes a deceased person’s estate and how inheritance advances may be used to avoid going through the lengthy court-supervised probate proceedings.

Navigating the probate laws of Kentucky can be a complex and daunting process, but understanding the state's inheritance advances and how to avoid probate are key components of the journey. Common questions about Kentucky probate include what is intestacy, what is an heirship affidavit, who has authority to administer an estate, what are the requirements for filing a will in court and how do you transfer real estate without going through probate.

Intestacy refers to when someone dies without a will; typically, their assets would need to go through the probate court process. An heirship affidavit is a document signed by those with knowledge of the deceased's family structure that states who is legally entitled to inherit their assets.

Heirship affidavits can help speed up the probate process by allowing assets to be distributed without going through all of the steps required by the courts. The executor or personal representative of an estate is typically appointed by a probate judge and given authority to gather assets, pay debts and distribute property according to state law.

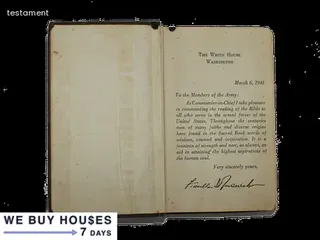

Requirements for filing a will in Kentucky involve submitting it to the county clerk's office with proof that it was signed by two witnesses or notarized. Finally, transferring real estate without going through probate may involve gifting prior to death or placing assets into a trust so that they don't have to be processed through court proceedings.

It is important for Kentucky residents to be aware of the state’s probate laws and understand how they can affect real estate inheritance.

It is essential to seek legal advice when navigating these complex laws as it is easy to make mistakes without proper guidance.

It is also important to understand how inheritance advances work, as well as how to avoid probate in order to ensure that assets are passed on quickly and efficiently.

Although individuals may feel confident enough to handle their own probate matters, it is always advisable to consult a qualified attorney who specializes in estate planning and probate law in order to safeguard their interests and protect their rights.

Navigating Kentucky's probate laws and real estate can be a complex process, but understanding the key steps to begin probate in Kentucky will help to ensure that inheritance advances are maximized and that probate is avoided. The first step is to consult a qualified attorney or other legal professional who specializes in Kentucky probate law.

This is important because they will be able to explain all of the relevant laws and regulations specific to Kentucky, as well as provide advice on how best to proceed. Next, it is essential to identify any living relatives of the deceased who are entitled to an inheritance, as their right to a portion of the estate must be taken into account.

Once this has been established, it will be necessary to determine if there is any real estate involved and if so what type of title holds claim over it. Finally, all debts owed by the deceased must be paid before any inheritance advances can be distributed among heirs.

Taking these steps when beginning the probate process in Kentucky will help ensure that everything goes smoothly during this difficult time.

Navigating Kentucky's probate laws and real estate can be a complicated process, especially when it comes to understanding inheritance advances and avoiding probate. For many families, the question of whether or not a formal probate is necessary in Kentucky is an important one.

To make an informed decision, it is important to understand what factors are taken into account when determining if a formal probate is required in Kentucky. One of the first considerations is the size of the estate; if the total value of all assets is less than $25,000, then no formal probate will be necessary.

Additionally, if all heirs agree on how to distribute the estate's assets without court supervision then a formal probate may not be required either. Understanding each of these conditions can help families make an informed decision about whether or not they need to go through with a formal probate in Kentucky.

Knowing that certain estates do not require a formal probate can help family members avoid unnecessary costs and save time in their efforts to settle inheritance issues in Kentucky.

In Kentucky, it is important for individuals to understand the differences in non-probate and probate property types. Non-probate assets are those that are transferred outside of probate courts and do not require a will or trust.

Examples of non-probate assets include life insurance policies, joint tenancies with right of survivorship, payable on death accounts, and transfer on death accounts. On the other hand, probate assets are those that must be distributed through the court system.

These assets may include real estate ownership, bank accounts, stockholderships and other investments. In addition to understanding what is considered a non-probate asset versus a probate asset in Kentucky, it is also important to understand how inheritance advances work.

