Understanding probate in Nebraska is an important part of understanding the state's inheritance laws. Probate is the legal process that allows a court to distribute assets and property among heirs after a person dies.

In Nebraska, when someone dies, the estate must go through probate before any assets can be transferred to the heirs or beneficiaries. This process will include determining who are eligible heirs or beneficiaries, validating any outstanding debts or taxes that need to be paid, and appointing an executor to oversee the distribution of assets.

The executor has an important role as they are responsible for making sure all assets are properly distributed according to the deceased's wishes. Heirs can usually sell inherited property if they wish but may have to wait until the probate process is complete.

Before selling, it's important for heirs to understand their rights and obligations under Nebraska law so they can make informed decisions about how best to handle inherited property.

In Nebraska, the process of obtaining a Grant of Probate is relatively straightforward. In order to be eligible, the applicant must be an heir or administrator of the decedent's estate.

To begin, the court must be petitioned for an Order for Probate and then a Petition for Grant of Probate must be filed with the court. The petitioner should provide as much information as possible about the assets in question and any potential heirs in order to expedite the process.

The court will also require documents such as a copy of the death certificate, deeds and titles that prove ownership of any real property, bank statements and other financial records, and any other relevant documents. Once all information has been submitted, the judge will make a decision whether or not to grant probate.

If approved, then an Executor/Administrator can be appointed to manage and distribute assets accordingly.

In Nebraska, the transfer of property from a deceased person to their heirs can be done in two ways—with or without probate. Probate is the legal process of administering an individual’s estate after they have passed away and involves validating the will or determining how to distribute assets if there was no will.

When a decedent's estate is administered through probate court, all creditors must be paid and any taxes owed must be settled before the remaining assets are distributed to the beneficiaries. On the other hand, if there is no will or if the estate qualifies for some form of simplified probate, certain property may be transferred to beneficiaries without involving probate court.

In Nebraska, certain real estate, assets held in joint tenancy with right of survivorship and some accounts with pay-on-death designations may pass directly to an heir without probate. It is important for individuals interested in understanding Nebraska inheritance laws to first determine whether a will exists and if so, whether it needs to be processed through probate court before property can be legally transferred.

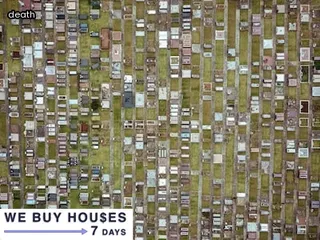

When it comes to selling a house in probate in Nebraska, the process can be complicated and may require extra steps to ensure that the sale is legal and valid. Understanding the state's inheritance laws can help heirs navigate the process.

Before putting a property on the market, heirs should take into account all applicable tax considerations, such as filing an estate tax return and paying any outstanding taxes. Additionally, Nebraska law requires that notice of the sale is given to all interested parties; this may include creditors or other heirs who may have an interest in the property.

It is also important to note that Nebraska requires court approval for any sales from an estate, so obtaining a formal court order is necessary before signing any contracts or accepting any offers. In some cases, it may be beneficial for heirs to hire an experienced attorney who can provide guidance on how best to proceed with selling a house in probate and ensure that all applicable laws are followed.

At [Company], we are committed to helping our clients understand inheritance laws in Nebraska and the implications of selling inherited property. We proudly serve all regions of the state, from Omaha to Lincoln and everywhere in between.

Our knowledgeable team is well-versed in the legal complexities of inheritance law and can provide comprehensive advice for those looking to navigate their rights as heirs. We are equipped with a range of services designed to assist you in making informed decisions about your inheritance, including advice on how best to sell any property you may have inherited.

With offices located throughout Nebraska, we are just a call away and willing to help answer any questions you may have about your inheritance rights.

If you're looking to stay up-to-date on the latest news, tips and advice concerning Nebraska inheritance laws, be sure to connect with us on our social media platforms. We post regularly on Facebook, Twitter, and LinkedIn.

Follow us today and join an active discussion with other individuals dedicated to understanding their rights as heirs of property within Nebraska's legal framework. Our social media platforms also include helpful resources like videos and webinars that can provide additional insight into the intricacies of inheritance laws in the state.

Don't miss out - connect with us today!.

When considering probate in Nebraska, there are a few important questions that should be asked to ensure the process goes smoothly.

What is the purpose of probate and how long does it typically take? Are there any special considerations for selling property inherited in Nebraska? Can real estate taxes be reduced or waived based on inheritance laws? Is it possible to contest wills in Nebraska and, if so, what are the procedures? How can an heir avoid paying inheritance taxes in Nebraska? What is the process of transferring title to inherited property in Nebraska? Understanding these questions and their answers is key to ensuring a smooth probate process and understanding the rights of heirs when dealing with inherited property in Nebraska.

