Social media has become a major part of our lives, and its impact cannot be overstated. It's important to understand the implications of its use in order to effectively manage the estate of a deceased person in New Jersey.

Social media can reveal personal information that may be useful for an administrator, such as contact information for beneficiaries or creditors, as well as any online accounts which should be managed. Additionally, social media can provide valuable insight into the deceased's personal relationships or potential legal considerations.

When considering how to become an administrator of an estate in New Jersey, it is essential to consider the role social media will play in the process. Mercer and Surrogate Courts have specific requirements that must be met before an administrator can be appointed, and understanding how social media could influence this decision is important.

Navigating the requirements to become an administrator of an estate in New Jersey can be a daunting task, particularly if one is unfamiliar with the nuances of surrogacy and Mercer County law. To help simplify this process, it is important to understand the basics for each county and look into any additional or state-specific regulations that may need to be taken into consideration.

Additionally, reaching out to experienced attorneys who specialize in estate administration is strongly advised as they can provide expert advice on navigating these processes. Furthermore, there are many online resources available where individuals can find information on what types of documents are required, filing procedures, timelines, and other useful guidance when preparing to become an administrator of an estate in New Jersey.

Ultimately, having a clear understanding of surrogacy and Mercer County laws will help ensure that all regulatory requirements are met in order to successfully navigate the process and become an administrator of an estate in New Jersey.

If you're looking to become an administrator of an estate in New Jersey, it's important to understand the requirements for both Surrogate and Mercer County. Knowing what to expect can help you make the most of your next steps towards becoming an administrator.

To get started, you'll need to file for probate with a Surrogate Court in the county where the deceased was living when they passed away. You'll also need to provide paperwork such as death certificates and legal documents, as well as proof that the deceased had no will or trust.

After completing this step, you may be required to post a bond or security deposit depending on your county's specific requirements. Once approved by the court, you will be appointed as personal representative or executor of the estate.

From there, you must collect all assets and put them into a bank account with your name on it so that any debts associated with the estate can be paid off before distributing remaining assets according to state law. Understanding these steps ahead of time can help ensure that this process runs smoothly.

At Our Services, we provide an overview of the requirements necessary to become an administrator of an estate in New Jersey. We specialize in Surrogate and Mercer County regulations so that our clients have a clear understanding of what is required.

We strive to present complex legal matters in a straightforward manner and make sure that our clients are informed of all the details associated with their case. As part of our services, we offer personalized advice on how to navigate the court system and fill out paperwork correctly.

In addition, we provide assistance with probate laws and help determine who qualifies as an executor for the estate. For those needing more detailed guidance, we offer estate planning resources and can answer any questions you may have about transferring assets.

Ultimately, Our Services is dedicated to providing the best service possible to ensure that all your needs are met when it comes to becoming an administrator of an estate in New Jersey.

Font resizing is an important tool for increasing the readability of text on a website or in printed materials. Font resizing can be used to adjust text size, line length, and spacing between lines within a document.

For example, when becoming an administrator of an estate in New Jersey, it is important to understand the Surrogate and Mercer County requirements. By utilizing font resizing tools, users can increase the size of text to make all relevant information more visible.

This allows users to easily read through the Surrogate and Mercer County requirements to understand the process for becoming an administrator of an estate in New Jersey. Additionally, with font resizing tools users can decrease the amount of white space between lines and adjust line lengths which makes it easier for readers to follow along with what they are reading.

Font resizing is also beneficial when creating documents that need to be printed as it ensures that all text is legible even when printed out at smaller sizes. Overall, font resizing provides a powerful tool for increasing readability of any document related to becoming an administrator of an estate in New Jersey.

Becoming an administrator of an estate in New Jersey involves various steps and requirements, depending on the county. The process for appointment as an administrator requires filing a petition with the Surrogate Court or Mercer County Probate Court.

First, you must fill out the appropriate application form and submit it to the court, accompanied by a death certificate of the deceased person whose estate is being administered. Once your petition is accepted by the court, you will need to complete a few additional forms such as an affidavit and a surety bond.

You may also be asked to provide proof that you are related to the decedent or have some other interest in their estate. After completing these steps, you will then have to appear before a judge who will review your application and appoint you as administrator of the estate.

If you're looking for fast access to key information about how to become an administrator of an estate in New Jersey, start by familiarizing yourself with the Surrogate and Mercer County requirements. Both counties have detailed instructions on their websites that explain the process of applying to become an administrator.

You'll find information on who is eligible and what forms are required, as well as links to other resources. Additionally, both counties offer online applications and payment options so you can complete your application in a timely fashion.

If you need any assistance along the way, there are customer service representatives available to help answer questions or provide additional guidance. With these quick links, you can quickly access all the information you need to begin your journey into becoming an administrator of an estate in New Jersey.

