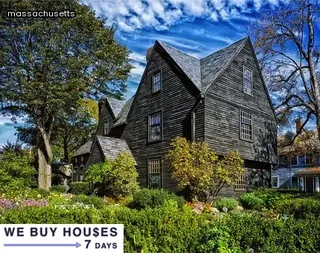

Foreclosure is a complicated process, and the laws and timelines vary from state to state. In Massachusetts, there are specific elements that must be taken into account when dealing with a foreclosure.

Firstly, foreclosures in Massachusetts are nonjudicial, meaning they take place outside of court. Secondly, it's important to understand the timeline of the foreclosure process; this typically begins with notification of default by the lender before proceeding to an auction sale.

Additionally, Massachusetts requires lenders to provide borrowers with at least 90 days notice prior to selling their property at auction in order to allow them time to find a solution with their mortgage lender. Finally, Massachusetts offers certain means of protecting borrowers from foreclosure through programs such as 'Right of Redemption' which allows homeowners more time to pay off any outstanding debt on their home after it has been sold at auction.

Understanding these key elements of foreclosure in Massachusetts is essential for anyone looking to navigate the processes associated with foreclosure in this state.

In Massachusetts, the preforeclosure process is a crucial part of the overall foreclosure timeline. Understanding the relevant rules and regulations can help alleviate stress and ensure that all parties are treated fairly.

The first step in understanding this process is to become familiar with the legal notices required by state law. These notices will be sent to borrowers who have fallen behind on their mortgage payments, informing them of the impending foreclosure action.

Once borrowers receive these notices, they will have a certain amount of time to respond and work out an arrangement with their lender. If no arrangement is reached, then lenders may proceed with filing a Complaint for Foreclosure at the local court house.

This document must be served to borrowers in order for foreclosure proceedings to move forward properly. Though there is no guarantee that a loan modification or other agreement can be made at this stage, having an understanding of Massachusetts’ preforeclosure process can provide homeowners with much-needed peace of mind during this difficult period.

The foreclosure process in Massachusetts follows a timeline that consists of multiple stages. It starts with the pre-foreclosure stage, which is when the homeowner has missed payments and the lender has initiated proceedings to repossess the home.

This is followed by the public auction stage, in which a third party can purchase the property from the lender at a public auction. If this auction does not result in a sale, then the property will enter into REO or real estate owned status, which means that it has been taken back by the lender.

The final stage of foreclosure is when legal action is taken against the borrower and title to the property is transferred to another party. Each stage of foreclosure carries its own set of laws and regulations that must be followed, making it important for homeowners to understand all aspects of Massachusetts foreclosure law before pursuing any course of action.

Foreclosure can be a difficult and complicated process, but it can also provide homeowners with the opportunity to get out of an unmanageable mortgage situation. When considering foreclosure, it is important to understand both the risks and benefits associated with the process.

Foreclosure can have a negative impact on credit scores, making it more difficult to qualify for loans in the future. Additionally, foreclosures often come with additional costs such as legal fees and title insurance expenses.

On the other hand, foreclosure can bring financial relief in some cases – allowing homeowners to avoid costly debt payments that would otherwise add up over time. Additionally, lenders may offer short sales or deed-in-lieu of foreclosure options which may reduce or eliminate the debt owed by a borrower.

Ultimately, understanding Massachusetts foreclosure laws and timelines is essential before making this potentially life-altering decision.

Mortgage loans are a type of loan that is secured by a borrower's real estate property. They are typically provided by banks and other financial institutions, and involve an agreement between the lender and the borrower to use the property as collateral for the loan.

The loan amount is usually determined by taking into account the value of the property, the borrower’s creditworthiness, and any applicable taxes or fees associated with the transaction. Mortgage loans are commonly used for purchasing homes or refinancing existing mortgages.

Interest rates on mortgage loans vary based on factors such as current market conditions, credit score, income level, and down payment amount. Borrowers must generally make regular payments over a set period of time to pay back their mortgage loan in full.

When borrowers fail to make these payments, they may be subject to foreclosure proceedings according to state laws.

Falling behind on a mortgage payment can have serious financial implications, and in the state of Massachusetts, these implications can be especially severe due to the strict laws and timelines governing foreclosure. Homeowners in Massachusetts need to understand the potential consequences of missing their payment and how they can avoid them.

If you don't make your mortgage payments on time, you risk having your home taken away from you through a process called foreclosure. This means that all equity you've built up in your property may be lost and you'll also be responsible for any remaining balance on the loan.

Foreclosure proceedings in Massachusetts can begin as soon as 45 days after defaulting on a payment, so it's important to take action quickly if you're unable to make your payments. Additionally, homeowners should be aware that even if they reach a resolution with their lender such as refinancing or loan modification, there could still be tax implications depending on their particular situation.

Taking a proactive approach to understanding the laws surrounding foreclosure in Massachusetts is essential for anyone who has fallen behind on their mortgage payments or is at risk of doing so.