When it comes to understanding inheritance laws in Nebraska, it is important to be aware of the potential for disagreements during the probate process. Probate is a court-supervised process that takes place after a death and involves the distribution of the deceased's assets.

During probate, family members may disagree about the distribution of property or how things should be handled, which can cause tension and conflict. In some cases, heirs may even try to sell inherited property before the court has determined who will receive it and how much each person will get.

It is important for all parties involved in an inheritance dispute to understand their rights as well as their responsibilities under state and federal law so that disagreements can be resolved promptly and fairly. Working with an experienced attorney can help ensure that all parties are informed about their rights and obligations under Nebraska's inheritance laws and that any disputes are handled efficiently and without further acrimony.

When researching an understanding of Nebraska inheritance laws, it is important to find helpful resources and directories to turn to for advice. The Nebraska Bar Association has a directory of lawyers who specialize in inheritance and estate planning, which can provide guidance regarding legal matters.

Additionally, the Nebraska Bar Association offers free legal advice through their website which may be beneficial in answering questions about inheritance laws. For those looking for more detailed information, the State of Nebraska's Official Website provides information on wills and probate as well as links to additional resources such as forms necessary for filing an intestate succession case.

There are also third-party organizations available that offer assistance with estate planning related issues such as Inheritance Lawyer Finder, a website that will connect you with local attorneys who can help with estate planning or inheritance law issues. Furthermore, the Internal Revenue Service has publications available online providing information on tax implications related to inherited property or gifts.

Ultimately, finding helpful resources and directories is essential when researching an understanding of Nebraska inheritance laws.

When dealing with probate issues, Nebraska residents have a number of e-services available to them. These services include online forms for estate planning, filing fees, and other resources related to the probate process.

There are also guidance documents that provide information on The Nebraska Probate Code and other relevant regulations. The Nebraska Department of Revenue offers an online tool that can help residents determine the inheritance tax that applies in their specific situation.

Additionally, there is an online calculator available to calculate estimated taxes owed by heirs after they receive their inheritance. Finally, the Nebraska Supreme Court website provides access to a variety of court records and documents related to probating an estate and understanding inheritance laws in Nebraska.

For those seeking additional information on probate laws in Nebraska, there are several excellent resources. The Nebraska Supreme Court provides an online guide to Probate and Estate Administration, outlining the process of administering estates in the state and offering helpful advice on how to proceed with a probate case.

Additionally, the Nebraska Bar Association's website offers an extensive library of legal documents related to estate administration and probate law. Finally, the University of Nebraska Law School has compiled a comprehensive list of frequently asked questions regarding inheritance laws in Nebraska.

Each of these links can provide further guidance and understanding as individuals seek to understand the intricacies of Nebraska Inheritance Laws.

When filing necessary tax forms after the death of a loved one in Nebraska, it is important to understand the state's inheritance laws and how they apply to the heirs. Specifically, there may be questions regarding whether or not heirs can sell property that was left behind.

To help ensure that all forms are filled out correctly, certain information must be gathered first. This includes any documents related to the deceased's estate such as wills or trust papers.

Additionally, a copy of the death certificate should be on hand as well as the Social Security number of both the deceased and their spouse if applicable. The executor of the estate will also need to provide any financial statements that pertain to assets such as bank accounts or investments.

Finally, heirs will need to determine which tax form needs to be filed for each asset being transferred within the estate. With this information in hand, it will be easier for heirs to make sure all necessary paperwork is properly filled out when filing taxes after death in Nebraska.

In Nebraska, inheritance taxes are imposed on the estate of a deceased person who was a resident or owned property in the state. Estate taxes are based on the taxable value of the decedent's estate, which is determined by subtracting allowable deductions from the total value of the estate.

The taxable value is then used to calculate both state and federal estate taxes. In addition, Nebraska imposes an inheritance tax on certain beneficiaries who receive tangible personal property, real property, and intangible personal property from an estate.

These beneficiaries must pay either a flat rate or graduated tax rate depending on their relationship to the deceased individual. All inheritance tax payments must be made within nine months after the death of the decedent in order to avoid penalties and interest charges.

Furthermore, it is important to note that heirs are not allowed to sell inherited property until all applicable taxes have been paid in full.

When a person passes away in Nebraska, their estate may be subject to federal or state taxes depending on the value of their assets. It is important for heirs to understand that they are responsible for filing taxes with the Internal Revenue Service (IRS) and the Nebraska Department of Revenue (DOR).

Estates valued at $11.18 million or more are subject to federal estate taxes while estates valued between $1.

