The probate process in South Carolina involves a court-supervised process of transferring the assets of a deceased person to their rightful heirs, known as an estate. It can be a lengthy and complex procedure, especially for those with real estate holdings.

In South Carolina, the probate court handles the distribution of the estate and any legal matters related to it. This includes resolving any disputes between heirs, determining who has legal rights to the property, and selling or distributing real estate holdings.

An executor is appointed by the court to oversee these tasks and ensure that all debts are paid off before any assets are distributed. In order to obtain a probate order from the court, an application must be properly filled out and submitted along with supporting documents such as death certificates, wills, and titles of ownership.

The court will then review the application in order to decide if probate is necessary. Once granted, an executor will handle all aspects of settling the estate according to state law.

This can include organizing appraisals, notifying creditors and collecting payments due on real estate settlements. The process may also involve transferring title deeds into another name and paying taxes on any inherited property.

For those in South Carolina looking for ways to avoid the probate process, there are a few options available. One of the most popular methods is to create a revocable living trust, which allows property and assets to be transferred outside of probate court.

This can also help ensure that beneficiaries receive their inheritance quickly and without interference from creditors. Additionally, if you have joint tenants with rights of survivorship, the property will pass on to the other tenant outside of probate upon your death.

To avoid probate completely in South Carolina, you may also consider transferring any real estate and other assets into an Account with POD or TOD designations. These accounts will specify exactly who should receive any remaining funds or property when an individual passes away.

Finally, if you do need to go through the probate process in South Carolina, it's important to understand the Real Estate Settlement Procedures Act (RESPA). RESPA helps protect people from fraudulent fees and unfair practices during real estate settlements.

Knowing this information can help guide you through the process as smoothly as possible and make sure that everything is handled correctly.

In South Carolina, the executor of an estate is entitled to compensation for their time and efforts. This compensation can be a fee or percentage of the estate's value, depending on the terms of the will.

The court must approve the amount requested and it should be reasonable given the complexity of the situation and amount of work required. The executor may also be reimbursed for any out-of-pocket expenses they have incurred while settling the estate.

It is important to note that if there are multiple co-executors, they must agree upon how much each will receive from the estate as compensation. In some cases, an executor may waive their right to compensation; however, if this happens it must be documented properly with the court.

The probate process in South Carolina is a legal system that carries out the distribution of a deceased person's property and estate. This includes, but is not limited to, appraising the assets and paying any debts or taxes owed.

The public administrator of the state is responsible for taking control of the estate if there is no designated executor. In South Carolina, it is necessary for all estates to go through a probate process regardless of whether there is a will or not.

If an individual has died with a valid last will and testament, then the court will appoint an executor to carry out their wishes as set out in the will. If no will exists, then South Carolina law sets out specific provisions in order to determine who should receive the assets from the estate.

Probate generally involves filing paperwork with the court and other parties involved such as creditors or beneficiaries, as well as gathering information related to assets and debts. Real estate settlements are also considered part of this process and involve transferring ownership of properties from one party to another after all debts have been paid off.

It is important to understand these common probate processes in South Carolina in order to ensure that any settling of real estate or other asset transfers are done correctly and legally according to state law.

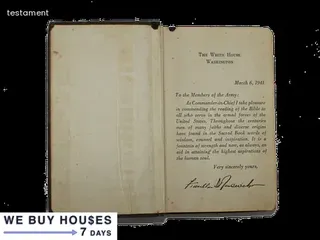

In South Carolina, for a will to be probated, it must meet certain criteria. It must be in writing, signed by the testator (the individual making the will) and two witnesses and dated.

If the will is not properly executed, it is invalid and cannot be probated. The deceased must have been of sound mind at the time of signing the document or it will also be invalid.

Additionally, all assets must pass through the probate process before they can be distributed to heirs and beneficiaries. This includes real estate that needs to be settled through court proceedings.

In order to ensure everything goes smoothly with a loved one's estate, it's important to understand what is required for probate in South Carolina and how real estate settlement works.

The probate process in South Carolina is designed to protect the interests of both the deceased and their heirs. After a person passes away, their estate must be settled by the court system before it can be distributed among their beneficiaries.

In order to settle an estate after death in South Carolina, certain steps must be taken to ensure that all legal requirements are met. The first step is to find an executor or administrator who will manage the estate's affairs during probate.

