Understanding the probate process in Pennsylvania can be tricky. Generally, settling an estate after a home is sold requires navigating the court-supervised probate process.

It's important to understand that the timeline for settling an estate can vary greatly depending on the complexity of the assets and other factors. For instance, if the deceased person left behind a will and other valid documents, it may take anywhere from 6 months to a year to settle the estate and distribute assets.

On the other hand, if there are disputes over assets or disagreements between heirs and beneficiaries, it could potentially take much longer. Additionally, all taxes must be paid prior to final distribution of assets.

This means that any debts or unpaid taxes must be taken care of before any remaining funds are distributed among heirs or beneficiaries. Of course, hiring a qualified attorney is essential for navigating this complex process and ensuring that all legal matters are handled properly - ultimately making sure an estate is settled in a timely manner with minimal hassle.

When the property of a deceased person is being divided, it is important to consider whether or not they had a will. The Pennsylvania estate settlement process can take longer when there is no will than when one is available.

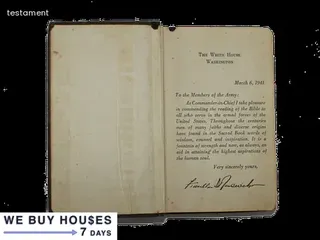

In cases where only a will exists, court involvement may be limited and the estate can be distributed according to the instructions in the document. However, without a will, the court must appoint an administrator to oversee the distribution of assets and debts.

This requires additional paperwork and legal proceedings that can lengthen the timeline for settling an estate after a house is sold in Pennsylvania. Furthermore, if there are disagreements among heirs regarding how assets should be divided, these matters must also be addressed before any funds can be released.

It is worth noting that even with a valid will in place, disputes between beneficiaries can also delay the completion of an estate's probate process.

In Pennsylvania, when a house is sold as part of an estate, the process of settling the estate can be lengthy and difficult. Before settling an estate in PA, it is important to determine whether or not probate is necessary.

Probate is a legal process that involves transferring the ownership of property from the deceased person to their beneficiaries. If the deceased person left a valid will or named beneficiaries in life insurance policies or other accounts, probate may not be needed.

In most cases, however, some type of probate proceedings are required to transfer ownership of assets to the appropriate heirs. The amount of time needed to settle an estate in PA after a house is sold can vary greatly depending on many factors such as whether or not there are any disputes regarding inheritance rights or if all heirs can be located.

In addition, if there are creditors involved with the estate, then additional steps must be taken to ensure that debts are paid off before any assets can be distributed. The probate process for an estate in PA can take anywhere from several months up to two years or longer.

In Pennsylvania, the time it takes to settle an estate after a house is sold can vary depending on the size and complexity of the estate. One way to reduce this timeline is by exploring alternatives to probate, which can save time and money for those settling an estate.

For example, in Pennsylvania, heirs may be able to avoid probate with a small estate affidavit if the gross value of assets is under $50,000. Additionally, assets such as life insurance policies with designated beneficiaries and retirement accounts like IRAs or 401(k)s can also bypass probate.

When all assets are distributed through alternative methods such as these, the estate can be settled much more quickly than if it had gone through probate. Property held jointly between two people can also be transferred outside of probate if both parties agree and sign off on the transfer.

However, when considering alternatives to probate in Pennsylvania there are important legal considerations that must be taken into account in order to ensure that all laws are followed and that beneficiaries receive their rightful inheritance in a timely manner.

The timeline of probate in Pennsylvania can vary greatly depending on the size and complexity of the estate. Generally speaking, it takes between 6 to 12 months for an estate to be settled after a house is sold.

This timeline is largely due to the time needed to pay off debts and taxes, as well as distribute any remaining assets to heirs or beneficiaries. It begins with a Petition for Probate, which must be filed by the Executor or Administrator of the Estate, and then requires several steps that must be completed before a court-approved final distribution can occur.

These steps include identifying debts owed by the decedent, notifying creditors, obtaining appraisals of all property, filing an inventory report with the court, and collecting all necessary documents such as death certificates and deeds. Once all debts have been paid and tax returns have been filed, then a Final Account can be submitted to the court for approval.

After this final step takes place, any remaining assets will be distributed among beneficiaries according to Pennsylvania law.

When a house is sold in Pennsylvania, the probate process begins.

This process will be handled by the executor of the estate who must follow all applicable laws and regulations.

