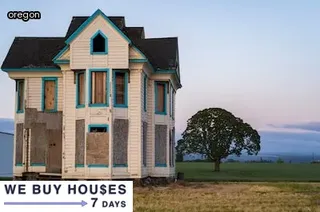

In Oregon, a small estate affidavit may be filed by an estate administrator when the deceased's estate is valued at $275,000 or less. The affidavit is used to transfer title of assets from the decedent to their heirs without the need for probate court proceedings.

The process begins with the executor filing a Notice of Death and Small Estate Affidavit to the county clerk in the county where the deceased resided. After that, a copy of the affidavit must be sent to all creditors and heirs of the estate who are named on it.

The administrator must also provide evidence of having notified any potential creditors, such as by publishing notice in at least one local newspaper. Once all parties have been notified, they have 90 days to challenge the validity of the affidavit; if no challenges are made within this period, title can be transferred and assets distributed according to law.

If there are outstanding debts or taxes owed by the deceased, they must be paid out of estate funds before any assets can be distributed and claimants must sign a receipt indicating that they were paid in full. As long as all necessary documentation is provided and all steps are followed correctly, navigating Oregon probate laws in regard to filing small estate affidavits is possible for an experienced estate administrator.

In order to file a guardianship in Oregon, there are certain requirements that must be met. The person filing the guardianship must be at least 18 years of age and have no criminal record.

The individual must also be able to provide proof of residency in Oregon for at least six months prior to filing. Along with the application, a fee must be paid and any additional documents required by the court, such as financial information or background check reports, must be submitted as well.

Furthermore, the individual seeking guardianship of another individual must submit references from people who can vouch for their character and ability to care for the person in question. Lastly, any potential guardian is also required to attend a training session held by the court before they can officially take on this responsibility.

Navigating Oregon probate laws can seem daunting but having a clear understanding of what is needed when filing a guardianship is key to becoming an estate administrator.

In Oregon, probate is required when the decedent has passed away and held assets in their name alone. This includes real estate, investments, cash, vehicles, and other personal possessions.

The probate process is initiated by filing a petition with the local circuit court in the county where the decedent lived at the time of their death. An estate administrator must be appointed for the duration of the probate process and will be responsible for gathering information about all of the deceased person's assets, paying any outstanding debts or taxes owed, and distributing remaining assets to beneficiaries as outlined in their last will and testament or state law.

Although probate can often be a lengthy and complicated process, having an understanding of Oregon’s laws regarding probate can help make it easier to navigate.

Navigating Oregon probate laws can be a complex and daunting task, but understanding the basics of estate administration is essential for avoiding probate in the state. Estate planning should always include a comprehensive will that clearly states your wishes, as well as covering any potential tax concerns.

Additionally, establishing a living trust is an important step towards avoiding probate, as it allows you to designate a trustee to manage your assets and disperse them according to your wishes upon death. Beneficiaries of retirement accounts or life insurance policies may also be designated outside of the will so that these funds are not subject to probate.

Transferring certain assets such as real estate out of your name during life can also help avoid probate in Oregon. Finally, taking steps to ensure joint ownership is established on any remaining property can help bypass the need for a lengthy probate process after death.

Ultimately, being aware of how Oregon's probate laws work and taking proactive steps early on can help simplify the process if you become an estate administrator in the future.

Navigating Oregon probate laws can be a daunting task, especially when it comes to understanding the compensation of an executor or personal representative. While it is not mandatory by law, court-approved fees can be requested by an executor or personal representative for their services in administering the estate.

Generally, these fees are calculated on a percentage basis of various assets in the estate. In Oregon, executors may be compensated for up to 4 percent of the estate assets distributed during administration and an additional 1 percent for assets distributed outside of administration.

The probate court also has discretion to allow direct payment of certain expenses incurred in administering the estate. It is important to note that if any beneficiaries object to the compensation requested, they have 30 days after receiving notice of the amount before the court will consider compensating the executor or personal representative.

Additionally, while no specific deadlines apply to requesting executor or personal representative compensation in Oregon, it is recommended that such applications are made as soon as possible during administration so that no time is wasted and distributions begin sooner rather than later.

When navigating Oregon probate laws, it is important for an estate administrator to understand the process of establishing executor fees. Generally speaking, these fees are determined by the size and complexity of the estate.