This individual will be responsible for collecting assets, paying any outstanding debts, filing tax returns, and distributing property according to the decedent's wishes. Once all of these tasks have been completed, real estate settlement must take place.

This involves transferring title of any real property belonging to the deceased into the names of the named beneficiaries. Lastly, any remaining funds or assets may need to be divided among those entitled to receive them.

Understanding and following these steps is essential for settling an estate after death in South Carolina properly and efficiently.

In South Carolina, an executor must file the probate case within three years of the decedent's death. If the estate is not administered within this time frame, any interested party may petition a court to open the probate.

Additionally, it's important to note that creditors have only one year from the decedent's date of death to make claims against the estate before they are barred from doing so once the statute of limitations has expired. The three-year limitation period starts on the decedent's date of death and runs until all assets have been distributed and all debts have been paid or barred by expiration of the statutory period.

It is therefore important for executors to be aware of this timeline and ensure that all necessary paperwork is filed in a timely manner throughout the real estate settlement process.

In South Carolina, the probate court plays an important role in real estate settlement. When a person dies, their will is taken to probate court for processing.

In this process, the court oversees the distribution of assets and property according to the wishes of the deceased. This may include distributing property or making other arrangements with creditors and beneficiaries who are named in the will.

The court also makes sure that any debts or taxes due from the deceased are paid before settling any transfer of real estate. As part of this process, an executor is appointed by the court to carry out all of these tasks, ensuring that everything is done properly and according to state law.

The probate court also has jurisdiction over trust funds, guardianships, conservatorships and other matters related to estates in South Carolina. It is important to understand how the probate court works when dealing with a real estate settlement in order to ensure that all parties involved are protected and treated fairly by the law.

South Carolina has a comprehensive set of laws and codes that govern the probate process and real estate settlement. One key code is the South Carolina Probate Code, which sets forth the rules for how estates are handled in the state.

The code covers all aspects of estate planning, including wills, trusts, executors, guardianships, and conservatorships. In addition to this primary code, there are also a number of other statutory laws that apply to probate proceedings and real estate settlements in South Carolina.

These include laws on tax issues, creditors' rights, transfer taxes, heirship determination, and more. The state also has regulations governing fiduciary duties with respect to probate matters and property transfers.

Understanding these codes and statutes is essential to ensure that all parties involved in a probate process or real estate transaction comply with their obligations under South Carolina law.

Understanding the probate process and real estate settlement in South Carolina can be daunting and emotional. There are also legal and financial ramifications to consider, such as estate taxes.

Fortunately, there are strategies available to reduce or even eliminate these taxes. One of the most common ways of reducing estate taxes is through the use of an irrevocable trust, which transfers assets outside of the estate.

Other strategies include giving away assets up to two years prior to death, gifting money throughout one's lifetime, or taking advantage of exemptions and deductions found within South Carolina's tax code. Additionally, donors may opt for a qualified terminable interest property trust, which allows assets to pass directly to beneficiaries without being subject to taxation.

Finally, spouses who are both residents of South Carolina may take advantage of unlimited marital deduction when it comes time for estate planning. By understanding the probate process and real estate settlement in South Carolina and utilizing one or more of these strategies for reducing estate taxes, individuals can ensure their families will be taken care of after they have passed on.

The probate process is an important part of settling the estate of a deceased person in South Carolina. It is essential to understand the legal requirements and steps involved in order to protect your assets during this process.

One way to do this is by ensuring that all debts and taxes are paid before the assets are distributed, as failure to do so can result in liability for those who received them. Additionally, it is important to consult with an attorney or other qualified professional who can provide guidance and advice on how best to manage your assets throughout the estate settlement process.

This includes making sure that appropriate documents such as wills and trusts are properly drafted and executed, and that any real estate transactions are completed correctly. By taking these steps, you can help ensure that your assets are protected throughout the estate settlement process in South Carolina.

When an estate is settled in South Carolina, a personal representative is responsible for paying off any debts of the deceased. This individual must collect all assets from the estate and use those assets to pay creditors and other heirs as designated in the will or by law.

The personal representative must also file taxes for the decedent, notify creditors of the death and pursue any disputed claims. It is important to note that not all debt is required to be paid off; only those debts which are specified in the will or by law must be taken care of.

Additionally, if there are insufficient funds within the estate to cover all debts, they may not be able to be fully satisfied. Unpaid debts may then become the responsibility of other heirs or beneficiaries as outlined in the will or by state law.