The executor is responsible for gathering all pertinent documents, such as deeds, wills, bank statements, and tax returns; filing a petition with the court to open probate; notifying heirs and creditors; liquidating assets; creating an inventory of assets and debts; paying creditors and filing taxes; distributing assets to heirs according to state law or the terms of a will; and filing the final paperwork with the court.

Depending on how complicated the estate is, how much time it takes to gather all necessary documents and information, and any delays caused by beneficiaries or creditors disputing portions of the estate or its distribution, it can take several months or longer for an estate to settle after a house is sold in Pennsylvania.

Filing a will with the Register of Wills in Pennsylvania is an important step in settling an estate after a house is sold. The process should be initiated as soon as possible to ensure that all assets and liabilities of the deceased are accounted for.

In most cases, this filing must be completed within 6 months of the date of death in order for the estate to be properly settled. While the Register of Wills can provide guidance on filing requirements, it is important to consult an experienced attorney who can ensure that all relevant documents are accurately submitted.

This includes obtaining a copy of the decedent's last will and testament and submitting it along with other necessary forms to the appropriate county office. Once filed, it is up to the Register of Wills to review the paperwork and approve or reject any claims made by heirs or creditors against the estate.

Depending on how complex or contested the case may be, this process can take anywhere from several weeks to several months before a final ruling is issued.

The role of a personal representative in Pennsylvania is to be the legal fiduciary for the estate of a deceased person. This individual is responsible for settling the estate and distributing assets according to the decedent's wishes, as outlined in their will or through state intestacy laws.

In Pennsylvania, this process typically begins with filing a petition with the court to have the will admitted to probate. Once this step is completed, an inventory of all assets must be taken and sent to creditors and heirs listed in the will.

After creditors are paid and taxes are filed, any remaining assets can then be distributed amongst heirs. Generally speaking, how long it takes to settle an estate after a house has been sold varies case by case but typically takes several months or longer depending on the size of the estate and complexity of its assets.

Personal representatives must also keep detailed records throughout this process as they are legally responsible for ensuring that all tasks are executed properly and that all debts have been paid before any distributions can be made.

As the personal representative of an estate in Pennsylvania, it is important to understand the process and timeline involved in obtaining compensation after selling a house. After selling the house, the proceeds are placed into the estate account and distributed according to provisions outlined in the decedent's will.

If there is no will, state law will govern how remaining assets are disbursed. The amount of time required to settle an estate can vary depending on the complexity of the assets, debts, and taxes due.

Generally speaking, most estates take around 6-9 months to settle but can take longer depending on any legal issues that arise or need to be settled first. The personal representative must also file a final accounting with the court which includes an itemized list of all expenses and receipts during administration of the estate as well as a detailed report of all distributions made from estate funds.

Once this has been completed and approved by the court, compensation for services performed as personal representative is often available within 30 days.

When settling an estate after a house is sold in Pennsylvania, it is important to locate all relevant parties. This includes the executor or administrator of the estate, as well as any surviving members of the deceased's family.

It may also involve creditors who have claims against the estate and any potential heirs. Additionally, if the property being sold was part of a trust, then locating and consulting with the trustee is important.

Furthermore, if there are any pending court cases concerning the estate that need to be resolved before settlement can take place, those must be looked into. A qualified attorney should be consulted for guidance throughout this process in order to ensure that all necessary documents are properly filed and all interested parties are notified in a timely manner so that an estate can be settled quickly and efficiently.

When settling an estate after a house is sold in Pennsylvania, the process can take several months or even years depending on the complexity of the situation. In cases where there is a contested will, the settlement process can be especially drawn out and difficult.

Investigating such contested wills requires patience and attention to detail, as all parties involved must agree that the will is valid and binding. This means that all assets must be carefully identified and evaluated.

A probate attorney should be consulted to ensure that all legal proceedings are conducted properly. Additionally, if any disputes arise regarding distribution of assets, they must be resolved before the settlement can be completed.

All of these steps require time and effort in order to guarantee that the estate is settled according to the wishes of the deceased.

When an estate is sold in Pennsylvania, it takes time to settle the estate and distribute assets to beneficiaries. The length of time it takes to settle an estate can vary depending on a variety of factors, such as the size of the estate and any debts or taxes that need to be paid before assets can be distributed.

Calculating beneficiary shares during the settlement process is an important step in ensuring that all parties receive their fair share of the proceeds. Beneficiaries must be identified, assets must be valued and liabilities must be accounted for before a final disbursement of funds can take place.

