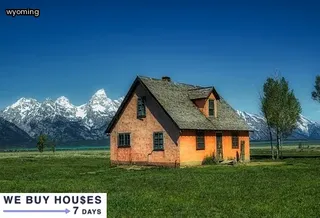

Navigating Wyoming's real estate probate laws to become an administrator is a complex process. It requires a thorough understanding of the state's legal requirements and procedures to guarantee that all steps are taken correctly.

The first step in assessing probate requirements in Wyoming is to determine if formal or informal administration is necessary. Formal administration includes court proceedings, which must be followed precisely.

Informal administration, on the other hand, does not require an appearance before a judge but must still comply with the state statutes. Additionally, executors in Wyoming have specific duties such as collecting and managing assets and paying creditors, filing tax returns for the decedent, distributing any remaining assets according to the will or applicable laws, and filing any additional court documents as required by law.

Therefore, it is important to understand these duties and make sure they are fulfilled properly before becoming an administrator in Wyoming's real estate probate laws.

Navigating Wyoming's real estate probate laws can be a difficult process for those who seek to become an administrator. The first step is to understand the process of avoiding probate in Wyoming, which may include transferring assets into a living trust, joint ownership with right of survivorship, and designating beneficiaries on financial accounts and insurance policies.

Once these steps have been taken, there are certain criteria that must be met by potential administrators in order to take control of the deceased person’s assets. These criteria often include being of legal age, having up-to-date contact information for all heirs, and providing proof of death.

It is important to note that each county in Wyoming has its own set of rules when it comes to administering a deceased person's estate and these rules should be consulted before beginning the process. Additionally, experienced legal counsel should always be sought out when attempting to navigate Wyoming's real estate probate laws in order to ensure that all necessary steps are taken correctly.

When it comes to estate administration in Wyoming, there are certain laws and regulations governing executor compensation and payments for services rendered. In some cases, the decedent's will may provide for a specific amount of compensation or reimbursement for expenses incurred on behalf of the estate, while other situations may require the court to determine an appropriate payment to be made.

In either instance, there is a minimum fee that must be paid to an executor based on the gross value of the estate; this amount is set by statute and can range from $100 - $10,000 depending on the size. A higher rate of compensation may be awarded in special circumstances, such as where complex legal or financial tasks are involved.

Additionally, any costs related to administering the estate (such as attorney fees) must also be taken into consideration when determining executor payment. Ultimately, understanding and navigating Wyoming's real estate probate laws is essential for prospective administrators who wish to ensure they receive fair and adequate remuneration for their services.

Navigating Wyoming's real estate probate laws can be a daunting task for anyone taking on the role of administrator. The probate process in Wyoming is generally lengthier than in many other states, due to the specific procedures and policies involved.

Depending on the size and complexity of the estate, the process may take anywhere from a few months to well over a year. Furthermore, it is important to note that some types of assets are exempt from probate entirely, including certain types of jointly held property and life insurance policies with designated beneficiaries.

It is important for administrators to understand all aspects of the probate process in order to ensure an efficient and successful outcome.

In Wyoming, probate is a necessary part of the process for individuals who want to become an administrator of a deceased person's estate. Probate laws in Wyoming are complex and navigating them can be difficult.

The only way to legally become an administrator of an estate is to go through the probate process, which requires the executor to file paperwork with the court and submit documents such as the will, inventory forms, and death certificate. This is necessary even if there are no assets or debts that need to be taken care of.

The court will then appoint an administrator who will oversee the management of assets and debts in accordance with state law. In some cases, it may be possible to bypass probate by transferring assets directly to heirs or by creating trusts; however, this should only be done with the guidance of a qualified attorney familiar with Wyoming's probate laws.

When a Will is involved in a probate case, it can have a major impact on the proceedings and determine how the estate is distributed. In Wyoming, real estate probate laws require an administrator to be appointed by the court when there is no will present or if the will is deemed invalid.

The process of becoming an administrator involves navigating many complex regulations, including filing paperwork and attending hearings. Even if there is a valid will present, the administrator must still ensure that all legal requirements and procedures are followed.

In addition to filing documents with the court, a good understanding of Wyoming's real estate probate laws is also essential for properly administering any estate. The administrator must also abide by any applicable state or federal laws that may affect their duties as executor of an estate.

It's important to remember that each situation is unique and requires careful consideration in order to ensure that all relevant parties are respected and protected throughout this process.

Navigating Wyoming's real estate probate laws as an administrator of an estate can be a complex process. It is important to understand the requirements and steps for settling an estate and completing administrative tasks in this state.