Inheritance advances are funds given to beneficiaries before the estate is settled by the court or before any remaining debts have been paid off. This can cause financial strain for beneficiaries if they do not plan accordingly and could even result in legal action taken against them if they cannot pay back the advance amount plus interest in a timely manner.

Therefore, it is essential for individuals to have an understanding of both non-probate and probate property types as well as inheritance advances when navigating Kentucky's probate laws and real estate matters.

When it comes to navigating Kentucky's probate laws and real estate, understanding inheritance advances and avoiding probate can be a complicated task. Small estate administration is an option for those who have inherited property in Kentucky, but determining when it is appropriate can be challenging.

It is important to understand the differences between small estate administration and regular probate when deciding which is right for you. Small estate administration often requires fewer legal steps than regular probate, meaning it can take less time for the process to be complete.

Generally, a small estate in Kentucky requires that the deceased's assets must not exceed $100,000 before taxes or liens, but this amount may vary depending on the county where the decedent resided. In addition, if there are any debts owed by the decedent they must be paid out of the estate prior to any distribution of assets to heirs.

Knowing when a small estate administration is appropriate ensures that all parties involved can benefit from avoiding lengthy probate proceedings.

Navigating Kentucky’s probate laws and real estate can be a complicated process, especially when it comes to understanding inheritance advances and avoiding probate. To gain a better understanding of the Kentucky probate process, it is important to become familiar with the relevant terminology associated with it.

Inheritance advances are funds provided to an heir in anticipation of their inheritance. An heir may need an inheritance advance if they need immediate funds due to medical bills or other expenses before their inheritance is distributed.

Probate is the legal process used to determine the validity of a will and distribute assets according to its instructions after someone dies. Other key terms related to the Kentucky probate process include intestacy, which refers to when someone dies without a will; executor, who is appointed by the court and responsible for settling an estate; administrator, who is appointed by the court if there is no executor; fiduciary duty, which requires that all decisions made during administering an estate must ultimately benefit the beneficiaries; and guardian, who takes on responsibility for minor children or incapacitated adults.

Becoming familiar with these terms can help those navigating Kentucky’s probate laws and real estate understand inheritance advances and avoid probate.

Initiating the Kentucky probate process can be an intimidating prospect, but with a basic understanding of the law and estate planning tools, it is possible to make sure that your loved ones' wishes are honored. It is important to know what steps need to be taken in order to begin the probate process in Kentucky, as well as how inheritance advances work and how to avoid probate.

First, you will need to understand the basics of Kentucky's probate laws, including when and how they apply. Then you should familiarize yourself with the different types of estate planning tools available in Kentucky such as wills, trusts, and powers of attorney.

Next, you will need to determine who will act as executor or administrator of the estate and notify them that they have been appointed. Once this has been done, it is important to collect all necessary documents related to the deceased person's assets and debts as well as any other pertinent information needed for filing a petition for probate.

Finally, you should research your options regarding inheritance advances, which are loan-like arrangements that allow family members or other heirs access to funds while their case is pending in court. Knowing these steps can ensure that the KY probate process is carried out properly so that inheritance rights are upheld and assets are distributed according to your loved one's wishes.

Navigating the probate process in Kentucky can be quite a challenge, especially when it comes to inheritance advances and avoiding probate. It is important to understand what happens after the hearing, as this will help you better navigate the process.

After the hearing, an executor or administrator of the estate is appointed by the court and given authority to administer the estate according to law. This includes collecting debts from creditors, determining who should receive assets from the estate, filing taxes on behalf of the deceased, and distributing assets to the appropriate beneficiaries.

Additionally, it is important to make sure all paperwork related to inheritance advances is completed properly and filed with the court in order for them to be approved. Finally, there are certain steps that must be taken in order to avoid probate entirely or minimize its effect on an estate.

These may include making sure certain property is held jointly with right of survivorship or having a living trust established prior to death. Understanding these post-hearing actions can help ensure a smooth transition through Kentucky's probate process.