The court will consider an executor's time, effort, and expenses when determining a fair remuneration for their services. An estate may also have specific instructions as to how much should be paid in executor fees, which must be followed.

Furthermore, executors cannot claim multiple types of compensation for the same duties; for example if an attorney is appointed as an executor they can only charge a fee and not hourly wages. In addition, any fees charged must be approved by the court before they can be collected.

Ultimately, understanding and adhering to the laws regarding executor fees in Oregon is essential in order to ensure fairness and compliance with state regulations.

Navigating Oregon Probate Laws can be a daunting task, but with the right knowledge and resources, you can become an Estate Administrator. Understanding the estimated time to complete the probate process in Oregon is important for anyone who wishes to become an Estate Administrator.

The length of time it takes to complete the probate process depends on whether or not there is a will or if it needs to go through probate court. If there is a valid will, then it could take as little as 2-4 months for the entire process to be completed.

On the other hand, if there is no valid will or if it needs to go through probate court, it could take up to one year or more. It's important to remember that these are only estimates and that each case may vary depending on its individual circumstances.

The best way to ensure that your estate is processed quickly and accurately is by having all of your documents in order and consulting with legal professionals throughout the process.

In Oregon, probate is a necessary step for all estates. This means that even if you do not have a will, your estate will be subject to the state's laws and regulations regarding probate.

Probate is an important process that allows the estate administrator, who is appointed by the court, to manage the distribution of assets according to the wishes of the deceased. Without going through probate, it would be difficult for an executor or trustee to know how to properly distribute assets to heirs and creditors.

The probate process also provides legal protection for both the estate and its creditors by ensuring that all debts are paid before any assets are distributed. Probate in Oregon can be complicated and time consuming so it is important to understand all relevant laws before becoming an estate administrator.

Furthermore, an experienced lawyer should be consulted when navigating Oregon's probate laws in order to make sure that everything is handled correctly and efficiently.

In Oregon, a will does require probate in order to be valid and to go into effect. Probating a will requires the assistance of an estate administrator who can guide you through the necessary steps.

The process begins with filing a petition with the local circuit court in the county where the deceased person resided at their time of death. Once approved, the court will issue Letters of Administration which officially appoints an estate administrator.

A qualified representative must then collect all assets, pay any debts or taxes owed by the deceased, and distribute any remaining assets according to the terms of the will. Any disputes that arise during this process must be handled by an Oregon probate attorney.

An estate administrator should be familiar with all applicable state and federal laws as well as local rules and procedures to ensure everything is handled appropriately. It's important to note that an executor may waive their right to probate a will if they choose not to file in court; it is ultimately up to them whether or not they wish to complete this process.

Oregon residents who are estate administrators are subject to state and federal estate taxes. In Oregon, the threshold for these taxes is $1 million (in 2020).

Estates that exceed this amount must pay both a state and federal estate tax. The state's tax rate is 10%, while the federal rate can range from 18% to 40%.

Estate administrators should also be aware of the Oregon Tax Credit, which allows estates under $2 million to receive a credit against the state tax liability. Additionally, there may be additional local taxes applicable depending on where in Oregon the estate is situated.

To ensure proper compliance with all applicable laws and regulations, it is important for estate administrators to understand their obligations and seek professional guidance when necessary.

When it comes to estate planning in Oregon, life insurance plays an important role. It can be used to help cover the costs associated with probate, such as attorney’s fees, taxes, and executor fees.

Additionally, life insurance benefits can be used to provide financial security for your loved ones should something happen to you. Many people choose to purchase a policy before they pass away so that their family or other beneficiaries can receive the death benefit.

It is important to carefully consider all of your options when selecting a life insurance policy, as there are several types available with different coverage amounts and benefits. Be sure to research each type thoroughly and consult with a financial advisor or estate planner if necessary.

Additionally, you may want to consult with an attorney who specializes in probate law in order to better understand the laws that apply specifically in Oregon. As you navigate the process of becoming an estate administrator in Oregon, understanding how life insurance fits into your overall plan is essential for successful estate management.

In the state of Oregon, the real property of a deceased person is typically assigned based on the terms of their will and probate laws. If a will is not present, then the estate will be divided according to statutes in Oregon's probate code.