Before administering an estate, individuals should familiarize themselves with the statutory filing requirements and deadlines associated with probate proceedings in Wyoming. This includes knowing which documents need to be filed in court, how long they must remain open after being filed, and the fees associated with submitting these documents.

Additionally, administrators should understand their duties and responsibilities once appointed by the court, such as notifying creditors, paying taxes, preparing inventories of assets and liabilities, distributing assets according to the wishes of the deceased, and closing out the estate. With knowledge of Wyoming's real estate probate laws, administrators can successfully settle an estate while fulfilling their duties as required by law.

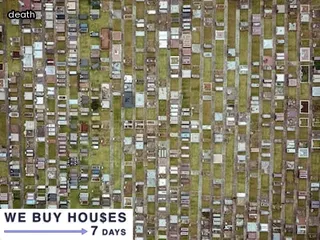

In the state of Wyoming, individuals who are appointed to be an administrator of a deceased person’s estate must follow certain statutory deadlines for filing after death. When an individual dies, their will must be filed within ninety days.

If there is no will, the estate must be opened in court within three months of the decedent's death. A Notice to Creditors must also be published in a local newspaper if creditors are unknown or reside outside of Wyoming.

Any debts or taxes due must be paid within seven months of the decedent's death. Lastly, all estate assets must be distributed within one year and four months from the date of death.

It is important to note these deadlines, as failure to comply can result in personal liability or other legal action by creditors and beneficiaries alike.

The probate court and code in Wyoming play an important role when dealing with real estate probate laws. Estate administrators must be familiar with the state's regulations and rules to ensure that the process is handled properly and efficiently.

The court must first determine whether a will exists, then appoint an administrator if necessary. It is also responsible for determining the validity of any claims made against the estate, as well as overseeing the distribution of assets according to the wishes of the deceased.

In addition, it ensures that all taxes are paid and debts collected. Wyoming has specific guidelines that must be followed regarding real estate transfers, such as ensuring that any liens or mortgages on the property are paid off or released before transfer can take place.

Understanding these laws can help ensure that any real estate transactions are conducted legally and in accordance with state law.

Navigating Wyoming's real estate probate laws can be a daunting task for those interested in becoming an administrator. Understanding what is involved with probate in Wyoming is key to making sure that all the steps are completed correctly and efficiently.

The process of probate involves identifying, accumulating and evaluating the assets of a deceased individual, notifying creditors and heirs of the death, settling debts and taxes, and finally distributing assets to beneficiaries. An executor or administrator must be appointed by the court to oversee this process.

This requires filing a petition with the court as well as providing information regarding the deceased individual's will or estate plan. Once appointed by the court, it is important that administrators understand their responsibilities which include inventorying property, valuing assets, liquidating some property if needed and paying creditors and taxes from estate funds.

In addition, administrators must provide regular accountings to interested parties during each step of the probate process. Navigating Wyoming's real estate probate laws can be complex, so having an understanding of what is involved before beginning this journey is essential for success.

Wyoming's real estate probate laws are unique in comparison to other states. While many states provide a set of regulations and rules regarding the handling of an estate, Wyoming outlines specific provisions that must be followed when an individual is appointed as an administrator.

This includes understanding the different types of probate proceedings, including independent and supervised administration, as well as navigating the complex paperwork associated with becoming an administrator. It is also crucial for potential administrators to study state-specific laws related to assets, such as taxes and creditors' rights, which can differ from other states.

Furthermore, it is important for administrators to understand the timeline and deadlines given by the court when filing certain documents. When examining the uniqueness of Wyoming's real estate probate laws, there are numerous factors that must be taken into consideration in order to navigate these laws successfully and ensure that all parties involved receive their rightful inheritance.

In Wyoming, the factors that determine if a real estate transaction must go through probate are based on the size of the estate, who the administrator is, and whether or not there is a will. If the estate size is greater than $100,000, then it must go through probate in order for an administrator to be appointed.

The type of administrator also matters; an independent executor or personal representative might be able to handle matters without going to court, but this depends on what type of property is involved and if any disputes arise. Additionally, if there is no will or other document outlining how the assets should be divided among family members, then you may need to go through probate in order to have a judge decide who gets what.

Taking all these factors into consideration when navigating Wyoming's real estate probate laws can help you become an effective administrator.

