Navigating Pennsylvania probate laws can be a daunting task when selling a house, but with the right knowledge and guidance the process can be made much simpler. Probate is a court-supervised process through which property is transferred from an estate to its rightful heirs and beneficiaries.

In Pennsylvania, probate law requires that estates are managed in accordance with certain regulations set by statute. The executor of an estate must obtain Letters Testamentary from the Register of Wills in order to transfer assets such as real estate, vehicles and other personal belongings.

The executor must also provide notice to creditors and pay all outstanding debts using funds from the estate before distributing any remaining funds or property to beneficiaries. Additionally, an inventory must be prepared for the estate that includes all assets and liabilities so that the court can ensure all assets have been properly accounted for during the probate process.

It is important to note that each county within Pennsylvania may have its own unique requirements for probating an estate, so it is important to seek out professional advice from a qualified attorney or accountant who specializes in probate law in order to ensure compliance with all applicable statutes and regulations.

Navigating Pennsylvania probate laws when selling a house can be confusing and time consuming. It is important to understand the types of estate administration that exist in order to ensure a smooth process.

Generally, two types of estate administration are available in Pennsylvania: Informal Administration and Formal Administration. Informal Administration is used for small estates with limited assets, usually under $50,000.

This type of administration does not require court involvement and allows for the distribution of assets without approval from the court or an executor's bond. Formal Administration is used for larger estates with significant assets, typically over $50,000.

This type of administration requires approval from the court and usually an executor's bond before any assets can be distributed or any real property sold. By understanding the types of estate administration available in Pennsylvania, individuals can ensure they are navigating through probate laws that are best suited to their situation when selling a house.

Navigating Pennsylvania probate laws when selling a house can be a daunting task without the proper understanding of how to file for probate. In Pennsylvania, probate is the legal process through which an executor or administrator is appointed to handle the estate of a deceased person.

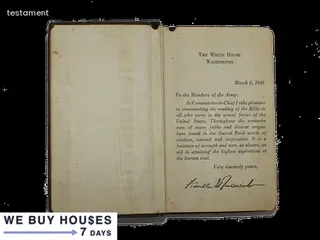

The executor or administrator must acquire Letters of Testamentary from the Register of Wills in order to administer the estate, including selling any real estate that was owned by the decedent. To apply for Letters of Testamentary, an application must be submitted with multiple documents that prove the applicant’s legal authority over the estate.

These documents include a will, death certificate, and any powers of attorney assigned to you by the decedent. After submitting all necessary documents, they will be reviewed and if approved, Letters of Testamentary will be issued and you can begin navigating Pennsylvania probate laws regarding selling a house.

Navigating Pennsylvania Probate Laws for selling a house can be a complex and intimidating process. Fortunately, there are people who can help with filing for formal probate.

Experienced estate planning attorneys are the most qualified to handle these cases as they are well-versed in the laws that govern probate in Pennsylvania. These professionals can provide guidance through the entire process from gathering information to filing paperwork and making sure all steps are taken in accordance with the law.

Additionally, an attorney can help ensure that all parties involved in the sale of the house adhere to their legal obligations and that title is passed properly. The legal counsel of an experienced estate planning attorney can provide immense peace of mind during this time and make sure your interests are protected.

Navigating Pennsylvania probate laws can be a complex and lengthy process when selling a house, but there are certain assets that are exempt from probate. If the asset is held jointly with rights of survivorship or if it is held in a trust, then it will not require probate to be finalized.

This means a faster and easier transfer of ownership upon the death of one of the owners. Other assets such as life insurance policies, retirement accounts, or annuities may also be able to avoid probate depending on their structure and how they are titled.

Furthermore, small estates which meet certain criteria may also be exempt from probate without having to go through the entire process. Understanding these exemptions can simplify the process of selling a house after death and allow for greater efficiency in settling an estate.

Navigating Pennsylvania probate laws for selling a house can be tricky. But if the estate is small, there may be an opportunity to utilize a simplified form of probate.

In order to qualify as a small estate, the total value of the assets must not exceed $50,000 and must include only real estate and personal property owned by the decedent. To apply for simplified probate in Pennsylvania, an executor or administrator must complete two forms: Petition for Grant of Letters and Acceptance of Appointment.

The forms must then be filed with the Register of Wills office and accompanied by documentation such as death certificates or deeds. Once these steps are completed, the executor or administrator can begin selling the house.

