When you close on a house in Wyoming, there are certain closing costs that are compulsory. These include attorney fees, title charges, survey fees, and taxes.

Attorney fees are typically charged by the lawyer handling the closing, and may be based on a flat rate or an hourly rate. Title charges can include those related to the title search, recording of documents, and the issuance of title insurance.

Survey fees may be necessary if there is not an existing survey of the property or if an updated survey is needed. Taxes may also need to be paid when closing on a house in Wyoming; these could include transfer taxes or excise taxes.

It's important to understand all these closing costs before signing any paperwork so that you know exactly what you're paying for at your house closing in Wyoming.

When purchasing a house in Wyoming, it is important to understand the closing costs associated with real estate transactions. Closing costs can vary depending on whether you are the buyer or seller of the home.

Buyers can expect to pay attorney fees, title insurance premiums, transfer taxes, and loan origination fees. Sellers usually pay a commission to their realtor, any liens that may be attached to the property as well as other taxes and fees.

Both buyers and sellers will typically also have to pay for an appraisal fee, recording fees, and prepaid home insurance premiums. It is important to speak with an attorney who specializes in real estate law in Wyoming in order to fully understand all the closing costs associated with buying or selling a home in the state.

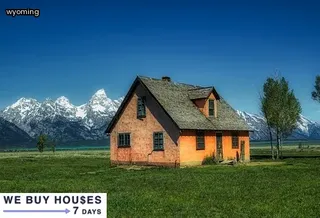

When looking into house closings in Wyoming, it is important to understand the impact of property type on closing costs. Depending on the type of property you are purchasing, your attorney fees may vary significantly.

Single-family dwellings, such as a typical family home, usually have lower closing costs than those associated with a multiple-family dwelling, such as an apartment building or condominium complex. Additionally, some properties may require more legal work from the attorney due to specific zoning regulations and other local rules that must be taken into consideration when determining closing costs.

It is also important to note that buying land also requires additional legal services from your attorney due to title searches and other paperwork. Knowing the type of property you are dealing with can help you better anticipate any potential extra fees associated with the closing process.

Understanding these impacts ahead of time will help ensure that your real estate transaction proceeds smoothly and efficiently while minimizing unanticipated expenses related to attorney fees for house closings in Wyoming.

When closing a house in Wyoming, there are applicable taxes and insurance that must be taken into consideration. Before closing on the house, you should determine what taxes and insurance need to be paid.

Property taxes are typically paid by the seller; however, it is important to understand if there are any other taxes due for the transaction as these can vary depending on the area. Homeowner's insurance is also required before closing on a home.

It is important to understand what kind of coverage is necessary for your particular home in order to ensure that all potential risks are covered. Additionally, you should make sure you have an understanding of what fees may be associated with attorney services during your house closing in Wyoming.

Understanding the closing costs associated with a house closing in Wyoming can be daunting. It is important to understand all of the components and associated fees in order to make an informed decision when looking at real estate law.

Closing costs include items such as title fees, transfer taxes, recording fees, prepaid items such as taxes and insurance, and attorney fees. Title fees are typically paid to the title company for collecting documents, performing research on the property's title history, issuing title insurance policies and handling the closing process.

Transfer taxes are usually paid by the seller and are based on a set percentage of the purchase price. Recording fees are also paid by the seller and cover expenses for filing legal documents with local government offices that certify ownership of the property.

Prepaid items such as taxes and insurance cover future obligations due during ownership. Finally, attorney fees may apply for both sides of the transaction which cover services such as reviewing documents, coordinating with other professionals involved in closing, attending closings or providing advice throughout the process.

All of these components and associated fees must be considered when navigating real estate law in Wyoming.

When looking to reduce closing costs in Wyoming, it is important to understand the different types of legal fees associated with a real estate transaction. Such attorney fees often include title insurance, escrow services, and other administrative costs.

It is best practice to review all closing documents thoroughly to ensure that all parties involved in the transaction are aware of these charges. Additionally, homeowners should be sure to ask their attorney for an itemized list of all legal costs associated with their house closing in Wyoming so that they can make an informed decision on how much they may need to pay out-of-pocket.

Understanding any additional fees ahead of time is essential when attempting to keep closing costs low. Furthermore, if possible, negotiating lower legal fees with the attorney could be beneficial since attorneys typically charge a percentage based on the total cost of the house.

By researching local laws and regulations, consulting experienced real estate lawyers, and inquiring about any available discounts or credits towards legal fees, homeowners can significantly reduce their closing costs when buying a home in Wyoming.

When it comes to closing costs associated with real estate transactions in the state of Wyoming, there are ways that individuals can maximize their savings. It is important to understand the different fees and laws related to house closings in Wyoming so that you can make sure you’re getting the best possible deal.

Attorney fees are one of the most expensive components of closing costs, so understanding what they cover and when they’re necessary can help you save money. Many attorneys offer flat fees or other payment options, so researching these options ahead of time is essential for ensuring you get a fair price.