Exploring state resources to become an administrator of an estate in New Jersey can be a daunting task. While the process may appear complex, there are several helpful resources available to guide people through the journey.

Surrogate and Mercer County offer useful links to information regarding state requirements and forms needed to complete the administration process. In addition, a list of probate attorneys and financial services companies that specialize in estate planning are also available.

These services can provide valuable assistance during this period of transition, allowing individuals to stay informed on the latest developments in their particular situation. For those wishing to handle the process without outside help, various online tools can give users access to important documents and information related to their estate's status.

Individuals will find that with a little research, they can successfully navigate the complexities of becoming an administrator of an estate in New Jersey with relative ease.

Accessing Members Areas with ease is an important part of becoming an administrator of an estate in New Jersey. The process for doing so can be complicated and time-consuming, depending on the county in which the estate is located.

For those located in Mercer and Surrogate counties, specific requirements must be met in order to obtain a court-appointed position as an estate administrator. This means that applicants must prove their qualifications and complete the necessary paperwork, including financial forms, before they may begin the process of accessing members areas.

Additionally, applicants must demonstrate proof of good moral character and provide references from individuals who are familiar with them. Once all documents have been submitted, a hearing will be held to determine whether or not the applicant has fulfilled all requirements needed to become an estate administrator in New Jersey.

With these steps completed, applicants are able to access members areas with ease and begin their role as administrators of the estate.

To become an administrator of an estate in New Jersey, there are a few prerequisites that must be met. In Mercer and Surrogate counties, applicants must be at least 18 years old and have no criminal record.

Moreover, they should also be a resident of the state of New Jersey or have been appointed by the court. Additionally, all applicants must provide a valid government-issued identification card such as a driver’s license or passport.

Furthermore, they may need to provide proof of residency in the form of a utility bill or bank statement. Additionally, applicants may be asked to demonstrate their financial responsibility by providing copies of tax returns, credit reports or other documents related to their financial situation.

As part of the application process, applicants will also need to submit letters of recommendation from people such as employers, colleagues or individuals who can vouch for their character and reputation. Finally, an applicant may need to pass an exam given by the Surrogate Court and/or take classes on probate law before receiving approval from the court.

Successful social media use begins with understanding the guiding principles of how to effectively and responsibly interact with others online. These guiding principles include being aware of the power of words, taking responsibility for your actions, being mindful of personal information shared, and recognizing that posts can be seen by a wide audience.

It is important to think before you post and be respectful of others online. Additionally, it is important to remember to keep all communications professional as well as avoid using offensive language or attacking other users.

Keep in mind that posts can last forever and can have long-term implications on your reputation. Finally, always strive to use social media for its intended purpose – connecting with family, friends, colleagues, and customers – in a positive way.

Navigating to the important pages on the website of a New Jersey estate administrator can be tricky, especially if you are not familiar with the Surrogate and Mercer County requirements. Subpage jumping strategies can help simplify the process by allowing users to quickly access relevant information.

To begin, it is important to first identify which county or counties are relevant for the case at hand. For instance, a probate or guardianship matter may be overseen by either Surrogate Court or Mercer County Probate Court.

This can usually be determined based on where the deceased resided before they passed away while guardianships are typically governed by Mercer County Probate Court. Once this has been established, users who need to understand how to become an estate administrator in New Jersey can easily jump from page to page for more detailed information about filing procedures, fees, and documents needed for each particular type of case.

Utilizing subpages will also allow users to stay organized and quickly locate vital forms or other necessary resources without having to search through multiple webpages. With clear navigation techniques and a little bit of patience, individuals can easily learn how to become an administrator of an estate in New Jersey while also becoming well-versed in Surrogate and Mercer County requirements.

It is important to understand the best actions to take after taking an initial step towards becoming an administrator of an estate in New Jersey. The first action should be to review the requirements of Mercer and Surrogate Counties, which are different in some cases.

Next, familiarize yourself with local court rules, as they can greatly affect the process. Additionally, it is critical to know where and how to file documents such as a death certificate, will, or any other associated paperwork.

Also, you must be aware of any fees that may accompany filing these documents. Furthermore, research what type of bond may be required for administrators and note any additional qualifications needed for approval by the court.

Finally, make sure that all deadlines associated with filing documents are met on time. All these steps are necessary for successfully becoming an administrator of an estate in New Jersey.

When deciding the best route to take when becoming an administrator of an estate in New Jersey, it is important to consider both the pros and cons of different services available. Applying for letters of administration through Surrogate Court has its advantages, as they are often preferred by creditors due to their increased legitimacy.

On the other hand, Mercer County offers informal probate proceedings which may be faster than those handled in court and may require less paperwork. Additionally, if the estate is small or does not contain any real property, Mercer County may offer a simpler process overall.