It’s important to note that certain rules and regulations may still apply even when utilizing a simplified form of probate so it’s best to consult with an attorney prior to making any decisions about selling a home through an estate in Pennsylvania.

A Regular Pennsylvania probate is a court-supervised process of distributing the assets of a deceased person's estate according to state law. This includes transferring ownership of their real estate, such as a house.

In order to sell a house in Pennsylvania, the executor or administrator of the estate must file an official petition with the court and submit all required documents to begin the probate process. After filing all necessary paperwork, the court will then issue Letters Testamentary which appoints the executor or administrator and gives them authority to act on behalf of the estate.

The executor can then proceed with selling any real property owned by the deceased, such as a house. During this process, it's important for both parties involved to understand and abide by Pennsylvania probate laws in order to ensure that all transactions are carried out properly and legally.

Probate is a court-supervised legal process in which the assets of an individual who has passed away are collected and distributed according to the terms of their will. It is important to understand Pennsylvania probate laws when selling a house as part of an estate, because these laws can have a significant impact on the estate planning process.

Probate involves numerous steps, such as identifying and inventorying all assets, paying debts, filing tax returns, appraising property values and distributing assets to beneficiaries. It can be a lengthy and costly process that requires time and resources that must be taken into consideration when navigating Pennsylvania probate laws for selling a house.

The probate court will make sure all creditors are paid before any assets are distributed to heirs or other beneficiaries. The court also monitors how estate assets are handled throughout the probate process, so it is important to understand the rules governing Pennsylvania probate law in order to properly navigate them when selling a house.

Navigating the probate process in Pennsylvania can be a complex and lengthy undertaking, but understanding the steps involved is key to completing the process. Initially, there must be an opening of the estate in court with a filing of a petition.

This petition includes information such as the deceased person's name, their last address and any next of kin who may have a claim to property. The court will then issue letters testamentary that appoint a representative for the estate.

The executor or administrator responsible for handling all matters related to probate is required to complete an inventory of all assets owned by the deceased person and file it with the court. Once any debts owed by the estate are paid, including taxes, creditors and other expenses associated with administering the estate, then assets may be distributed according to state law or as laid out in a will.

When it comes time for selling real property such as a home, legal documents that transfer ownership from one party to another must be filed in accordance with state law before closing on the sale can take place. Each step during this process should be carefully monitored and overseen by an attorney knowledgeable in Pennsylvania probate law.

Navigating Pennsylvania probate laws can be confusing and complicated when it comes to selling a house. When a deceased family member's home needs to be sold, estate executors often have questions about the process.

To help provide clarity, here are some frequently asked questions about the Pennsylvania probate process. How long does the probate process take? In most cases, the entire process takes around six months.

Is there an advantage to filing in a particular county? If all of the beneficiaries are local, then the executor should file in the county where they reside. What documents are needed to start the process? A death certificate, will, and any other relevant paperwork must be presented to initiate proceedings.

Are there any costs associated with probate? Yes, fees vary by county but can range from $500 - $3000 depending on complexity of the estate. How much tax is owed during probate? Any taxes due depend on state and federal tax laws at that time; however, heirs may qualify for certain deductions or credits to reduce taxation on inherited assets.

These FAQs provide valuable information for those navigating Pennsylvania’s probate laws when selling a house.

Selling a house during a Pennsylvania probate sale can be a complicated process. To make sure that the process goes as smoothly as possible, it is important to understand what you need to know before selling the house.

One of the first things to consider is whether or not the estate will require court approval. If court approval is necessary, then the executor of the estate must file an inventory and appraisal with the court.

Additionally, all potential buyers must be given notice of the sale so that they have an opportunity to submit bids. It is also important to check with local zoning laws and ordinances when determining how much money can be received from the sale of a house during a probate sale in Pennsylvania.

Furthermore, if there are multiple heirs involved in the sale, it is important to ensure that all parties are treated fairly and equitably throughout the entire process. Understanding these basic guidelines about navigating Pennsylvania probate laws for selling a house can help make sure that everything goes as smoothly as possible during this often-complicated process.

When selling a house in Pennsylvania, it is important to understand when a property becomes subject to probate laws. In general, any real estate owned by someone who has passed away must go through the probate process before a sale can be completed.

During this legal process, a court will appoint an executor or administrator to manage the deceased person's estate. The executor has the authority to list the house on the real estate market and also has responsibility for locating heirs and distributing assets accordingly.