When navigating Kentucky's probate laws and real estate, it is important to understand the necessity of obtaining a federal tax ID number and bank account. During probate proceedings, this can help ensure that taxes are properly collected on any inherited assets.

Additionally, it can provide a secure place to hold funds that were obtained from an inheritance advance. Furthermore, a tax ID number and bank account are also necessary for filing the paperwork required by the court in order to receive an inheritance.

Without them, the entire process can be significantly delayed or even stopped altogether. It is important to note that setting up these accounts does not have to be a complicated process and can even be done online with minimal effort.

Ultimately, having a federal tax ID number and bank account during Kentucky probate proceedings is essential for ensuring that everything runs smoothly and there are no unexpected issues or delays.

Accurately filing an inventory of the estate is a critical part of navigating Kentucky’s probate laws and real estate. During probate, a court-appointed personal representative must list all assets owned by the deceased person and file a copy with the court.

This document serves as proof that the person who died left behind certain property and money, and is used to determine how it should be distributed among the heirs. It is important to be precise when filing an inventory because inaccuracies can lead to delays in the probate process or even disputes between heirs.

In addition, if any assets are not listed on the official inventory, they may not be eligible for distribution to heirs after probate has concluded. For these reasons, it is essential to take time during Kentucky’s probate proceedings to ensure that all necessary documents are filled out correctly and completely.

Navigating Kentucky's probate laws and real estate can be confusing. It is important to understand the process of inheritance advances and how to avoid probate in order to protect assets.

One of the most effective strategies for identifying and protecting assets is to create a detailed list of all inheritance items, including real estate, investments, bank accounts, and other property. Before beginning the process of transferring assets, it is important to research Kentucky state laws regarding probate and estate planning in order to ensure that all legal requirements are met.

Additionally, if there are any disagreements between family members or beneficiaries during asset distribution, it is important to seek guidance from a qualified attorney who specializes in Kentucky probate law. Another strategy for avoiding probate is setting up a trust fund prior to death, which allows for more control over asset distribution.

Finally, it is essential for heirs to accurately report their inheritances on tax returns in order to avoid any potential penalties or fees associated with delayed filing. By understanding the process of navigating Kentucky's probate laws and real estate regulations, individuals can ensure that their assets remain protected throughout the inheritance transition process.

When navigating Kentucky's probate laws and real estate, it is important to understand the debts owed by the decedent. Before any assets can be distributed, any debts must first be paid off.

This includes taxes, credit card bills, mortgages, and other loans. During probate proceedings in Kentucky, creditors have the right to file a claim against the estate of the decedent.

The executor has a legal obligation to satisfy all valid claims before distributing assets to the heirs. If there are insufficient funds in the estate to cover all debts, then those creditors must wait until more money becomes available at a later date.

It is important for heirs to understand that if they receive an inheritance advance from a company or law firm (which is not an uncommon practice), then that money will need to be repaid out of their inheritance after all debts have been settled. This could significantly reduce their overall share of assets if they are not careful when planning for the future.

Navigating Kentucky's Probate Laws and Real Estate can be a daunting task, with many different factors to consider. One of these important considerations is the Creditors’ Claim Period during KY Probate.

It is a critical time in the process as creditors have a certain amount of time to file claims against an estate during probate. The timeframe varies depending on the type of claim, but generally lasts between four-six months after the date of death.

During this period, creditors have the right to present claims for debts owed by the deceased at any point until the end of this period. If unsecured debts are not paid prior to this period ending, they could potentially go unpaid or become part of the estate’s assets when distributed among heirs.

Therefore, it is important for executors to weigh all creditor claims carefully and act accordingly before distribution of assets so that all debtors receive their due payments. Inheritance advances may also need to be considered as part of navigating through KY probate laws and real estate.

Understanding how inheritance advances work can help reduce or even avoid probate entirely in some cases, allowing heirs to quickly receive their inheritance without going through prolonged court proceedings or other delays associated with probate processes.