However, it's important to note that Mercer County does not have jurisdiction over all types of assets so this should be considered before moving forward with any service. Ultimately, choosing which service is right for you requires careful consideration of all options and thorough research into what each process entails.

Streamlining the Appointment Process as an NJ Administrator is a critical step in becoming an administrator of an estate in New Jersey. Surrogate and Mercer County both have specific requirements for those wishing to take on this role.

It is important to familiarize oneself with the legal steps necessary for appointment, including submitting the appropriate paperwork, attending hearings, and providing evidence of legal authority over the estate. In addition, the individual must be able to demonstrate their ability to serve as a trustworthy fiduciary and provide proof that they are qualified and legally responsible for the decisions made regarding the estate.

Additionally, there are certain financial obligations such as filing taxes that must be taken into consideration. The New Jersey courts have set forth guidelines for surrogates to follow when making appointments so it is essential that all relevant documents are filed correctly and in a timely manner.

Taking these steps will help ensure that your application is expedited without any delays or complications.

In New Jersey, it is possible to become an administrator of an estate and the process can be made easier with access to the right resources. Quick links provisions offered through the state website provide a convenient way to connect easily.

By discovering what resources the state has to offer, members can secure access with convenience and navigate their path to becoming a NJ estate administrator. The Surrogate and Mercer County requirements must be met and each step of the process should be followed accordingly.

Keeping up with any changes in law is also important as it can affect how an individual may qualify for this role.

Anyone who meets the requirements set forth by New Jersey law can apply to be an administrator of an estate in New Jersey. Generally, the executor or executrix of the will, a family member of the decedent, or a creditor of the estate may apply for letters testamentary to become an estate administrator.

In most cases, only those who are legal residents of Mercer County or Surrogate Court Division can administer estates in New Jersey. Furthermore, an applicant must be at least 18 years old and possess sufficient knowledge and ability to manage the estate’s affairs.

In addition, they must not have been convicted of any felony which could affect their fitness as administrator. Finally, all applicants must provide proof that they are able to faithfully execute their duties as required by law and ensure that all creditors receive payment due them from the estate.

If these qualifications are met, then individuals may apply for letters testamentary through Surrogate Court Division and serve as administrator for an estate in New Jersey.

Becoming an administrator of an estate without a will in New Jersey can be a complicated process, especially if the deceased did not appoint an executor. In Surrogate and Mercer County, there are specific requirements that must be fulfilled before one can become an administrator of the estate.

To begin, the potential administrator must submit a petition to the New Jersey Superior Court - Chancery Division: Probate Part. This petition should include information about why they are qualified to take on this responsibility as well as details about any heirs or beneficiaries of the estate.

After the petition is accepted, it must be published in two newspapers and then served upon all interested parties within 20 days of acceptance. The petitioner will also need to provide evidence that they have provided notice to all interested parties and have obtained their consent.

Once this step is completed, the court will hold a formal hearing to determine whether or not the petitioner is fit to serve as an administrator for the estate. If approved, the court will issue Letters of Administration which grants them legal authority over the assets of the deceased and allows them to carry out their duties as specified by New Jersey law.

In New Jersey, the amount an estate administrator is paid is determined by the Surrogate and Mercer County Courts who oversee the administering of estates. Estate administrators in New Jersey are typically compensated at a rate of 5-10 percent of the total value of an estate.

The amount paid to an administrator also depends on the complexity of the estate and other factors such as the size and number of beneficiaries, as well as any special handling that may be required. Additionally, some courts may require an additional fee for filing documents or other court services.

It is important to note that these fees should not exceed 20 percent of total estate value or 10 percent if there is only one beneficiary involved in the estate. Furthermore, any compensations must be approved by a judge prior to payment being issued.

An administrator of an estate in New Jersey is a person appointed by the Surrogate's Court in a county to manage and distribute the assets of an estate when someone dies without a will. The Surrogate's Court oversees the administration of estates in all counties, including Mercer County.

An administrator must have a clear understanding of New Jersey estate law and be able to handle the financial, legal, and personal tasks required to administer an estate. In addition, they must demonstrate competency, diligence, fairness and honesty in their management of the assets of the deceased.

As part of this process, administrators must follow state-mandated procedures for filing documents with the court, making inventories and appraisals of assets and liabilities, providing notice to creditors and distributing assets to beneficiaries according to law.

Becoming executor of an estate in New Jersey can be a complicated process, but the key to successfully becoming an administrator is understanding the requirements of Surrogate and Mercer County. To become executor, one must have a valid New Jersey driver's license or state identification card, meet certain age and residency requirements, submit an application to the county Surrogate Court, and provide proof of appointment from the court.