If there are no living heirs, then the executor is responsible for disposing of all remaining property according to Pennsylvania law. Furthermore, if there are multiple heirs involved in the sale of the home, they may have to work together to agree on how they will proceed with selling it.

It is critical that everyone involved in this process understands their rights and obligations under Pennsylvania probate law so that they can navigate these complexities successfully.

When a Pennsylvanian estate is “adjudicated”, it means that the court has made a determination of the rights of the heirs to the property. This process is also referred to as “order of distribution” and involves the court issuing an order on how assets should be distributed among heirs.

Adjudication is an important step in navigating Pennsylvania probate laws for selling a house, as it determines who has legal ownership of the property and who must grant permission before it can be sold. In order to complete this step, all interested parties must sign or agree to paperwork granting permission for the sale, which typically requires submitting documents to the court such as death certificates, wills or other relevant documents.

Once all parties have agreed, an adjudication order can be granted by the court and the house can be sold in accordance with Pennsylvania probate law.

Navigating Pennsylvania probate laws for selling a house can seem like a daunting task. Knowing the amount of time it takes to complete such a sale can help alleviate some of the stress associated with the process.

Generally speaking, depending on the circumstances, it can take anywhere from three months to one year or more to complete a PA probate sale. This timeline is due in part to the filing of necessary paperwork and court proceedings that may be involved in order to transfer property ownership.

In addition, other factors that determine how long it will take for a PA probate sale to be finalized include whether or not all heirs have been located, if there are any disputes as to who should receive what share of the estate and if there are any debts owed that must be settled prior to closing. With so much involved in completing a PA probate sale, having an understanding of how long it could take provides peace of mind when navigating the intricacies of Pennsylvania's probate laws.

When a loved one passes away in Pennsylvania, it is often necessary to navigate local probate laws for selling their house. An executor or administrator of the deceased person's estate must carry out certain duties during this process.

This includes gathering the information and assets of the decedent, filing paperwork to open an estate with the local court system, notifying potential creditors and beneficiaries, collecting assets on behalf of the estate, paying debts and taxes owed by the estate, and finally distributing remaining assets according to any valid will or based on PA state law if no will exists. The executor or administrator may also need to manage any real estate owned by the decedent while they are overseeing probate proceedings.

This can include continuing to pay property taxes, maintaining insurance on a home and taking steps to sell a house if needed. It is important that executors and administrators of an estate understand their duties throughout Pennsylvania probate proceedings in order to ensure all financial matters related to a decedent's house are properly handled.

As an heir or beneficiary in Pennsylvania, it is important to be aware of your rights during the probate process when selling a house. Generally, you have the right to receive a copy of the will and other documents related to the estate, as well as be informed of proceedings during the probate process.

You are also entitled to copies of any inventories and appraisals of estate assets. Furthermore, you have the right to be notified in advance if an executor wishes to sell or transfer any estate property.

In addition, you can petition for a formal accounting from the executor and challenge any actions taken by them that do not adhere to Pennsylvania probate laws. Finally, it is your right to be able to file objections if you disagree with anything regarding administration of the estate or distribution of assets.

Navigating Pennsylvania probate laws for selling a house is not an easy process and can be overwhelming, especially if you are unfamiliar with the legal system. Working with an attorney during your Pennsylvania probating process can provide many benefits, such as helping to ensure that all the paperwork is filed correctly, informing you of any deadlines that need to be met, and providing representation in court if necessary.

Keeping accurate records throughout the entire process is essential, as it helps to make sure all assets are accounted for and proper distribution of those assets takes place. Additionally, having a lawyer on hand can provide peace of mind that all the documents are completed accurately and properly.

Understanding the tips and strategies that can make this process easier can also help alleviate some of the stress associated with probating a property in Pennsylvania. From knowing which forms need to be completed to understanding how to handle financial matters after a death, having an experienced lawyer available can help guide you through the entire process from start to finish.

Probate is the legal process of administering a deceased person's estate in Pennsylvania. It involves verifying the authenticity of a will, determining and paying debts, collecting and evaluating assets, identifying and distributing property to heirs, and settling any remaining taxes or expenses.

The process can be complicated and time-consuming, but understanding the basics of probate law in PA can help make selling a house easier. Probate laws in Pennsylvania are designed to ensure that all assets are properly distributed according to the deceased person's wishes.