It's important to understand that in Oregon, real property includes land as well as any buildings or improvements attached to it. When assigning real property after death in Oregon, an estate administrator must locate all assets owned by the decedent and determine whether they are part of the estate or not.

This includes identifying any liens or mortgages against them, which would need to be addressed before distribution can occur. In some cases, certain assets may be exempt from probate due to an existing Transfer-on-Death designation or other beneficiary designation form.

Lastly, if there are multiple heirs who have conflicting claims over particular pieces of real property, it may be necessary for an estate administrator to mediate between them in order to reach a consensus about how it should be distributed.

Navigating the probate process in Oregon can be a daunting task, especially if you are unfamiliar with the laws and regulations that govern it. For those hoping to become an estate administrator, it is important to be aware of the detailed steps involved in the probate process.

In Oregon, there are specific procedures for filing a petition for probate, notifying interested parties, and collecting assets. Additionally, any debt must be paid off before distributing property to beneficiaries.

Furthermore, an executor must complete various paperwork and file tax returns before the probate process is considered complete. It is also essential to document all transactions throughout the process in order to ensure accuracy and compliance with Oregon probate laws.

All of these steps require attention to detail and a thorough understanding of applicable laws and regulations; thus making it essential for anyone considering becoming an estate administrator to have knowledge of the intricacies of navigating Oregon probate laws.

Understanding the statute of limitations to file for probate in the state of Oregon is an important part of navigating Oregon probate laws. Estate administrators must know when they need to file a petition with the court to be able to administer an estate.

In Oregon, a petition for probate must be filed within three years of the decedent’s death. If the petition is not filed within this time period, then any assets belonging to the estate will become part of the state’s escheatment process.

While an extension can be requested if there are extenuating circumstances, it is best to adhere to these statutes and initiate proceedings as soon as possible. Additionally, spouses and other heirs may have rights that could expire if not exercised within this timeline.

It is also important for estate administrators to understand how long creditors have to file claims against an estate as well as what counts toward calculating this deadline in order to ensure that all obligations owed by a deceased person are taken care of properly.

Becoming an estate administrator or personal representative of an estate in the state of Oregon can be a complex process. It is essential to have a thorough understanding of the state's probate laws and regulations.

Before beginning the process, it is important to contact a qualified attorney for guidance. The state requires that all potential administrators provide current proof of identification and consent from the court to act as administrator.

After properly filing the appropriate paperwork, a person must then receive a Letters Testamentary from the court, which legally allows them to serve in their appointed role. Typically, applicants are responsible for providing information about all assets associated with the estate, such as real estate properties, bank accounts, investments, etc.

In addition, they will also need to provide details related to potential creditors and beneficiaries of the estate. Once this information has been submitted to the court, an appointed representative may begin collecting and distributing assets according to Oregon probate laws.

In Oregon, an administrator or personal representative is someone appointed by the state to handle the estate of a deceased person. This individual has a variety of duties and responsibilities that must be carried out when navigating Oregon probate laws.

The administrator is responsible for gathering all of the deceased's assets, paying any outstanding debts, and distributing the remaining assets according to the instructions in their will or trust. They must also handle any tax obligations associated with the estate, including filing appropriate forms with the IRS and other agencies as needed.

Additionally, they must contact creditors to inform them of the death and arrange for payment of any amounts due. The administrator may also need to take steps to protect any real property owned by the deceased and manage it until it can be sold or transferred according to their wishes.

Finally, they are responsible for keeping detailed records related to all activities associated with administering the estate, such as financial transactions and communications with beneficiaries and creditors.

When it comes to discharging debts from an estate in the state of Oregon, it is important for individuals to understand their obligations as estate administrators. Oregon probate laws dictate that an executor or administrator must identify and pay all creditors who are owed money by the deceased person’s estate.

This includes any taxes, medical bills, funeral expenses, court costs, loans, and other outstanding debts that were incurred during the decedent’s lifetime. The process of satisfying these claims can be complex due to the various legal requirements for notification and documentation.

It is also essential for the administrator to prioritize paying off certain claims over others depending on whether they are secured or unsecured debts. In order to issue payments to creditors in a timely manner and ensure compliance with Oregon probate law, it is essential for estate administrators to be familiar with the state's regulations and procedures when discharging debts from an estate.