Navigating the complexities of Real Estate Inheritance Law in South Carolina can be a daunting task, as the Probate process and Real Estate Settlement in the state can be both confusing and complicated. Understanding the process requires a comprehensive knowledge of the laws that govern real estate transactions in SC, and how those laws affect inheritance rights.

To begin with, it is important to understand that all real estate transfers must go through the Probate Court, no matter whether they are small or large estates. This means that any transfer of property from one individual to another must be done through probate proceedings.

Additionally, when it comes to settling real estate issues after a death has occurred, there are certain statutes and regulations which must be followed in order for the transfer to take place without any legal complications. In addition to understanding these processes, it is also important to consider other factors such as tax implications and title insurance when dealing with real estate inheritance law in South Carolina.

Knowing how each of these factors affects an inheritance can help ensure that all legal matters are handled properly and that heirs receive their rightful share of an estate. With careful planning and proper guidance from experienced professionals, navigating these complex laws can help protect family members from potential disputes or financial losses related to real estate inheritance law in South Carolina.

When it comes to settling real estate in South Carolina, there is typically a probate process that must be followed. During this process, it is important to coordinate with various professionals who can help ensure the settlement is done in an efficient and effective manner.

This may include lawyers, appraisers, and other experienced real estate professionals knowledgeable about South Carolina's laws governing the transfer of property. They can help make sure all documents are properly filled out and filed in accordance with state regulations.

Furthermore, they can provide guidance on how to manage any potential delays or complications encountered during the settlement process. Additionally, they can also offer advice on how to handle any financial concerns that may arise as part of the proceedings.

Ultimately, having the right support throughout this process is essential for ensuring a successful real estate settlement in South Carolina.

When settling an estate in South Carolina, it is important to find qualified representation that can assist in understanding the probate process and real estate settlement. An experienced attorney should be consulted to review the estate documents, advise on the executor’s duties, and help with filing relevant paperwork.

In addition, they can provide guidance on how to distribute assets, modify existing trusts and wills, and address any inheritance tax issues. Understanding these legal details is essential for a successful estate settlement.

Researching potential candidates for representation is key to ensuring that the probate process runs smoothly. This can be done by asking friends or family members for referrals or looking up local attorneys online who specialize in this field.

It is also beneficial to review their background and experience before making a decision. Although finding qualified representation may require some effort upfront, it will ultimately make settling an estate in South Carolina much easier.

When settling an estate in South Carolina, there are certain documents that must be provided in order to complete the probate process and real estate settlement. The most important document is the will, which outlines how the deceased person would like their property divided.

Other documents required include a death certificate, information on any debts or taxes owed by the deceased individual, proof of ownership of any real estate or other assets in the estate, and a list of creditors with contact information. In addition to these documents, if the deceased individual had made any changes to the will prior to passing away, those amendments must also be presented.

Finally, a certified copy of Letters Testamentary or Letters of Administration must be obtained from the probate court. This document grants legal authority to whomever is appointed as executor or administrator of the estate and serves as proof that they have been legally appointed in such capacity.

Understanding what types of documentation is required when settling an estate in South Carolina is essential for ensuring that all legal requirements are met and that the process runs smoothly.

Navigating a complex estate in South Carolina can seem overwhelming, but there are many resources and tools available to assist. For example, probate attorneys are experienced in understanding the laws and regulations of the state and can help guide you through the process.

In addition, many financial institutions offer real estate settlement services to help ensure all paperwork is properly filled out and filed in a timely manner. Online research can also provide invaluable information about the probate process in South Carolina, including guidance on filing required documents and navigating court proceedings.

Finally, local county courthouses may have clerks or other staff members that can provide assistance with understanding the legal requirements of real estate settlement. With these resources at your disposal, you can feel confident that you’re taking the right steps when it comes to managing an estate in South Carolina.

After the final disposition has been issued by the court, there are several steps that must be taken in order to complete the probate process and real estate settlement in South Carolina. First, all debts and taxes must be paid off.

This includes any medical bills, funeral costs, or other expenses related to the estate. Next, proof of payment must be provided to the court.

Then, all outstanding claims against the estate must be settled with any creditors or heirs that have a legal claim to it. Finally, all assets from the estate must be distributed according to the will or regulations of South Carolina law if there is no will.