Navigating Kentucky's probate laws and real estate can be a complex process. It is important to understand the potential consequences of disallowing a claim during probate in order to ensure that inheritance advances are maximized and that probate is avoided as much as possible.

When a claim is disallowed, it means that the claimant will not receive any of the estate or property being claimed. This can be particularly problematic if there was substantial money, real estate, or other valuable assets in dispute.

Additionally, if a deceased individual did not have a will or trust in place prior to their death, disallowing a claim could lead to disputes between relatives over who should receive what part of the inheritance. Furthermore, disallowing a claim could result in costly court proceedings for all parties involved if the matter cannot be resolved outside of court.

In order to minimize complications and maximize inheritance advances, it is important for individuals navigating Kentucky’s probate laws and real estate to understand all potential consequences prior to making decisions about disallowing claims during probate.

In Kentucky, it is important to understand and recognize possible will contests during probate proceedings in order to ensure that the decedent's estate is properly distributed. Will contests are generally initiated when an individual or entity believes that a will was not validly executed, or that the testator was unduly influenced.

A variety of factors may contribute to a successful will contest, including lack of testamentary capacity at the time of execution and forgery. Additionally, any interested party can challenge the appointment and/or removal of an executor or administrator.

It is also important to consider Kentucky's inheritance advances which allow individuals to receive money from a deceased relative's estate while it is still in probate. Understanding all aspects of Kentucky's probate laws and real estate law can be difficult; it may be helpful to consult with an experienced attorney who can guide you through the process.

Navigating Kentucky's probate laws and real estate can be complicated when trying to understand inheritance advances and how to avoid probate. It is essential to understand the interplay between these two components in order to ensure that any transactions are done properly.

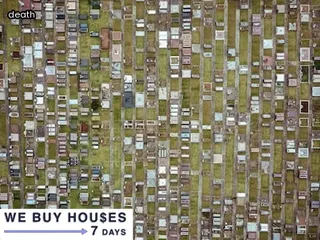

In Kentucky, real estate transactions are handled differently than other kinds of assets during the probate process. When a person passes away, their real estate must go through probate before it can be transferred to a beneficiary, which can take a significant amount of time.

Inheritance advances are an option for those who wish to receive money quickly from the deceased’s estate without having to wait for it to go through probate court. However, it is important for individuals to know the potential risks involved with this process and how they may affect their inheritance.

For example, if the deceased had mortgages or liens attached to his or her property, then those debts must be paid off before an inheritance advance can be given out. Additionally, taking out an inheritance advance may reduce or eliminate any remaining funds that could have been available after the debts have been paid off.

Taking all of this into account can help individuals make informed decisions when navigating Kentucky's probate laws and real estate in order to understand inheritance advances and avoid going through probate court.

When navigating Kentucky's probate laws and real estate, understanding inheritance advances and avoiding probate are important steps to ensure compliance with state statutes. It is essential to understand the different types of probate proceedings available in Kentucky, such as summary administration and regular administration.

Additionally, it is important to be aware of the various notices that a person must file when going through the probate process. Furthermore, one should be aware of any applicable laws or regulations pertaining to inheritance advances, as these may help minimize or avoid the need for a full probate proceeding.

When dealing with real estate assets in Kentucky, it is necessary to familiarize oneself with any transfer taxes or sales taxes that may apply to the transaction. Understanding these requirements can help ensure compliance with all applicable state statutes.

Navigating Kentucky's probate laws and real estate can be a complicated and time-consuming process. It is essential to understand the nuances of inheritance advances in order to make sure that your assets are properly transferred when you pass away.

Knowing how to avoid probate will help ensure that your loved ones receive the assets they are entitled to without unnecessary delays or legal complications. To facilitate a smooth transition, it is important to be aware of best practices for Kentucky's probate process.

This includes researching state laws and regulations, understanding the differences between intestate succession and testate succession, creating a valid last will and testament, and properly executing all paperwork required for estate administration. Additionally, those who plan ahead should consider setting up trusts or other means of asset protection in order to minimize taxes and maximize the amount that their beneficiaries will receive.