When exploring breach letter requirements in Massachusetts, it is important to understand the foreclosure timeline and laws. In Massachusetts, a lender must provide a borrower with a notice of intent to foreclose that contains certain required information.

This notice must be sent at least ninety days before initiating the foreclosure process. The breach letter is considered part of the notice of intent and must include facts demonstrating that the borrower has defaulted on their loan agreement.

The breach letter must also contain language informing the borrower of their right to cure the default and any other options available to them. It is important for lenders to follow all requirements when sending out breach letters in order to ensure a successful foreclosure process in accordance with Massachusetts laws.

In Massachusetts, the preforeclosure process begins when a homeowner receives a notice of default from their lender. This notice informs the homeowner that they are in violation of their mortgage agreement and must take action to remedy the situation or risk foreclosure.

It is important for homeowners to understand and comply with all preforeclosure notice requirements in order to avoid foreclosure. In Massachusetts, lenders must provide several notices prior to initiating foreclosure proceedings, including a Notice of Default, Right to Cure Notice, and Notice of Foreclosure Sale.

Each document serves an important purpose and helps ensure that homeowners have sufficient time to remedy their default and avoid foreclosure. The Notice of Default contains information about the loan balance, payment due date, any late fees charged, and other details.

The Right to Cure Notice gives homeowners an opportunity to pay off their delinquency or otherwise negotiate with their lender in order to cure the default. Finally, the Notice of Foreclosure Sale includes information about the scheduled auction date and other relevant details regarding the sale itself.

Understanding these preforeclosure notices is key for homeowners who want to avoid foreclosure in Massachusetts.

The foreclosure process in Massachusetts begins when the lender files a Complaint with the court. Once the Complaint is served on the borrower and a Summons, the borrower has 20 days to respond.

If they fail to do so, then a Default Judgment may be entered against them. The court is then responsible for setting up a sale date for the property, which must be at least 10 days after the judgment was entered.

After that date, the lender can take possession of and sell the property at auction. During this time period, homeowners have an opportunity to work out a payment plan with their lender or file for bankruptcy before their home is foreclosed upon.

The state also provides many resources such as loan modification programs and housing counseling services for homeowners who are facing foreclosure in order to help them avoid it altogether.

Investigating Massachusetts state foreclosure laws is an important step in understanding the process of foreclosure. Knowing the laws and timelines that govern foreclosure in Massachusetts can help protect homeowners from unfair or illegal practices during the proceedings.

The comprehensive guide to Massachusetts foreclosure laws and timelines provides a thorough overview of the legalities surrounding foreclosures. It covers topics such as who has authority over the process, what types of properties are subject to foreclosure, when a homeowner may be eligible for relief, what procedures must be followed, and how much time is allotted for each stage in the process.

Additionally, this guide includes information about filing appeals and how to access resources to protect your rights as a homeowner. With all this knowledge at your fingertips, you can make informed decisions about managing a potential or ongoing foreclosure situation in Massachusetts.

The foreclosure process varies in length depending on the state, but in Massachusetts it typically begins with the lender filing a complaint with the court. After this initial step, the homeowner has 20 days to respond.

If the homeowner does not respond, then a default judgment will be entered and the house can go up for auction. The auction must be held at least 21 days after notice is given of the sale.

In most cases, there is an additional 14 day period for redemption before ownership officially transfers to the new owner. This means that from start to finish, it can take more than two months for a foreclosure to take place in Massachusetts.

Additionally, if a homeowner is able to reach an agreement with their lender prior to a foreclosure sale taking place, then this can reduce the amount of time it takes for them to be evicted from their home.

In Massachusetts, a homeowner has the right to redeem their property after foreclosure. This redemption period allows a homeowner to reclaim their home by paying off the debt owed to the lender or investor that purchased their property at the foreclosure sale.

The length of this redemption period will depend on several factors, including whether or not the mortgage is a judicial or non-judicial foreclosure. Generally, if it is a judicial foreclosure, the redemption period lasts one year while non-judicial foreclosures only allow for three months of redemption.

It is important to note that during this time period interest accrues on the amount due and must be paid in full by the end of the redemption period in order for the homeowner to reclaim their property. As such, even if it does not appear that a homeowner can afford to pay off their debt within this timeframe, they should still seek out legal advice as soon as possible in order to explore their options and determine if there are any other ways they can redeem their home and avoid losing it entirely.

Eviction is a common consequence of foreclosure, but the specifics vary from state to state. In Massachusetts, understanding the nuances of foreclosure laws and timelines is key to grasping what eviction looks like in the wake of such an event.

Knowing the details of foreclosure proceedings can help those facing this difficult situation to plan accordingly, and be aware of their rights in the process. Massachusetts law requires that any foreclosures must be done through court order, which includes a notice being sent to the property's occupants that provides details about what will happen next.