This includes ensuring that all debts have been settled before any assets can be divided among beneficiaries. Additionally, it is important to understand how certain types of property are treated under PA probate laws, such as real estate.

Generally speaking, real estate must go through probate before it can be sold by an executor or heir.

When navigating Pennsylvania probate laws in order to sell a house, it is important to understand the difference between probate and non-probate assets. Probate assets are all property that is owned by an individual, including real estate, bank accounts, investments, life insurance policies and other personal items.

Non-probate assets are those which pass directly to another party outside of the probate process, such as jointly held property or retirement accounts with designated beneficiaries. In Pennsylvania, if the deceased had only non-probate assets such as joint tenancy or payable on death (POD) accounts then no probate court action will be necessary when selling their house.

If however there are any probate assets involved in the sale of a house, a petition must be filed with the court in order for the executor of the estate to gain authority over them and proceed with the sale.

In Pennsylvania, some assets are exempt from probate and not subject to the formal process. These assets include joint tenancy property, life insurance proceeds with a designated beneficiary, retirement accounts such as 401(k)s or IRAs that name a beneficiary other than the estate, and revocable or irrevocable trusts.

Joint tenancy property is automatically transferred to the surviving owner after death and does not have to go through probate. Life insurance proceeds named in a beneficiary designation also bypasses probate.

Retirement accounts such as 401(k)s and IRAs will be distributed directly to the named beneficiary listed on the account, avoiding probate altogether. Additionally, assets held in living trusts (such as revocable trusts and irrevocable trusts) are not subject to probate because they are already legally owned by the trust instead of by individuals.

In Pennsylvania, these types of assets can be excluded from the probate process when selling a house after someone dies.

When navigating Pennsylvania probate laws for selling a house, one of the primary questions prospective buyers will have is how long it takes for an estate to go through probate. Generally speaking, the length of time it takes to complete the probate process can vary depending on certain factors such as the complexity of the estate and whether or not all parties involved agree with the decisions being made.

In most cases, however, it typically takes between six and nine months to go from filing a petition to receive letters of administration until closing on a sale. During this time period, assets must be inventoried and appraised, assets must be distributed according to instructions in the will (if there is one) or by state intestacy law (if there is no valid will), creditors must be paid off and any applicable inheritance or estate taxes must be settled.

Once all these steps have been completed, then you can begin the process of selling an estate property in Pennsylvania.

A: A probate listing in Pennsylvania is a list of assets that are held in trust or inter vivos trusts for distribution to the beneficiaries of a trust fund or estate. The Law of Trusts guides the process of distributing these assets according to the terms set out in the trust document.

A: A probate listing in Pennsylvania includes devises, devisees, legacies, and testamentary trusts.

A: A probate listing in Pennsylvania is a legal document that lists all the tangible personal property and personal estate of a deceased person, which includes any assets held in trust or inter vivos trusts.

A: According to the Law of Trusts, Trust Funds, Held in Trust and Inter Vivos Trusts, anyone who is listed as a fiduciary in a probate listing in Pennsylvania has a responsibility to act with loyalty and care in managing the estate. They must administer the estate according to the terms of the will or trust agreement, and they must use reasonable diligence when investing and managing assets. Additionally, they have an obligation to keep accurate records of all transactions related to the estate and to provide regular reports on the status of the estate.

A: Probate listings in Pennsylvania refer to the process where the court assigns an executor or administrator to manage a decedent's estate and distribute their assets according to their will or state law.

A: Under Pennsylvania law, a probate listing is a process through which an administrator is appointed by the court to manage the decedent's estate and ensure that all debts are paid and assets are distributed according to the wishes of the deceased.

A: An Intestate Share is the portion of a decedent's estate that will be distributed according to Pennsylvania's Law of Intestate Succession if the decedent did not leave a valid will.

A: A probate listing in Pennsylvania is a legal document that outlines the process for inheriting a decedent's estate. It helps to identify the rightful heirs and ensure that the assets are transferred in accordance with the wishes of the deceased. It also provides guidance on how to navigate Pennsylvania's probate laws when it comes to selling a house or other property.

A: A probate listing in Pennsylvania is part of the required legal process for distributing the assets of a deceased person's estate. The court will oversee the payment of any debts and taxes due from the estate before allowing for the distribution of any remaining property to heirs or beneficiaries.