Navigating Wyoming's real estate probate laws for becoming an administrator can be a daunting task, especially when the deceased person did not leave behind a will. When someone dies without a will in WY, their assets are distributed according to state law and creditors are paid first, leaving the remainder of the estate to surviving family members.

This process can create complications and additional stress for those left behind. Family members may disagree on how the deceased person’s assets should be distributed or they may not be aware of all of the estate’s assets.

If there is no clear heir, the court must appoint someone to act as an administrator who will ensure that all debts and taxes are paid before any remaining property is distributed. It’s important that anyone considering becoming an administrator understands their legal rights and responsibilities so that they are able to properly manage the estate’s finances and fulfill their duties as an administrator in accordance with Wyoming's real estate probate laws.

Navigating Wyoming's real estate probate laws can be a complex process for those looking to become an administrator. At the heart of this process are the different types of probates available in the state.

Generally, there are four types of probates, including formal proceedings, summary proceedings, informal proceedings and ancillary proceedings. Formal proceedings involve court hearings and rulings from a judge or magistrate regarding a decedent's assets and debts; these are the most complicated type of probate and may require legal assistance.

Summary proceedings are for smaller estates or those without complicated matters; these typically do not require court appearances but do require notice to interested parties. Informal proceedings provide a simplified version of summary proceedings that do not include court appearances and allow administrators to handle most matters on their own.

Lastly, ancillary proceedings are required when property is located in another state, as different procedures and filings must be completed in both states to settle the estate. Understanding each type of probate available in Wyoming is essential for anyone looking to become an administrator as they determine how to navigate the real estate probate laws effectively.

Navigating Wyoming's real estate probate laws for becoming an administrator involves understanding the timelines and deadlines associated with the probate proceedings. In Wyoming, an individual who is chosen to serve as an administrator must be notified within 30 days of being appointed.

Once they have been notified, they have 10 days to accept or decline the position. If they do accept the appointment, they will then need to file a form with the Register of Deeds in the county where the deceased resided.

It is important that this form is filed within 60 days of being appointed or else the appointment will be considered void. Additionally, when filing this form, administrators need to make sure that any fees associated with it are paid in full at this time.

The Register of Deeds must also receive notice of any creditors who are owed money from the estate within 90 days of the administrator being appointed. The Administrator must also provide notice to all persons interested in the estate within 90 days after being appointed as well.

Lastly, once all other steps have been completed, including filing all necessary paperwork with both the court and Register of Deeds, an inventory of assets must be filed no later than 6 months after being appointed as an Administrator. Understanding these timelines and deadlines is essential for anyone wishing to navigate Wyoming's real estate probate laws for becoming an administrator.

Navigating the probate laws in Wyoming can be daunting when it comes to becoming an Administrator of an Estate. To become an Administrator, you must be appointed by the court, and the appointed person must meet a few requirements.

Generally, to be eligible for appointment, you must be 18 years of age or older and a resident of Wyoming or related to the deceased. Additionally, you must have no criminal record and no conflict of interest with the estate.

You will also need to pass a background check prior to being appointed as Administrator. In some cases, you may need to post a bond in order for your appointment to be approved by the court.

When submitting your petition for appointment as Administrator, you should include a valid identification document such as driver's license or passport and proof of your residence in Wyoming such as utility bills or bank statements. Lastly, if there are multiple executors appointed, they should all sign the documents agreeing on their roles and responsibilities during the process.

Navigating Wyoming's real estate probate laws for becoming an administrator of an estate involves understanding the duties required during the estate administration process. These may include locating and inventorying assets, paying any outstanding taxes or debts, collecting money owed to the deceased, making distributions of assets to beneficiaries, and filing necessary court documents in a timely manner.

An administrator may also be responsible for preparing financial statements so that all parties can see how funds have been used. Additionally, they may have to appear in court to answer questions or provide additional information.

Understanding these obligations is essential for those seeking to become an administrator of an estate in Wyoming.

Navigating Wyoming's real estate probate laws can be a complex process for those hoping to become an administrator of a deceased individual's assets. Beneficiaries of the estate must understand the legal requirements for accessing these assets and how to obtain them in a timely manner.

One of the first steps is to officially identify the decedent's heirs and beneficiaries because all parties will need to agree on who will act as administrator and how assets should be divided. The intestacy laws in Wyoming also define who may receive assets if there are no designated heirs or beneficiaries, such as creditors and distant family members.

The court system is then involved in proving that all debts are paid, including taxes, before any remaining assets can be distributed among the eligible parties. It's important to note that some items, such as jewelry or art, may need to be appraised before being distributed fairly among all heirs.