Additionally, some attorneys may be willing to negotiate on their rates if there isn’t a lot of work involved in the closing or if the buyer or seller has a good relationship with them. Knowing about all these different ways to reduce your attorney costs can help you get the most out of your real estate transaction and make sure your house closing goes smoothly.

When negotiating closing costs in Wyoming, it is important to understand the different types of fees associated with a real estate transaction. This includes attorney fees related to house closings.

The amount charged for these services will vary depending on the complexity of the case, and it is important to be aware of all costs before signing a contract. When looking for an attorney, ask them what specific services they provide and make sure that this is included in their fee structure.

Additionally, look into any additional fees such as filing fees or document preparation fees that may be required. Knowing what you are being charged for can help you negotiate the best deal possible when closing on your home.

It is also beneficial to compare rates among different attorneys in order to get the most competitive price for your services. Understanding real estate law and having an attorney who knows how to properly navigate any legal pitfalls can save you time and money when dealing with house closings in Wyoming.

When considering the purchase of a home in Wyoming, it is important to understand how attorney fees associated with the closing process can affect your overall closing costs. One way to potentially reduce these costs is by exploring alternatives to traditional mortgages.

There are a variety of options available which may provide more favorable terms than what you might find with a standard loan. For example, adjustable-rate mortgages (ARMs) and interest-only mortgages offer different payment structures than conventional loans, and can be advantageous for those looking to save money on closing costs.

Additionally, some buyers may be eligible for government-backed loans such as FHA or VA programs that feature lower down payments and better rates and terms than other mortgage products. Taking the time to research all available options can help buyers in Wyoming make informed decisions when it comes to financing their real estate transactions.

When closing on a house in Wyoming, it is important to understand that attorney fees can be one of the large unknown expenses. It is helpful to prepare financially for these unexpected costs during the home closing process.

Homebuyers should familiarize themselves with the laws and regulations related to real estate law in Wyoming in order to have a better understanding of what fees may be charged by attorneys. Knowing what you may owe your attorney beforehand can help you budget for legal bills during the closing process.

Additionally, when shopping for a real estate lawyer, it is good practice to compare rates and services from multiple professionals before making a decision. Doing research ahead of time can save you money and provide peace of mind during what can be an intimidating process.

In general, remember that requesting an itemized list of fees from your attorney prior to signing any contracts is essential for managing finances during house closings in Wyoming.

When it comes to understanding attorney fees for house closings in Wyoming, a closing cost calculator can be an invaluable asset. This is because the calculator provides users with an estimated final settlement statement that includes all of the costs associated with the transaction.

The final settlement statement typically includes details such as mortgage and title insurance, transfer taxes, appraisal fees, closing costs and document preparation charges. By using a closing cost calculator for Wyoming, buyers can get a better understanding of all of their expenses for their house purchase before signing any documents.

Additionally, real estate attorneys can use these tools to help clients understand exactly what will be due at the time of closing so they are not surprised by any unexpected charges. It is important to note that some calculators may provide estimates only and should not be used as a replacement for speaking directly with an experienced real estate lawyer about your individual transaction.

When it comes to understanding attorney fees for house closings in Wyoming, the role of a title company is significant. Title companies play an important part in ensuring that all documents involved in a real estate transaction are accurate and legally binding.

They will typically review the title search, check for any liens or encumbrances on the property, examine legal documents such as deeds and mortgages, and ensure that all parties involved have signed off on the paperwork. Title companies also provide an escrow account where funds are held until closing day when they are released to the appropriate recipients.

By providing these crucial services, title companies help protect buyers and sellers from possible disputes arising from real estate transactions. Additionally, they help to simplify the process by streamlining document-handling procedures and minimizing chances of errors or oversights.

It’s no wonder that having a knowledgeable title company involved during home closings in Wyoming is essential for those looking to understand attorney fees for house closings in this state.

When buying or selling a home in Wyoming, it is important to understand the potential costs associated with closing. One of the most common misconceptions about who pays for closing costs in Wyoming is that the buyer and seller both typically split the cost.

However, while this may be true in some cases, there are other variables that should be taken into consideration when preparing a comprehensive budget before you buy or sell a home. Evaluating potential lenders and mortgage rates can help minimize the cost of closing, and understanding the pros and cons of using an attorney when buying or selling a home can also help ensure that all legal requirements are met.

In addition, researching local real estate laws and regulations will help ensure an accurate estimate of total closing costs is received. Furthermore, exploring different payment options to finance your down payment and other major expenses when buying a home will help you make an informed decision.

Finally, third-party services may be able to provide additional discounts on overall expenses during a home sale or purchase.

Closing costs in Wyoming can vary greatly depending on the type of property being purchased and the services required by both the buyer and seller. Generally, a buyer should expect to pay some closing costs, which can include fees for title insurance, survey, attorney fees, origination fees, home inspection fees, and more.