Following these steps ensures that all parties involved in a probate process are fairly treated and all debts and taxes associated with an estate are satisfied before its assets can be distributed.

When it comes to understanding the probate process and real estate settlement in South Carolina, the decision to hire professional assistance for your estate settlement can be a tricky one. On one hand, having an experienced professional guide you through the complex legal and financial details of the probate process can provide an invaluable service, removing much of the stress involved in settling an estate.

Professionals are also able to provide counsel on any tax implications that may arise due to changes in ownership or transfer of assets. On the other hand, hiring a professional requires additional costs that can add up quickly and diminish any potential gains from settlement of the estate.

Additionally, some professionals may not be familiar with all aspects of South Carolina's probate laws, which could end up making matters even more difficult than they were before. Ultimately, it is important to do extensive research into both potential costs and benefits when deciding whether or not to hire a professional for your estate settlement in South Carolina.

Navigating disputes between beneficiaries during the probate process and real estate settlement in South Carolina can be a tricky endeavor. Beneficiaries typically have conflicting interests over how to divide assets, and as a result, disputes can arise.

It is important to come to an agreement in order to avoid long-term repercussions, such as lengthy delays in the settlement process or costly litigation. To help avoid these problems, it is essential for all parties involved to understand their legal rights during the settlement period.

This includes knowing which assets are subject to distribution and being aware of the relevant inheritance laws that govern how those assets are split among beneficiaries. Additionally, it is important for all parties to understand their roles in the dispute resolution process, including their ability to initiate mediation or other alternative forms of conflict resolution.

Taking these steps will not only help ensure that disputes between beneficiaries are navigated successfully but also help ensure that the overall probate process and real estate settlement in South Carolina runs smoothly.

The probate process and real estate settlement in South Carolina typically takes anywhere from six months to two years, depending on the complexity of the estate. The length of time it takes to settle an estate is largely determined by how quickly paperwork can be processed and filed with the courts, as well as the number of beneficiaries involved in the process.

In some cases, if all parties cooperate and paperwork is filed promptly, a South Carolina estate may settle within six months. On the other hand, if there are multiple beneficiaries or contested will provisions, it can take significantly longer for an estate to settle.

It's important for executors of estates to understand that most estates take between six months and two years to settle in South Carolina.

In South Carolina, the probate process can take anywhere from several months to a year, depending on the complexity of the estate and the responsiveness of beneficiaries. The waiting period for probate starts at four months, but can be extended if there is an issue with settling the estate or if a beneficiary challenges the will.

As part of the probate process, all claims against the estate must be settled before real estate settlement takes place. In most cases, this means that creditors must be paid off and any taxes due must be settled before distribution of assets can begin.

The length of time it takes to settle these issues ranges from several months to over a year in some cases.

Settling an estate in South Carolina can be a confusing process. However, understanding the probate process and real estate settlement requirements can help make the process a little easier.

To begin, you must identify the executor of the estate who will be responsible for making sure all assets are distributed properly. This person is often chosen by the deceased individual prior to their death but can also be appointed by the court.

The executor is responsible for filing applications with the court to open probate proceedings, and must also publish a notice in local newspapers for creditors of the deceased. After this is done, any unpaid debts or taxes must be paid from estate funds before any other distribution takes place.

Any disputes among family members or creditors should also be resolved before distributions are made. Finally, all real property owned by the deceased individual must go through a real estate settlement process that includes transferring titles to beneficiaries, paying off mortgages and other liens, and performing title searches if necessary.

By taking these steps, you can ensure that your loved one's estate is settled properly in South Carolina.

When a deceased individual's estate is settled in South Carolina, the beneficiaries may receive their money through the probate process. Probate is the legal process used to validate a will and distribute assets to designated beneficiaries after death.

Depending on the size of the estate, this process can take anywhere from several months to two years or more to complete. In South Carolina, any estate with assets worth more than $100,000 must go through probate court before assets can be released.

Once the court validates a will and confirms all heirs are accounted for, real estate settlements can begin. Beneficiaries typically receive their money in one lump sum when all outstanding debts are paid off and taxes are collected.

The executor of the estate is responsible for making sure that all debts are paid in full before any remaining assets can be distributed among the beneficiaries. If you have questions about how to receive your money as a beneficiary of an estate in South Carolina, it’s best to contact an experienced probate attorney who can guide you through the process.