In the state of Oregon, the distribution guidelines for an estate are set by the probate court. The court will review and approve an estate plan that has been submitted by the executor or administrator, which includes a detailed list of how assets and debts should be allocated.

It is important to note that any changes to an estate plan after it has been approved must also be approved by the court. Before making any decisions regarding distributions, it is important to understand Oregon's probate laws and rules.

Generally speaking, Oregon law requires that all assets are distributed according to instructions in a will or trust document, if one exists. If no will or trust document exists, then assets are distributed according to Oregon's intestacy laws.

In addition, creditors must be paid prior to any distributions being made to heirs-at-law. The court may also order that certain assets be held in trust until specific conditions have been met.

For example, if there is a minor beneficiary involved in the estate, the court may require that certain assets not be distributed until the minor reaches adulthood or a specified age set by the court. When navigating Oregon probate laws as an estate administrator, seeking professional legal advice is highly recommended due to its complex nature.

Navigating Oregon probate laws can be a daunting process for those unfamiliar with the process. When it comes to releasing assets under a will in the state of Oregon, there are specific steps that must be taken to ensure that assets are distributed according to the wishes of the deceased.

Generally, estate administrators must file a petition with the court to open a probate case and then obtain letters of testamentary or administration which serve as evidence of legal authority to manage an estate. If no will is present, administrators may need to look into intestate succession laws.

Once appointed by the court, administrators must identify, collect, and value all assets belonging to the estate before providing notice to creditors and paying debts accordingly. Additionally, they must secure any real property owned by the decedent before distributing remaining assets according to instructions provided in their will.

Throughout this process, it is important that administrators remain compliant with all applicable Oregon probate laws and regulations in order for them to properly fulfill their duties as an administrator.

In Oregon, closing out an estate account is the final step of administering the estate. It is important to understand all the necessary steps involved in the process, as well as any relevant state laws that may apply.

The first step is to obtain a court order from a probate court permitting the closure of the estate account. Once this has been obtained, it is necessary to pay any remaining debts and taxes owed by the deceased or his/her estate.

This includes filing all required federal and state income tax returns and making sure that all outstanding bills are paid in full before distributing assets to heirs or beneficiaries. After paying all debts, it is important to make sure that any remaining assets are properly distributed according to Oregon law.

Finally, once all assets have been distributed, an administrator must file a final report with the court confirming that all debts have been paid and any remaining funds have been distributed according to Oregon probate laws. With this final document in hand, the estate can be officially closed out in Oregon.

In Oregon, probate is the legal process of distributing a deceased individual's estate. An estate must go to probate if its total value exceeds $275,000.

This amount includes all assets owned by the decedent individually or jointly with another person, such as real estate, vehicles, bank accounts, investments and life insurance policies. If the total value of an estate is less than $275,000, it does not have to go through probate.

However, even if an estate does not exceed this amount and does not need to be probated in Oregon, there may still be other requirements such as filing a final income tax return or notifying creditors about the death that must be fulfilled to ensure all debts are settled and taxes are paid. It is important for anyone considering becoming an Estate Administrator in Oregon to understand these rules so they can help their clients navigate the probate process successfully.

The Oregon Estate Administration Program is a comprehensive system for administering an estate in the state of Oregon. This program provides resources to help simplify the process of navigating probate laws and becoming an estate administrator.

It provides information on the various steps involved in probate, from filing the necessary paperwork to distributing assets. The program also offers guidance on how to properly discharge the duties of an estate administrator, such as settling debts and taxes, handling asset transfers, and more.

Finally, it offers advice on how to protect yourself while serving in this role, including best practices for asset management and other financial matters. With the Oregon Estate Administration Program, you can be sure that your estate will be handled accurately and efficiently by a qualified professional.

To become a personal representative for an estate in Oregon, it is important to understand the laws and regulations governing the probate process. The probate process involves the administration of a decedent's estate by a court-appointed administrator or personal representative, such as an executor or executrix.

In Oregon, there are specific requirements that must be met before a person can qualify to serve as a personal representative of an estate. For example, applicants must be at least 18 years old, a resident of Oregon, and not have been convicted of certain felonies.

Additionally, applicants must complete an application form and file it with the appropriate court in their county. Once approved by the court, the applicant will receive Letters Testamentary from the court which grants them authority to act on behalf of the estate.