As part of this process, heirs must attend multiple court hearings and complete necessary paperwork related to the administration of an estate so they can access their inheritance quickly and efficiently.

Navigating Wyoming's real estate probate laws can be a daunting task for those who are trying to become an administrator. Fortunately, there are several other sources of information and guidance that can assist with settling an estate in the state.

The Wyoming Bar Association offers a variety of resources including a comprehensive legal guide on probate and estate administration. Additionally, the State of Wyoming provides detailed information about the filing process through its Department of Audits and Accounts website.

There are also helpful online forums dedicated to providing guidance on navigating the complex probate process in the state. Furthermore, local attorneys who specialize in probate law can provide valuable insight into the specifics of settling an estate in Wyoming.

All these resources provide useful information that can help simplify the process of becoming an administrator in Wyoming.

Navigating Wyoming's Real Estate Probate Laws can be a complex and complicated process when it comes to becoming an administrator. Preparation and planning are key to helping avoid or minimize the necessity of probate in the state of Wyoming.

Doing research on the laws, regulations, and procedures is critical for understanding how best to plan for future real estate transfers. Additionally, there are available resources that provide information about the process and associated fees.

Working with knowledgeable professionals, such as attorneys and accountants, who are familiar with WY real estate probate law can also be beneficial in developing an effective strategy. It is important to consider both short-term and long-term objectives when making decisions regarding property transfers.

Additionally, having a comprehensive plan in place to deal with unexpected circumstances can help protect both parties involved in the transfer should any disputes arise. By being prepared and taking action now you can ensure that you have taken the steps necessary to navigate Wyoming's Real Estate Probate Laws successfully.

Navigating Wyoming's real estate probate laws for becoming an executor of an estate can be complex and daunting. In order to become an executor, you must first understand the relevant state laws and regulations.

In Wyoming, individuals must be appointed by a court to serve as executor of a deceased person’s estate. This is done through a process known as probate.

The court will appoint an individual that the decedent designated in their will or someone chosen by the court based on certain criteria. To initiate probate proceedings in Wyoming, the personal representative must file a petition with the local district court, which includes providing proof of death and all required documents.

Once appointed, the executor is responsible for collecting and managing assets, paying creditors and taxes, distributing assets according to the terms of the will or intestacy laws if no will exists, filing final tax returns, and closing out the estate when all steps have been completed. An attorney with experience in Wyoming's real estate probate law can help guide you through this process.

With their help, you can become an executor quickly and efficiently.

In Wyoming, a probate is triggered when the estate of an individual exceeds $100,000. If the estate is valued at more than this amount, it must go through the probate process and be administered by an appointed administrator.

It's important for those considering becoming administrators to understand the laws governing Wyoming's real estate probate proceedings. Administrators are responsible for collecting all assets from the deceased person's estate, paying off any debts or taxes owed, and distributing what remains to any beneficiaries listed in the deceased person's will.

Understanding these laws can help you better navigate Wyoming's real estate probate laws and become an effective administrator.

In Wyoming, an executor of an estate is entitled to compensation for their services. The amount a person can receive depends on several factors including the size of the decedent's estate and the complexity of their will.

If a will stipulates that an executor receives a fixed fee, then that amount must be paid as stated in the will regardless of the estate's size or complexity. If no set compensation is mentioned in the will, then Wyoming law allows for statutory fees based on a percentage of the gross value of all assets in the estate at the time of death.

Generally, this percentage ranges from 3-5%, however, it can range up to 7% depending on how much work is required to administer and settle the estate. While serving as an executor may involve considerable effort, it can also be quite rewarding for those who are willing and able to take on such responsibility.

Yes, Wyoming requires probate when the estate of a deceased individual has assets that exceed $100,000. In order to navigate Wyoming's real estate probate laws and become an administrator, it is important to understand the process and requirements.

Probate is the court-supervised process of collecting a decedent’s assets, paying off any debts or taxes that are owed, and distributing the remaining property to heirs or beneficiaries. Wyoming law requires that a personal representative be appointed by either the court or by agreement of all interested parties to handle administering the estate.

The personal representative is responsible for identifying and appraising all assets in the decedent’s name; notifying creditors; filing tax returns; taking possession of bank accounts and other financial accounts; and ensuring that all legacies are paid out according to state law and the terms of any will. Once the probate process is complete, the personal representative must file a final accounting with the court before distribution of assets can take place.

Understanding these requirements will help ensure that navigation of Wyoming's real estate probate laws leads to successful administration.