By following these steps, individuals can ensure that their assets are passed on according to their wishes in an efficient and timely manner.

In Kentucky, real estate does go through probate. Probate is the legal process of administering a deceased person’s estate by transferring ownership of property and other assets to their heirs and beneficiaries.

The transfer of real estate can be complicated and time-consuming, especially when it comes to inheritance advances or avoiding probate altogether. Understanding the laws that govern Kentucky's probate system can help ensure a smooth transition for all parties involved.

To ensure that real estate is properly transferred after death, it is important to understand how inheritance advances work, whether or not you have the right to contest a will, and what steps should be taken if you want to avoid probate altogether. There are also certain exemptions that may apply in specific cases which could further simplify the process.

Knowing your rights and understanding the necessary steps can help make navigating Kentucky's probate laws and real estate easier for all involved.

Yes, you can sell a house in probate in Kentucky. The process of selling a house in probate requires navigating the state's probate laws and real estate regulations. It is important to understand how inheritance advances work and the steps to take to avoid probate.

This article will provide an overview of these key elements related to selling a house in probate in Kentucky. First, it is important to have an understanding of Kentucky's probate laws. These laws dictate the procedures for handling the distribution of assets from an estate, including the sale of real estate.

It is also important to be aware of any real estate regulations that may affect the sale of a property in probate. Next, it is helpful to understand how inheritance advances work and how they could impact a potential sale. Inheritance advances are funds that are paid out by an insurance company or other lender before any assets are distributed through an estate.

Finally, it is essential to know what steps can be taken to avoid going through the process of probate when selling a house in Kentucky. An experienced lawyer can help guide you through this process and answer any questions you may have about selling a house in probate in Kentucky.

When it comes to navigating Kentucky's complicated probate laws, it is important to understand the process of inheritance advances and property sales. In most cases, all heirs must agree to sell property in Kentucky.

This means that if one heir objects to selling the property, then the sale cannot go ahead until a resolution has been found. In order for an heir to agree to a sale, they must understand their rights as well as any tax implications that may be involved.

Furthermore, when dealing with inherited real estate in Kentucky, it is vital to know how the state’s probate laws apply and whether or not an inheritance advance will be necessary. Understanding these various factors before engaging in a real estate transaction can help ensure that all heirs are on the same page and that any probate issues are avoided.

In Kentucky, transferring property after death is a complex process governed by the state's probate laws. The transfer of real estate or other assets is usually done through a legal process called probate.

Depending on the circumstances of the deceased, property may have to go through probate before it can be transferred. This process can be lengthy and costly and typically involves filing an application with the court, having an executor appointed to handle the deceased's estate, and then having the court approve the distribution of assets.

To avoid the expensive and time-consuming probate process, many people opt for inheritance advances or other methods of transferring property outside of probate. An inheritance advance is when a lender provides money from a deceased person's estate before it has gone through probate.

These advances are not always available; lenders decide whether they will provide them on a case-by-case basis. Additionally, some states have specific laws regulating inheritance advances that should be taken into account when considering this option.

Ultimately, navigating Kentucky's probate laws and understanding inheritance advances are key for successfully transferring property after death in Kentucky without going through probate.

A: The probate process in Kentucky involves filing the decedent's will with the court, proving that it is valid and authentic, providing notice to heirs and devisees, collecting and inventorying assets, paying debts and expenses, and distributing assets according to the will or state law. A Probate Lawyer can help guide you through this process by providing advice on probate procedures, Inheritance Law issues, tax matters, asset distribution issues, and other related matters.

A: Federal Estate Taxes apply to estates above a certain value. In Kentucky, individuals must file an estate tax return if their gross estate, plus adjusted taxable gifts and specific exemptions exceeds the filing threshold set by federal law. A Probate Lawyer can help advise on how much of an estate is subject to taxes, as well as provide guidance on filing the necessary paperwork.