As a personal representative, it is important to understand various tasks associated with administering an estate such as collecting assets, paying taxes and debts, and distributing remaining assets to beneficiaries. It is also important to follow all state laws related to estates and probate proceedings when carrying out these tasks.

With knowledge of Oregon's probate laws and regulations, anyone can become qualified to serve as a personal representative for an estate in Oregon.

Navigating Oregon probate laws can be a difficult and complex process. Becoming an estate administrator requires knowledge of the state's probate laws and regulations.

One common question for those considering becoming an estate administrator is, "How long does it take to settle an estate in Oregon?" The answer depends on the size of the estate as well as the complexity of any issues surrounding the settlement. Smaller estates with a simple asset structure may be settled within six months, while larger or more complicated estates may take up to two years or longer.

The court must approve all decisions made by an estate administrator, which can add additional time to the process. An experienced attorney can help guide you through the process and ensure that all requirements are met in a timely manner.

A: Devisees must appoint an attorney to file a petition with the court, which must be signed by at least two witnesses.

A: A Devisee must adhere to the will of the Testator or Testatrix and fulfill any requirements outlined in the will in order to be appointed administrator of the estate. Additionally, the Devisee must file a Petition for Probate with their local county court and meet other statutory requirements set forth by Oregon law.

A: Under Oregon statutory law, Devisees must file a petition with the court to become administrators of an estate. The petitioner must demonstrate a fiduciary relationship and provide an inventory of the estate’s assets. The court may then appoint the petitioner as the fiduciary administrator of the estate.

A: If a Devisee is appointed as administrator of an estate in Oregon, they must provide a reasonable amount of funeral and burial services for the deceased according to state law.

A: According to Oregon statutory law, Devisees of an estate must present a petition to the probate judge evidencing that they are at least 18 years of age and not a convicted felon in order to be appointed as administrator. If the devisee is a minor child, then the petition must be presented by an adult relative or guardian.

A: In order to become administrators of an estate in Oregon according to Oregon Probate Laws, Devisees must be appointed by the court within the state's jurisdiction.

A: In order to become an Administrator of an Estate in Oregon, one must first file a petition for appointment with their local Clerk of the Court. The petition must include information about the deceased’s assets including any real estate or personal property. Once the petition is filed, the court will then review it and determine if appointment is appropriate. If approved, the court will issue letters of administration which authorize the Devisee to act as administrator. Additional requirements may include paying attorney fees associated with filing and obtaining documents, as well as accounting for assets and expenses associated with administering the estate.

A: A Devisee would need to file a petition with the court, providing proof of their identity and a copy of the deceased's will. They must also provide proof that Securities, Appraisals and Personal Property have been secured, as well as any other necessary documents. The Judge may then grant letters of administration that allow the Devisee to serve as the Administrator of the Estate.

A: In Oregon, a Devisee may become an Administrator of an Estate by establishing Joint Tenancy with right of Survivorship and then having the estate appraised. The Appraiser will then determine if the Devisee is eligible to become administrator.

A: A Devisee must first contact the Department of Veterans Affairs to determine if any will contests are pending. If no contests are pending, they can then file an application with their local court. The applicant should also provide contact information such as a telephone number and address. After filing the application and providing all necessary documentation, the court will issue a certificate of appointment authorizing the Devisee as administrator of the estate.

A: According to Oregon statutes, a Devisee must submit a written signature attesting that they understand their obligations under the applicable privacy policies and will not engage in any misconduct while serving as an Administrator of the estate.

A: No, a person convicted of a felony or who is a tenant by the entirety or under any form of judgment is not eligible to become administrator of an estate in Oregon according to statutory law.

A: In order to become an Administrator of an Estate in Oregon, the Devisee must be at least 18 years old, possess legal capacity and not have been convicted of a felony. Additionally, they must be approved by their employer or other interested parties.

A: To become an Administrator of an Estate in Oregon, a Devisee must first understand the Oregon probate process. This can be accomplished through Navigating Oregon Probate Laws, A Guide To Becoming An Estate Administrator, and Understanding the Oregon Probate Process. Once they have a full understanding of the process, they must then file an estate tax return with the appropriate state office. Finally, they must ensure the privacy and integrity of the estate prior to becoming an administrator. Convicted felons are ineligible to become administrators according to statutory law.