Attorney fees are typically calculated as a percentage of the purchase price or flat fee for services rendered. In most cases, buyers should expect to pay 1% to 2% of the total purchase price for attorney's fees.

Additionally, it is important to understand that real estate laws in Wyoming vary from other states so it is essential to consult with an experienced real estate attorney who is familiar with local rules and regulations. Furthermore, buyers may also be responsible for additional costs such as deed preparation and recording or appraisal fees which can add up quickly if not accounted for beforehand.

By understanding all associated costs prior to closing on a house in Wyoming, buyers can ensure that they are adequately prepared for this major investment.

When it comes to understanding attorney fees for house closings in Wyoming, one of the most important aspects to consider is what the closing costs will be. These charges can vary depending on the type of real estate transaction and the complexity of legal documents that are required.

Generally speaking, closing costs include title search and insurance fees, recording fees, lien searches, title insurance premiums and other miscellaneous expenses related to obtaining a final deed or mortgage. Additionally, attorneys may charge an hourly fee for their services as well as a flat fee for handling the paperwork associated with closing a real estate transaction.

It is important to discuss all potential charges with your attorney ahead of time so you can understand exactly how much you will pay in closing costs.

When it comes to closing costs associated with buying a house in Wyoming, understanding who pays what can be confusing. The buyer and the seller of the home typically each pay some portion of the closing costs, including attorney fees.

The buyer typically pays for things like loan origination fees, title search and insurance, recording fees and transfer taxes. The seller typically pays for things such as real estate commissions, prorated taxes and any liens or judgments against the property.

In most cases, the buyer will pay more in closing costs than the seller because they are taking out a mortgage loan. It is important to understand all of your legal obligations prior to signing any documentation so that you know exactly what you are responsible for paying during the closing process.

Yes, Wyoming is an escrow state. When closing a house in the state, buyers and sellers must understand the rules for attorney fees for real estate law.

In Wyoming, attorneys are required to be present at the closing table and all fees must be paid in advance before the transaction can take place. According to the Wyoming State Bar, the seller typically pays for their own attorney’s fees while the buyer pays their attorney plus any other costs associated with closing.

The buyer's attorney fees can range from $500 to several thousand dollars depending on the complexity of the sale. To ensure that all parties involved understand what they are paying for, it is important that they have a comprehensive understanding of Wyoming real estate law and its associated costs.

By educating themselves on these topics, buyers and sellers can make sure that their closing goes as smoothly as possible.

A: The attorney fees for house closings in Wyoming under Real Estate Law vary depending upon the complexity of the transaction. Generally, an attorney will charge a flat fee plus additional costs associated with title searches and other services.

A: In Wyoming, attorney fees for house closings under Real Estate Law typically range between $1,000 and $2,000.

A: When closing on a house in Wyoming, you will need to provide the amount of cash or escrow funds that you are providing for attorney fees.

A: In Wyoming, the attorney fees for a house closing are typically around $500-$1,000 depending on the complexity of the transaction.

A: In Wyoming, attorney fees for house closings typically range anywhere from $400-$600.

A: Yes, the HOA fees must typically be paid regardless of whether the property has been appraised for flood purposes or not.

A: According to A Guide to Real Estate Law, understanding attorney fees for house closings in Wyoming requires an analysis of state laws and regulations as well as local real estate practices. Homeowners should also be aware of applicable homeowners association (HOA) fees and any flood appraisal requirements.

A: Closing costs on FHA and VA loans in Wyoming typically include mortgage insurance premiums, discount points, lender fees, title insurance, and appraisal fees. Homeowners may also be required to pay homeowners association (HOA) fees on properties that have been appraised for flood purposes.

A: The pro-rated interest rate for refinancing a house closing in Wyoming is generally the same as the current market rate in Missouri.

A: Yes, the estate agent is typically responsible for the payment of attorney fees when closing a house in Wyoming.

A: Yes, credit scores can influence the fees associated with house closing in Wyoming. Credit scores are considered by lenders, creditors and advertisers when determining advertising rates as well as approval for credit. Credit reporting companies may also use credit scores to determine eligibility and rate loans or other financial products.

A: The guide to understanding attorney fees for house closings in Wyoming is A Guide To Real Estate Law.

A: Generally, banks are not liable for any fees associated with house closings in a flood plain. Homeowners may be responsible for certain closing costs such as loan origination, appraisal, title searches and insurance premiums.

A: Yes, USDA Loans are available for house closings in Wyoming. The value of the property can have an impact on the fees associated with closing as well as other factors such as credit score and interest rate.

A: Generally, no. Mortgage insurance premiums are not intended to be a source of profit for either the lender or borrower. The premium is simply a fee paid to protect the lender from any potential losses resulting from a homeowner's default on their loan.

A: Hiring an expert attorney for a house closing in Wyoming may provide certain incentives such as privacy, newsletters, and other expert services that can help simplify the process.