A: In Kentucky, when property is held in joint tenancy, both tenants have an equal right to the whole property. Upon death of one joint tenant, the surviving joint tenant automatically inherits the deceased's interest in the property without probate. As such, inheritance tax is not applicable as there is no transfer of ownership upon death. Additionally, due to the same principle, federal estate tax does not apply either as there is no transfer of property upon death. A probate lawyer can help ensure a proper and smooth transfer of title to the surviving joint tenant according to Kentucky laws.

A: In Kentucky, the intestacy laws dictate how real property is passed upon death and what kind of tenancy is established. When an individual dies without a will, the property passes to their heirs and is typically held under a “Tenancy in Common” agreement. This type of tenancy provides each heir with equal rights to ownership and management, but allows them to pass on their share at death. A probate lawyer can help ensure that all legal requirements are met when it comes to estate planning and real estate matters.

A: A Living Trust in Kentucky can provide protection for real property from potential lawsuits by placing the title to the property into the trust, which is managed by a trustee. This allows the spouse and other beneficiaries entitled to inherit the property after death to avoid probate and any associated delays or expenses of a lawsuit. The trust also ensures that all taxes due on the transfer of real property are paid on time.

A: Inherited real estate in Kentucky is subject to estate tax, but not income tax. However, any income generated from the property after inheritance may be subject to federal and state income taxes.

A: An Inheritance Advance is a way to access funds from an estate without having to go through the lengthy and expensive probate process. A Probate Lawyer can provide assistance with obtaining an Inheritance Advance, which allows heirs to receive their inheritance quickly and without the need for court involvement.

A: Inheritance Advances are typically used by individuals inheriting real estate in Kentucky in order to access a portion of the inheritance before probate is completed. A Probate Lawyer can help identify any potential issues or challenges with this process and ensure that all legal requirements are met.

A: Navigating Kentucky's probate laws and real estate can help avoid probate by understanding inheritance advances, the Inheritance Tax and Federal Estate Tax implications of Joint Tenancy, and how a Living Trust can protect real property in Kentucky from potential lawsuits. A Probate Lawyer can provide assistance in understanding these issues and helping to strategize an appropriate solution.

A: In Kentucky, a married couple can create a joint tenancy with right of survivorship for their personal property, which allows the surviving spouse to inherit the deceased's property without having to go through probate. During this process, a Probate Lawyer can help ensure that all necessary legal documents are correctly filed and any potential inheritance taxes or federal estate taxes are properly handled.

A: Avoiding probate is an important way to protect real estate inheritance in Kentucky. Probate can be a lengthy, expensive and public process and assets distributed through it are exposed to creditors and lawsuits. Setting up a living trust or transferring the property into joint tenancy are two strategies for avoiding probate in Kentucky that can help protect inherited real estate from potential creditors and lawsuits. An experienced Kentucky probate lawyer can provide advice on how best to avoid probate when inheriting property in the state.

A: An inheritance advance is an option available to parties who are beneficiaries of an estate. It allows them to access a portion of their inheritance prior to probate proceedings being finalized. This can be especially helpful when real estate is involved, since it may take several months or even years for probate proceedings to be completed. A probate lawyer can help guide you through the process of obtaining an inheritance advance in Kentucky, and ensure that you receive the full amount due to you under state and federal law.

A: When probating a will in Kentucky, there may be state and federal taxes that must be paid. Inheritance Tax is imposed on the estate of each decedent, while Federal Estate Tax may apply to certain estates. Additionally, estate administration costs can also be taxed. An experienced Probate Lawyer can help to ensure all applicable taxes are properly accounted for and paid.

A: An Inheritance Advance is a loan against the proceeds of an estate and can be helpful in navigating the probate process in Kentucky. By using this form of financing, heirs and beneficiaries may be able to avoid probate court altogether and receive their inheritance funds faster. A probate lawyer can provide guidance on understanding the laws related to inheritance advances and real estate in order to make the best decision for you and your family.