Additionally, applicants must post an official bond with the county clerk who will oversee the administration of the estate. The bond requirement can be waived for smaller estates upon request.

Once appointed, the executor is responsible for collecting all assets of the deceased person, paying creditors, filing tax returns and settling debts with beneficiaries according to NJ Probate Law. It is important to follow all court-mandated rules and regulations when dealing with estates as failure to do so can result in liability for the executor on behalf of the estate.

A knowledgeable attorney can help guide you through this process and ensure that all necessary paperwork is filed properly. With a bit of preparation and research into Surrogate Court policies and procedures in Mercer County, individuals can make sure they are fully prepared to become executors of estates in New Jersey.

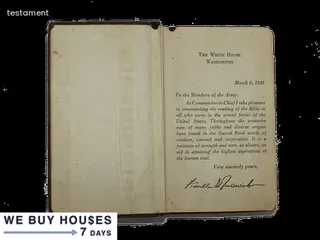

A: To become an executor of an estate in New Jersey, one must be named as such in either the Last Will and Testament or the Revocable Living Trust of the deceased. If a person has been named as executor in either of those documents, they will be responsible for carrying out the wishes outlined in the Last Will or Trust.

A: In order to become an administrator of an estate in New Jersey when the deceased died intestate, the individual must fulfill the fiduciary duties of loyalty, care, and impartiality. This includes ensuring that assets are properly managed and distributed according to state laws and regulations.

A: Grandparents can become administrators of a grandchild's estate in New Jersey by filing an application with the Superior Court of New Jersey. The court may grant the application if it finds that the administration is in the best interest of the child, including whether any child support payments are due and unpaid.

A: To become an administrator of an estate in New Jersey, a taxpayer must file a waiver to accept the role. The costs associated with this process vary depending on the complexity of the estate, but may include filing fees, attorney's fees, court costs, and any other related expenses.

A: Domestic partners, civil union partners, spouses and surviving spouses can become administrators of an estate in New Jersey by filing a petition with the Surrogate's Court in the county where the decedent died. The petition must include proof of death and a copy of the will (if applicable). Additionally, all parties involved must provide required documentation such as valid IDs and proof of residency.

A: If there is no surviving spouse, then a family member or other person who is nominated by the deceased may apply to be appointed as the administrator of the estate. The application must be submitted to the Superior Court of New Jersey in the county where the decedent resided. After review, if approved, Letters of Administration will be issued and the applicant will become administrator of the estate.

A: To become an administrator of an estate in Mercer County, New Jersey, you must petition the Surrogate Court by filing a formal request for Letters of Administration. You will need to provide a valid copy of the deceased's last will and testament and any other relevant documents.

A: To become an administrator of an estate in New Jersey, first you must understand the role and responsibilities of an administrator. Then, you must gather the necessary documents to file a petition for Letters of Administration with the Surrogate or Mercer County Court. After filing your petition, you will need to attend a hearing in either Surrogate or Mercer County Court.

A: To become an administrator of an estate in New Jersey involving inheritance and valuation, you must first be appointed by a court. This typically involves submitting a petition to the Surrogate’s Court outlining your qualifications and reasons for wanting to be appointed, along with the decedent’s last will and testament if one exists. You must also provide evidence of the decedent’s death, such as a death certificate or cremation certificate, in order to be considered. Once appointed by the court, you will need to inventory all assets of the estate, pay any valid debts owed by the deceased, file all necessary tax returns, determine what assets are subject to inheritance taxes, and distribute any remaining assets according to the terms of the will or applicable state laws.

A: To become an administrator of an estate in New Jersey, you must first gather all necessary documents and understand the requirements in Surrogate Court and Mercer County. You will then need to file a Petition for Administration of Estate with the court. Finally, you must attend a court hearing to be officially appointed as administrator of the estate.

A: To become an administrator of an estate in New Jersey, you must first understand the New Jersey probate process. Next, you will need to gather the necessary documents and file a petition for administration of the estate. Once your petition has been accepted by the court, you will need to attend a court hearing to complete the process and be issued letters of administration.

A: To become an administrator of an estate in New Jersey, the individual must file a petition with the Surrogate Court. The petition must include legal documents such as death certificates and tax forms such as W-9s and income tax returns. Additionally, Mercer County may have additional requirements that need to be met in order to become an executor of an estate.

A: To become an administrator of an estate in New Jersey, you must first understand the Surrogate Court System and gather any necessary documents. Then, you must file a Petition for Administration of Estate with the court, and attend a hearing before the Surrogate Judge.

A: In order to become an administrator of an estate in New Jersey, you must first file a petition with the Surrogate's Court. Once the petition is approved, you will be responsible for taking inventory and appraising assets of the estate, as well as paying any debts and taxes owed by the estate. Additionally, you may need to produce various legal documents and tax forms.