A: A probate listing in Pennsylvania provides guidance on the legal requirements for selling a house when there is an inheritance involved. It outlines the steps necessary for determining who is legally entitled to inherit the estate, as well as how to transfer title and ownership of the property. This ensures that everyone's rights are respected and that all taxes and other liabilities are properly addressed.

A: In Pennsylvania, a probate listing requires that a decedent's estate must be processed through probate court. This includes determining heirs, distributing assets according to the decedent's will, and obtaining court approval for any distribution of cash or assets. It also requires that any Power of Attorney or Durable Power of Attorney documents must be valid and properly executed in order to be recognized by the court.

A: Executors of estates in Pennsylvania must abide by state probate laws when selling a house and determining heirs. They are responsible for obtaining an appraisal of the decedent's assets, preparing and filing the required court documents, paying taxes, debts, and other obligations associated with the estate, as well as distributing any remaining assets according to the terms of the will or trust. In addition, they must ensure that all estate planning documents such as cash transfers, powers of attorney, durable powers of attorney and durable power of attorney are properly prepared and executed.

A: A probate listing in Pennsylvania can help to determine the correct heirs of a decedent's estate, as well as provide guidance on how to properly handle cash, powers of attorney, and durable powers of attorney. It also assists executors in determining their responsibilities related to the estate.

A: Probate listings in Pennsylvania require that executors file all necessary documents to transfer ownership of the decedent's estate according to the Law of Trusts, Trust Funds, Held in Trust and Inter Vivos Trusts. This includes filing applications for cash, power of attorney, durable powers of attorney and durable power of attorney. Executors are also responsible for providing notice to heirs and creditors as well as managing assets in accordance with applicable state laws.

A: Typically, a probate listing in Pennsylvania requires that an executor is appointed to administer the decedent's estate. The executor is responsible for locating and notifying heirs, inventorying assets and liabilities, paying debts, filing taxes, and distributing the remaining assets to heirs according to the decedent's will or state law. In order for a house to be sold as part of the estate, the executor must obtain court authorization by petitioning for an Order of Sale from the court.

A: A probate listing in Pennsylvania can provide important information about the decedent's estate, including cash assets, powers of attorney, and durable powers of attorney. It also outlines the executor's responsibilities related to the inheritance and sale of the house. Understanding these requirements helps to ensure that all legal considerations are followed when navigating the process.

A: A probate listing in Pennsylvania aids in navigating the laws of Trusts, Trust Funds, Held in Trust and Inter Vivos Trusts, by determining which heirs are entitled to portions of a decedent's estate. It also helps to ensure that cash, power of attorney, durable powers of attorney and durable power of attorney requirements are met. The executor has specific responsibilities related to the probate listing as well.

A: A probate listing in Pennsylvania requires that all vacant properties owned by the decedent must be listed according to their respective terms of years or tenants in common. The executor is responsible for ensuring that all rental agreements are up-to-date and compliant with state laws and regulations. Furthermore, any tenant rights must be respected, including the right to remain in occupancy until the term of years has expired or when there is mutual agreement between the executor and tenant(s) to vacate.

A: A probate listing in Pennsylvania affects the Right of Survivorship and Joint Tenants by determining the inheritance of a decedent's estate. In this way, it helps to determine who will receive property through the laws of Trusts, Trust Funds, Held in Trust and Inter Vivos Trusts. Additionally, it can help to navigate Vacancy, Tenants, Term of Years, and Tenants in Common rights as they pertain to inheritance.

A: A probate listing in Pennsylvania will require an Affidavit of Inheritance to be filed by the executor of the estate. This affidavit is used to determine who is entitled to receive any Pension or Employee-benefit Plan rights as well as any Investor accounts that had been established by the decedent.

A: A probate listing in Pennsylvania helps to navigate the process of selling a house, determining heirs and settling inheritance and estate taxes. The executor is responsible for filing the necessary documents to initiate probate, setting a reasonable market price for the property and ensuring that all debts are paid. It is important to also be aware of any potential vacancy issues, tenant rights, power of attorney provisions, and other legal considerations that may affect the sale price or transfer of ownership.

A: A probate listing in Pennsylvania is used to determine the value of a decedent's estate based on assets such as real property, stocks, bonds, life insurance policies, and other investments. Through this process creditors will be paid off and any remaining assets will be distributed to the heirs according to the instructions outlined in the decedent's will or according to statutory law.