51 million and $11.18 million may be subject to Nebraska inheritance tax.

In addition, if the deceased had any income during the year they passed away, heirs will need to file a final individual income tax return with both the IRS and DOR. All necessary forms can be found on both organizations’ websites, however, it may be wise for heirs to consult with an accountant or attorney for assistance in understanding these tax filing requirements and ensuring all necessary deadlines are met.

The passing of a loved one is never easy, and it can be even more difficult to think about the transfer of their property. In Nebraska, it is important to understand the laws regarding inheritance to determine if heirs are able to sell or transfer property after death.

According to Nebraska law, an heir is allowed to transfer their inherited property as long as there is no will in place that specifically states otherwise. Without a will in place, the court typically views all heirs as co-owners who must agree unanimously on any sale or division of the inheritance.

Heirs may also be able to sell part or all of their inherited property with court approval, depending on the circumstances. It is essential for an heir considering selling inherited property to consult a lawyer familiar with Nebraska's inheritance laws before they proceed.

In Nebraska, if someone passes away without a will, the estate is referred to as an intestate estate. In these cases, the state's inheritance laws determine who receives the deceased's assets and property.

When dealing with an intestate estate, there are alternate ways to transfer property. Determining which of these apply depends on the size of the estate and whether or not there are surviving family members.

If there is no surviving spouse but children or siblings, then the children or siblings typically receive equal shares of the estate. If there are no surviving family members at all, then it is possible that a public administrator can be appointed to handle the distribution of assets.

In addition to this, other parties such as creditors may be able to make claims against any remaining assets in order for them to be paid in full before any heirs receive their share. It is important for heirs to understand all of their options when dealing with an intestate estate so they can ensure the proper handling of their inheritance.

When one sibling is living in an inherited property but refuses to sell, the other siblings must understand their legal rights under Nebraska inheritance laws. In this situation, a Court may decide to partition the real estate through a partition action.

This means that a court determines how much each sibling should receive from the sale of the real estate and will order its sale. The proceeds from the sale are then divided among all parties according to the court’s decision.

If a sibling living in the property still refuses to sell, they may be forced out of the property or required to pay rent to remain there until it is sold. Furthermore, if siblings cannot agree on a price for the sale of the inherited property, they can submit their dispute to an independent appraiser who will determine its fair market value.

As always remember that it's best to consult with an attorney when dealing with any legal matters involving inheritance laws in Nebraska.

If you have inherited a property with siblings and decide that you would like to buy them out, there are a few things to consider when it comes to understanding Nebraska inheritance laws. It is important to know the legal process for buying out your siblings in order to avoid any costly mistakes.

Firstly, you must establish the fair market value of the inherited property. This can be done by getting an appraisal from a qualified real estate professional or by researching similar properties recently sold in the area.

Secondly, contact your siblings and discuss their willingness to sell their share of the inherited property. If they agree, draw up an agreement with all parties involved and have it notarized for both protection and legal validity.

Once this has been completed, make sure all transfers are recorded with the county Register of Deeds Office so that ownership is legally recognized. Finally, consult an experienced attorney who specializes in Nebraska inheritance law if you have any questions or need assistance navigating the complicated process of buying out your siblings’ share of an inherited property.

In Nebraska, inheritance laws are regulated by the state’s Probate Code. An individual who inherits property in the state may be entitled to a share of the deceased’s estate depending on the size of their relationship with the deceased.

Generally, spouses and children are given first priority to receive assets from an estate. If there is no surviving spouse or children, then surviving parents, brothers and sisters, or other relatives can receive assets.

For example, in Nebraska if a person dies without leaving any surviving spouse or children, then their parents will be given the first right to inherit any assets that were left behind. In addition to determining who is entitled to receive assets from an estate, Nebraska inheritance laws also dictate how those assets are distributed.

Generally speaking, when it comes to distributing property after death, heirs have three options: they can keep it and use it as they see fit; they can sell it; or they can transfer ownership of the property to another heir or beneficiary. However, before any such action is taken regarding inherited property in Nebraska, it is important for heirs and beneficiaries to understand all of their rights and obligations under the law so that their interests are fully protected.

In Nebraska, heirs are able to inherit up to $40,000 of a decedent's estate without owing any taxes. This exemption applies to both real and personal property and excludes tangible personal property such as cars, boats, and furniture.

Nebraska inheritance tax is calculated based on the value of the inheritance above $40,000. It is important to note that this amount is only applicable if the decedent died between January 1, 2020 and December 31, 2021.

For those who die after this date, the exemption amount may increase or decrease depending on the change in state laws. It is important to be aware of these changes when making decisions about how much property can be inherited without incurring taxes in Nebraska.