It is also necessary to consider inheritance tax laws when calculating beneficiary shares; this will ensure that each beneficiary receives their correct share without having to pay additional taxes. Furthermore, any disputes between beneficiaries should also be taken into account when determining how much each person will receive from the proceeds of the sale.

All these calculations need to be made accurately in order for an estate settlement to move forward and for beneficiaries to receive their due payments.

When settling an estate after a house is sold in Pennsylvania, potential conflicts can arise that require attention and resolution. To prevent lengthy delays in settling the estate, all parties should be aware of any potential issues that could lead to disagreements or legal disputes.

It's important that heirs understand their rights and responsibilities outlined in the will, as well as any relevant state laws regarding inheritance tax, probate fee schedules, and the distribution of assets. A knowledgeable attorney can provide advice on best practices for resolving any conflicts before they become protracted court battles.

Any potential issues should be addressed and discussed openly with all involved parties to ensure a timely settlement of the estate. Additionally, keeping accurate records of all transactions is essential throughout the process to prevent misunderstandings or disagreements over what was agreed upon.

With clear communication and proper legal guidance, it's possible to settle an estate without unnecessary delay and hassle.

Navigating the disbursement of assets after an estate sale in Pennsylvania can be a complex and lengthy process. The exact time frame to settle an estate often depends on a variety of factors, including the complexity of the estate, the number of heirs involved, and any court-ordered decisions.

It is important to understand that the process can take anywhere from months to years depending on these factors. Once all debts are paid, assets must be distributed according to either the will or laws of intestacy if there is no will present.

The executor of the estate is responsible for filing this information with the local court and ensuring all parties are notified of their rights and responsibilities throughout the process. Furthermore, they must provide complete and accurate accounting information to the court so that all parties involved can be kept informed about how assets are being distributed.

It is also important for executors to seek professional legal advice when navigating this complex process as it can help ensure that all taxes are properly accounted for, which further delays settlement.

The process of settling an estate after a house is sold in Pennsylvania can vary in length depending on numerous factors. Generally, the process will take several months to complete.

Depending on the complexity and size of the estate, it can take anywhere from three months to a year or more. The main factor that influences how long it takes to settle an estate is the probate process, which must be completed before the house can be sold.

The probate court will decide how assets are distributed and who will receive them. After probate has been finalized, other steps such as title transfers, settlement fees, and transfer taxes must be completed before the sale is finalized.

If all of these steps are completed quickly and efficiently, it may only take a few weeks for an estate to be settled after a house is sold in Pennsylvania. However, due to complexity or delays in other areas of the process, it may take several months or even longer to settle an estate.

The process of settling an estate in Pennsylvania is a complex one and can take considerable time. The process typically starts when the executor files a petition to open an estate with the court.

After the probate court grants this petition, the executor is then responsible for gathering all information necessary to settle the estate. This includes collecting assets, paying debts, filing tax returns, and distributing assets to beneficiaries as specified by the deceased's will or other applicable laws.

The length of time required to settle an estate varies based on its complexity and size, but it can generally take from 6 months up to two years or more. Executors should understand that they have a legal responsibility to settle an estate according to state law and failure to do so could result in legal action being taken against them.

When it comes to finalizing an estate in Pennsylvania, there are a number of factors that will determine how long it takes to settle. The process of settling an estate can be lengthy and involve many steps, depending on the complexity of the estate.

In general, the time required for an estate to settle depends on whether or not the deceased left a valid will, the size and value of assets involved, and any potential claims from creditors or other parties. It is important to note that if all parties agree, an estate can often be settled quickly.

On average though, it can take anywhere from six months to several years for an estate to be finalized in Pennsylvania. This is especially true if there are multiple heirs involved in complex estates with substantial assets requiring probate court approval.

Additionally, executors must submit paperwork to various government agencies such as the Internal Revenue Service (IRS) and state departments of taxation before they can distribute inheritances to beneficiaries. Therefore, when selling a home as part of an estate settlement in Pennsylvania, it is important to understand that this step is only part of a larger process which may take some time before completion.

When an estate is settled in Pennsylvania after a house is sold, the priority of payments first goes to the creditors. Creditors have a higher priority than beneficiaries and heirs when it comes to receiving payment from an estate.

In Pennsylvania, there are certain creditors that must be paid before other creditors or beneficiaries. These include any funeral expenses, costs of administering the estate, taxes due on the estate, claims for wages due to employees of the deceased, and mortgage lenders or other secured debt holders.

After all creditor claims have been paid off, then any remaining funds from the estate can be divided among beneficiaries and heirs according to Pennsylvania law.