Additionally, there are time limits imposed on how quickly a lender or buyer can take possession after a sale or foreclosure deed has been recorded. If a borrower does not vacate their property within this timeframe, then a landlord may begin eviction proceedings with assistance from the court system.

In such cases it is important for borrowers to understand their legal rights and obligations during this difficult process.

Navigating the complexities of Massachusetts foreclosure laws and timelines can be a daunting task, especially without the help of a professional. An experienced Massachusetts foreclosure lawyer can provide invaluable assistance during this difficult process.

By working with an attorney knowledgeable in all aspects of foreclosure law, homeowners can gain an understanding of their rights and options, as well as pursue legal action if necessary. A lawyer will also help individuals remain within the bounds of their state’s foreclosure laws and timelines and ensure they are not taken advantage of.

Further, an attorney is able to provide advice on how to negotiate with lenders in order to come to a mutually beneficial agreement. Thus, seeking assistance from a qualified professional is highly recommended for anyone going through a potential foreclosure in Massachusetts.

Preforeclosure is an important concept to understand when discussing Massachusetts foreclosure laws and timelines. Preforeclosure occurs when a homeowner defaults on their mortgage payments, and the lender begins the process of reclaiming the property or negotiating a payoff agreement.

During preforeclosure, homeowners can take proactive steps to avoid foreclosure, such as seeking loan modifications or refinancing options. It is also possible for third parties to purchase the home from the lender during this period, which can help homeowners avoid foreclosure and remain in their homes.

The preforeclosure stage is often seen as a window of opportunity for homeowners to regain control of their finances and save their home from foreclosure. By understanding Massachusetts foreclosure laws and timelines related to preforeclosure, homeowners can take the necessary steps to protect their rights and interests throughout the process.

The foreclosure process in Massachusetts is a complicated one, and it's important to understand the timeline and laws associated with it. Foreclosure proceedings in Massachusetts may begin when a homeowner defaults on their mortgage payment.

Once this happens, the lender may file a complaint with the court - typically within 90 days of the default - detailing why they are seeking to foreclose on the home. The borrower then has 20 days from receiving notice of the complaint to respond and set forth any defenses they have to foreclosure.

After this response period is over, the court will hold a hearing to determine whether or not the foreclosure should proceed. If it does, the court must issue an order authorizing a sale of the property.

From there, lenders can advertise and schedule an auction for bidding on the property. The highest bidder at these auctions becomes responsible for paying off any remaining debt owed on the property, as well as costs associated with completing a successful foreclosure sale.

It's important to remember that while Massachusetts law allows lenders to pursue foreclosure proceedings against homeowners who are behind on payments, they are still required to provide borrowers with ample opportunity to cure their default before proceeding further down this path.

In Massachusetts, a homeowner must usually miss 4 months of mortgage payments before their lender can start the foreclosure process. This is known as the pre-foreclosure period, and it allows homeowners to negotiate with the lender for a resolution, such as a loan modification or repayment plan.

If no resolution is reached during this period, the lender can initiate a foreclosure action against the homeowner. The timeline for foreclosure in Massachusetts depends on whether the loan was taken out before or after April 5, 2012.

For loans taken out prior to that date, legal proceedings are initiated as soon as 4 missed payments have been recorded. Afterwards, the timeline progresses through various stages of review by attorneys and judges until foreclosure is complete.

For loans taken out after April 5, 2012, there is an additional 90 day requirement set forth by state law before any legal proceedings can begin. Regardless of when the loan was taken out, Massachusetts foreclosures typically take between 6 and 12 months to complete from start to finish.

After foreclosure in Massachusetts, the title of the property is transferred to the foreclosing party, either a bank or other financial institution. The former homeowner no longer has any legal claim to the property, and they must vacate it by the court-ordered date.

The foreclosing party will then become responsible for paying all taxes and fees associated with owning the property. Additionally, it may be difficult for a former homeowner to obtain a new mortgage loan in Massachusetts after foreclosure due to restrictions imposed by state law.

Fortunately, there are government programs available that can assist individuals who have experienced foreclosure in Massachusetts with rebuilding their credit score and obtaining financing for another home. In order to minimize their losses, foreclosing lenders will often look for ways to quickly sell properties that have been foreclosed upon through auctions or short sales.

In Massachusetts, homeowners who are behind on their mortgage payments may enter foreclosure proceedings after three months of missed payments. Once the homeowner has missed three months of payments, the lending institution can begin the process of foreclosure.

During this process, a Notice of Default is sent to the homeowner, which states that they have three months to pay the overdue balance or face foreclosure proceedings. If payment is not made within those three months, a Notice of Foreclosure Sale will be issued to the homeowner and recorded in public records.

This notice will usually require a minimum bid amount and provide a timeline for when the property must be sold. Ultimately, if payment is not made before this deadline, the lender will take ownership of the property and sell it at a foreclosure auction.